It's time to close: Stories of famous stock exchanges of Chicago

Taking into account that in a month [original article published in June 2015 - approx. Perevi.] Many futures closed sites, former and current traders have decided to share their ups and downs. i>

July 2 CME Group will close more than half of its 35 stock exchanges. It will be a big step towards the cessation of one of the types of trade, by which Chicago began once the financial center of the Midwest, and this city began to be thought of as a place where enterprising traders can earn a fortune.

What are the futures platform will be closed? CME Group plans to July 2 closing 20 of its 35 trading floors in Chicago and New York. Below is a list of the goods traded on them.

Corn Wheat Soybeans Soy flour Soybean Oil Live cattle Lean pork Beef timber The index of commodity futures Goldman Sachs (GSCI) Dairy products The currency pair EUR / USD The federal funds US Treasuries Currency futures The Dow Jones The index Nasdaq Gold / Silver (New York) Copper / platinum / palladium (New York) Energy Futures (New York)

Futures platform emerged with the development of agriculture and the construction of railways. With the increasing supply to the city of wheat, corn, beef and pork formed a certain market. Then, in 1848, was founded by businessmen Chicago Board of Trade (Chicago Board of Trade, CBOT), and later, in 1874 - the Chicago Stock Exchange of agricultural products, the predecessor of the Chicago Mercantile Exchange (Chicago Mercantile Exchange, CME). The spacious halls of the men exchange - at the time there were only men - screamed and spun in different directions, to buy or sell contracts for the supply of various commodities in the future.

November 2014. Traders in the "pit" for options trading on the currency pair EUR / USD, the most active "hole» i>

As a result, in order to shelter the restless crowd of Chicago Board of Trade, at the intersection of Jackson Avenue and Lasalle Street was built 45-storey building. A June 9, 1930 after US President Herbert Hoover pressed a symbolic button in Washington, began trading. In 2007, after the merger of CME and CBOT in this building were their common sales areas, and the "pit» CME on Walker Drive were abolished.

In the last decades of the XX century trading rooms were filled with thousands of traders who crowded into the pit stock. From there, from the aggressive crowd, they gave signals and gestures, shouting their orders. Many traders wore bright jackets, to stand in the "pit" and to attract attention. A Exchange introduced futures contracts on financial instruments like bonds and currency pairs and futures options, offering companies and farmers to protect themselves against surges in market prices.

For decades, brokers and traders from Chicago billion contracts traded, making your city rich. Stock exchanges have not only been a major trading center. As noted by CEO of the Chicago company Cheiron Trading Larry Shulman, they also offered to any young man who has a "share of perseverance and innate talent," a full-fledged career and a real opportunity to make good money.

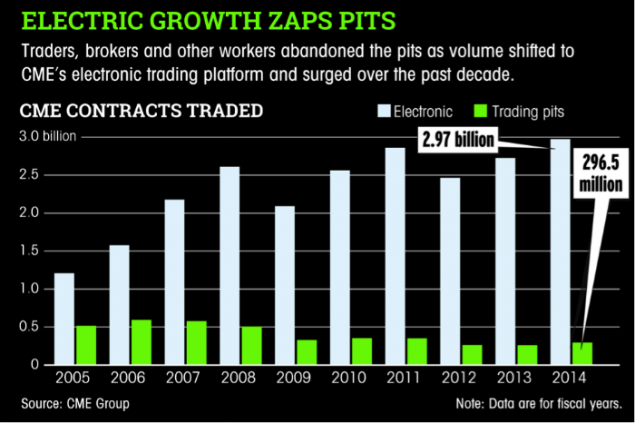

The growth of e-commerce displaces workers from the exchange pits. Traders, brokers and other employees leave "holes" due to the fact that in the last ten years, the volume of electronic trading on the CME has increased dramatically. Source: CME Group. Note: All figures are for the fiscal year i>

Today, a few hundred brave men are located on 2 acres of a 30 "holes" in a desperate attempt to save "the system cries" from extinction. For some time the most active option "holes" will remain open.

CME is still the world's largest futures exchange, but in the last 20 years, traders and trading firms gradually transplanted to the computer, thereby increasing the share of electronic trading to 90%. E-commerce continues to grow and with the development of high-speed communications is not limited geographically: many firms were established far beyond Chicago.

CME does not announce when is going to close the remaining 13 sites, but when she does - and this is likely to happen in the next few years - to disappear as the arena in which traders every day fighting for their orders, and the community in which They folded their long-term relationship. In this article six people to share their experience in the stock market well and tell what value it has for them and for the city as a whole.

pastoralists h4> Note: Here and below, the video opens by clicking on the image.

