1927

How to buy stocks of IT companies before, during and after the IPO

In comments to our previous article (about IPO and output the exchange group Alibaba) readers asked questions about how to participate in these offerings and become a shareholder of well-known companies. Today we look at this question in more detail.

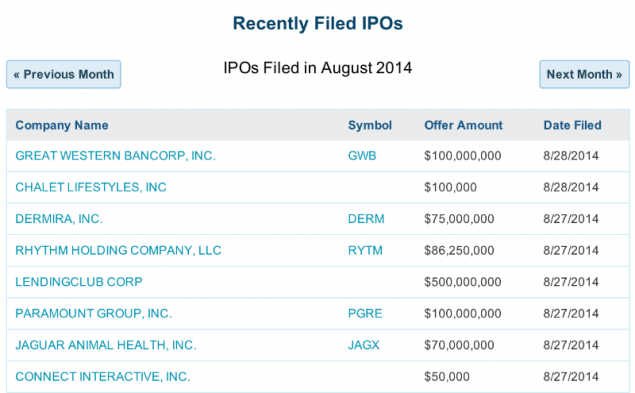

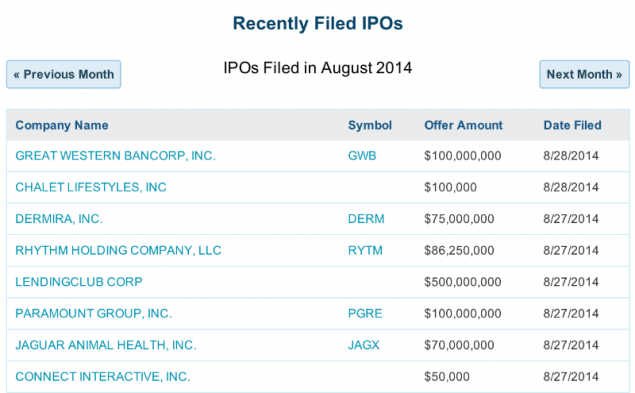

How to learn about the IPO h4> Members Habra interested in not only how to buy stocks, for example, the same Alibaba, but also because where do get information about upcoming public offering. It is not very detailed coverage in the media process - it's pretty routine and is the continuous monitoring of special sites aggregators (here пример such resource) or the sites of stock exchanges (eg, Nasdaq ). On such resources is usually a calendar applications for IPO, filed by companies.

Need to be prepared for the fact that the bulk of these companies are completely unknown wide range of Internet users, and many of them are not very ambitious plan accommodation.

How do investors buy shares before the IPO h4> We all know that the main beneficiaries in the course of entering the stock exchange recovered shareholders who have been established in advance. For this purpose, it is logical, the company must invest. Accordingly, the amount of investment must be substantial - otherwise generate interest owners of the company to the sale of the share is difficult. In general, companies that are looking for investment, there is usually a person responsible for investor relations, which helps them to define the conditions and make a deal.

Another possibility of buying shares - the so-called pre-market. Shares of the company gathered in the IPO, you can buy even before the underwriter (we considered its role in the general topic of IPO ). Similarly, conventional investment in the company, the amount of financial investments should be significant, in order to arouse the interest of owners.

Buying shares after the start of trading h4> After the action officially began his address on the stock exchange, they are no different from the previously traded on a platform of financial instruments. For the first time after the start of trading, usually easier to buy shares because these days increases liquidity in connection with the general interest to the event.

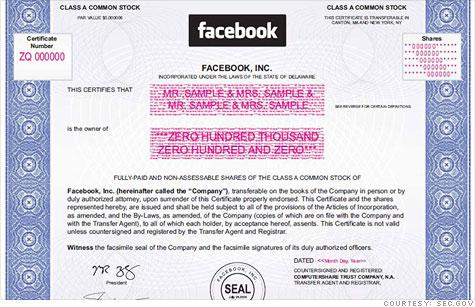

For example, on the day of IPO Facebook has sold (and bought) more than 80 million shares - for the very first 30 seconds of the auction. Such a high volume of transactions made trading robots (HFT).