37,465,474

Name

Company

Age

The role of "pit»

Name of products in the "hole»

«When Exchange starts into motion, brokers pushed out of the" hole "and had to wade to it again." - Jim Clarkson blockquote> Jim Clarkson expressed interest in trading in college and after graduation began his career on the stock exchange as a messenger [ English. runner i>]. Soon he took to the brokers, who in 1994 was accused of fraud and sent to prison, and the whole business got Clarkson and his colleague. Currently their company, A & A Trading, is engaged in the execution of orders to buy and sell cattle farmers in the Midwest. I>

In 1982, when I started to work on the stock exchange, "pit" for the trading of the currency pair EUR / USD [probably refers to the European Currency Unit ECU, which was used from 1979 to 1998 and was the forerunner of the euro - approx. Perevi.] was filled with so much that brokers were sent there at 6:30 am to take a seat, while the market is opened only at 7:20. When Exchange starts into motion, brokers pushed out of the "hole" and had to wade to it again. The excitement was transcendent.

The "pit" were very different characters. There have been clever with a bunch of formulas, tried to overtake the market due to their intelligence. There were those who possessed inside information they have tried to overtake the market by these data and, as larger players could affect the movement of the market. In this cauldron boiled people with remarkable intelligence, people with connections, and some were then, and another, and they are all trying to make money.

The Exchange has brought the city huge income and had a very large employer. In addition, all workers gathered every day in the city center, so all the bars and restaurants in the area were filled, and bars and restaurants themselves were twice as many as today. This activity continued until the early 2000s, and then began to decline.

Through the exchange still takes a large flow of information, but the work of a trader has since changed dramatically, so now we have algorithms for conducting electronic trading. In my time the market moves large traders in the "pit", owning valuable secret information. Today the market is moving those who are engaged in e-commerce.

Amateur roller coasters h4> 45,727,280

Name Company Age «role» in the pit Name of products in the "hole»

«I remember that at first I was struck by the magnitude, swiftness and directness of what is happening. It catches the eye "- Chris Graseffa blockquote> Chris Graseffa moved to Chicago after the end of Wesleyan University in Middletown, Connecticut, with a Bachelor of Economics and worked at WH Trading, one of the many companies involved in high-frequency trading . After working as a clerk and messenger on the stock exchange, he became a trader, sitting in front of computer. Having worked for them a few years, Chris returned to the "pit" to trade options on 10-year Treasury bonds, but as a trader. I>

I have an analytical mind. I was very active, and I was told that I have everything it takes to succeed in this field, though I was born for this.

I remember how at first I was struck by the magnitude, swiftness and directness of what is happening. It immediately catches the eye. Everything is so real, and it's easy to feel. Still I remember what I was ecstatic. Here, I would not have to sit at a desk for 12 hours a day and follow the changes in the table, than for sure, I would have to deal with otherwise.

It's like a roller coaster: some days will be successful, some - not. You have to be ready for it. When I have everything turns out, I really enjoy what I'm doing. I can wake up every day and go to work in anticipation of a new day, new opportunities, new challenges to be faced. Here, all the days are different from each other and each of them - this new test. There is no place monotony that even routine work every day is different.

Eight years ago I was told that the "hole", where they sell options on the currency pair EUR / USD will disappear in 3-4 years. The same thing I said about the "pit" to trade 10-year options. Nevertheless, I try to keep the place in the "pit." I still can not really succeed in the auction, because too many people want to do the same. All stock exchanges are closed within a year, 10 or 20 years; maybe they will close in 18 months. But I am confident that I can do, and e-commerce, if need be. I think there will always be a versatile specialist in demand: if you are good in several areas, then you will always be able to succeed in one of them.

Anyway, people need certain goods - be it insurance or loan options on oil - and I'll sell them, sitting at the computer. In addition, I am sure that my company, like many others, will do everything to stay on the leading positions, and then I just go back to electronic trading.

The storm hooligans h4> 63,581,058

Name Company Age: 56 years

«role» in the pit Name of products in the "hole»

«Many called me too rude words, so sometimes I had to respond in kind," - Virginia MakGeti blockquote> Virginia MakGeti gained experience trading options on the Chicago Board Options Exchange. In 1983 she moved to Chicago Board of Trade, where she worked in the "pit" for options trading in corn, and after - traded options on wheat. In 1987, she founded the company McGathey Commodities. I>

I went through the trials and unbearable suffering. It's hard to believe that I did it. Some situations very hard for me to tell. It was so difficult, that if you are too sensitive or not developed enough confidence in itself, I would advise to stay away from all this.

Once I decided that I would become a broker, I have tried to understand the essence of business practice. Some just told me: "I would never allow a woman to touch his orders, even if it was the only broker in the trading floor." I just did not expect to hear such words. Other treated me worse, so you can imagine what they told me.

I think that without coarseness hard to survive here, so if you want others to respect you have to treat them very harshly. Many called me too rude words, so sometimes I had to respond in kind. I have learned to tame these people, so if someone wants to compete with me, it would be this much regretted.

A little later there were computers, which have become quite powerful weapons, and they have given me invaluable assistance. At first I did not understand that their appearance will change the entire market, rather, will this market.

One of the most memorable times of my life came after my company started working my two nieces, two nephews and my two brothers. We all worked side by side: one selling something or filled paper. I am happy that I was able to take the company to such a level, and provide an opportunity for each of them, no matter how much they earn. It was an unforgettable experience, and I think everyone would agree. Since then, we had to discuss at the table on Thanksgiving Day.

Support for beginners h4> 30,089,931

Name Company Age «role» in the pit Name of goods "hole»

«For many it is the club with the same interests; are they friends of yours; this is your way of life "- Larry Shulman blockquote> In 1982, Larry Shulman was one of the first who began to trade 30-year treasury bills of options in the Chicago Chamber of Commerce. Since then, he has taught a lot of traders trading in art "pit" and conduct online trading. Today, his company, Cheiron Trading, employs 15 people, and they are exclusively electronic trading on interest rates and contracts for the supply of goods. Larry still remembers his first deal at the exchange. I>

I had to make the deal, but I could not utter a word. So much I was nervous. I was just paralyzed. I tried to give a signal to the broker for the purchase of 14 futures and immediately agree on the phone with a client. Fortunately, they both guessed what I wanted from them, but it was just awful. However, for me this was a good lesson, because in time I brought into this business a few hundred people. Having experienced all the hard way, I clearly understand what it is - to be a beginner in this business, how much nerve it takes and how much they seem unusual place and the work itself.

I really became an expert in this field. To succeed on the stock exchange 30 years ago, it was necessary first of all to consider the mind quickly, act aggressively and harmonize your voice with gestures.

For many it is the club with the same interests; are they friends of yours; this is your way of life. Do you like to be here. Many prefer to have their booth on the trading floor, rather than own office, as they have been here for 30 years, and the trading floor became their second home.

Now everything is different: the only reason I'm in Chicago - that I had in Chicago, and I do not want to move. Now the firm appear in Texas and Montreal, where there are large players engaged in high-frequency trading. Now you can start your business anywhere, now it's not a problem. 20 years ago you would have to start it in Chicago.

Very much to change the way the development of skills. Methods of success will not be as democratic as 30-40 years ago. Now it will have to work hard at an early age: should be able to choose the right university and study diligently.

It is unlikely that you will have a number of separate sources of income, because maintaining separate business involves additional costs. The increasing role of the gaining popularity of your company. Previously, you could be a small entrepreneur from Chicago, where all the business community. Now everything is different.

Public relations and the economic impact of the company are carried out differently: I think they have decreased. Even if your totals above, this does not mean that your influence will be stronger. If revenue of $ 1 billion, it will have less impact than a thousand individual small entrepreneurs whose income is 1 million. This group of a thousand people a lot more connections than these companies.

The voice of experience h4> 1,700,436

Name Company Age «role» in the pit Name of products in the "hole»

«Anyway, the stock exchanges are closed for a long time. 95% of trading is now conducted with the help of computers, "- Lee Stern blockquote> Lee Stern longer than anyone else, is trading at the Chicago Board of Trade: the start of its membership on the exchange dates back to 1949. He was considered a consummate trader, engaged in trade in futures for soybeans, and founded his own company clearing, guaranteeing fulfillment of obligations for transactions. In 1992, when one of his clients illegally attempted to monopolize the market US Treasury bonds, Stern lost 6, $ 5 million. (Neither he nor his company no charges). Now you will not see Stern on the trading floor: he sells a variety of contracts from your computer, located in one of the office buildings CBOT. I>

After the army I got a messenger in the CBOT.

Source: geektimes.ru/company/itinvest/blog/260494/