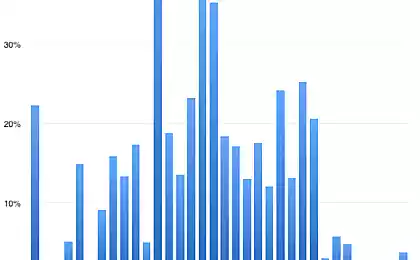

When you try to buy stocks that go on IPO, you should always keep in mind the possibility of a sharp rise in prices in the first day. For example, in 2011, LinkedIn shares on the first day of trading rose in price by 109% - from $ 45 to $ 94, 25 per share. Often later the price is adjusted and may even fall below the value of the initial placement.

How to buy shares on foreign exchanges h4> To trade on foreign stock exchanges, it should also apply to local or broker to open an account (which is not so easy to do), or to find a Russian broker, which provides access to trading.

Shares of many popular technology companies are traded, such as NASDAQ, respectively, need a Russian broker that has access there (a good post for beginners looking for a way to trade on the NASDAQ can be found here ). If the interests of investors traded on the London, New York or Chicago Stock Exchange, it will need a Russian broker, having partnerships with companies operating in these areas (through ITinvest can work with several foreign exchanges, their list posted here ).

How to buy shares on the Russian stock exchanges h4> Buy paper on the Russian stock exchanges easier due to lack of spare units and complex circuits. The main Russian stock exchanges is "Moscow Exchange", formed after the merger of two competitors - the RTS and MICEX. An individual can not own so easy to trade on the stock exchange, it needs to be a professional participant and obtain the appropriate license.

Such licenses have brokers and some banks. List of operators, for example, the stock market and statistics on them, can be found at site Exchange. In general, open an account with a broker is quite simple - you need to do is not so much paperwork (we application for opening, you can leave on the site). Then it will be necessary to have the money to a brokerage account, establish a special trade software (we have developed its own terminal) and start to make transactions in shares and other financial instruments.

IPO on "the Moscow stock exchange" are not so often. One of the latest news on the topic - the intention spend IPO holding editions Slon.ru, «Big City" and the TV channel "Rain". In addition, Russian companies, whose shares are traded abroad, sometimes carried out in the Russian additional accommodation - so, for example, in the early summer entered «Yandex" (we wrote a separate topic on how to buy shares of the company).

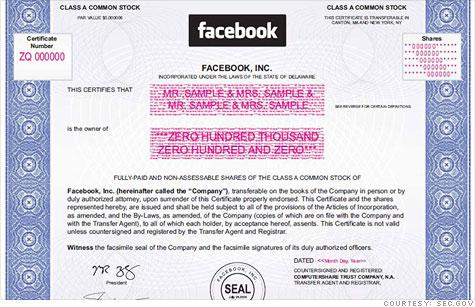

I want to buy one share and all h4> Sometimes all of the above methods are not suitable for one simple reason - I want to buy a single share, not for profit, and the "for show" (I am co-owner of Facebook!) Or, for example, a present for a friend. This can be achieved without opening a brokerage account. Abroad, there are projects specializing in the sale of securities of public companies that offer its shareholders a special certificate of ownership (such certificates is not at all the companies, such as Apple does not use them).

Sites like GiveAShare.com , OneShare.com or Uniquestockgift.com provide an opportunity to buy the stock at the market price without opening a brokerage account, but take an extra fee of a few tens of dollars. Buyer need to select the interests of the company and fill out a short form. Certificate of ownership action can "decorate" a variety of frames, plaques engraved etc.

That is all! Thank you for your attention, we will be happy to answer questions in the comments.

Posts and related links:

How-to: How to buy tech stocks as an example of "Yandex» li > What is a stock index and why they are needed Банки vs Exchange where more advantageous to buy the currency Analytical materials about the stock market from the experts ITinvest Source: habrahabr.ru/company/itinvest/blog/235495/

At the University of Tokyo have developed a fast runner bipedal robot with new balancing system

Google and Bungie created an interactive game world Destiny using Street View