949

The birth of the credit card

In 1949, Frank Maknamara, head of the finance company Hamilton Credit Corporation, went to dinner. After dinner, Frank reached for his wallet to pay for food. However, there was not enough money, so he had to call his wife and ask her to urgently bring cash. After this incident, McNamara vowed that such a situation it will never happen again.

The story of the credit card is very interesting. In 1949, Frank Maknamara, head of the finance company Hamilton Credit Corporation, went to dinner with Alfred Blumingdeylom (grandson of the founder of the famous store Bloomingdale's) and attorney Ralph Snyder. Sitting at the table of the New York restaurant, they were discussing the case of a customer who was in a difficult financial situation. This man owned several lending books from stores, which he had opened a loan, when several of his friends asked him to borrow money. The money he gave them, but allowed to use their credit books for a fee, which the Friends have promised to pay him apart from debt repayment. As a result, credit for books has grown substantially, and the debtor became insolvent. This unpleasant situation forced the unfortunate owner of the credit to borrow money in the Hamilton Credit Corporation, that is Frank McNamara.

After dinner, Frank reached for his wallet to pay for food. However, there was not enough money, so he had to call his wife and ask her to urgently bring cash. After this incident, McNamara vowed that such a situation it will never happen again. I thought about the two topics memorable dinner (possibility to lend their credit and lack of cash to pay for food), Frank thought of a completely new idea - the idea of a credit record, which would be used not one shop and many trade institutions. The special novelty of this concept was to use the company's intermediary between buyers and sellers.

Loan book or card issued by a specific store or a gas station, were very popular in the early XX century. This has helped the companies to ensure customer loyalty - the debtor likely will return to the store to buy something else. Credit cards are usually distributed among customers about the solvency of which was known for certain. For a long shopping list needed a whole stack of credit cards, on a separate card for each trading venue. McNamara genius idea was that he intended to use only a single card for all retail outlets. In addition, the proliferation of cars and airplanes, people started to travel and, of course, they want to buy things not only in his native city.

McNamara discussed his idea with Blumingdeylom and Snyder, and in 1950 they opened a new company called Diners Club, and that was to become a mediator between customers and businesses. Now, not individual companies offer their own credit, and Diners Club offered open credit customers for many companies. Collect money from debtors, holders of credit cards Diners Club, was carried out not by the companies themselves, and Diners Club. Prior to that, the company benefited from the use of credit cards that create permanent clientele, which provides a high level of regular sales. Diners Club, but I could not make money in this way. It was decided that for each purchase made through the card by Diners Club, the company will pay 7% of its value, and holders of cards - annual fee of $ 3.

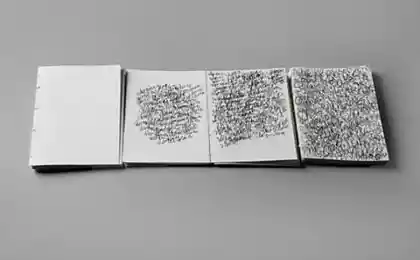

McNamara to focus on businessman. They were the most frequent visitors to the restaurant, and therefore may have an interest in his services. This explains the name of the company, which can be roughly translated as "Club restaurant regulars." The first Diners Club cards were distributed to two hundred people, mostly friends and acquaintances of the company owners. The card is accepted in dozens of New York restaurants. They were printed on thick paper box with a list of all the restaurants on the back side.

At the beginning things were not going well. Restaurant owners did not want to pay their 7% and feared competition Diners Club cards with their own credit books. Potential clients Diners Club did not want to buy cards Diners Club, because at first they did not offer a sufficiently large choice of places where cards are accepted. However, by the end of 1950 about 20 thousand. New Yorkers paying for restaurant dining pieces of paper from Diners Club. By the second year of its existence the company has made a profit of $ 60 thousand., That left no doubt in the financial success of the new enterprise.

Diners Club continued to develop unbeatable space until 1958, when the horizon of American businesses have credit cards American Express and Bank Americard (which later became part of Visa). Both companies have opened a new era in the mass popularization of credit cards by making them available not only the US but the rest of the world. In 1966, the UK has released the first non-US credit card Barclaycard. However, global expansion of banknotes in different countries was different rates. Much depended on the state of local banking systems and financial conservative views of the population. However, now you can pay by credit card in almost all countries of the world - this financial network has become one of the manifestations of globalization.

According to the company Nilson, in 2007 the share of Visa cards accounted for 46% of the US market for MasterCard - 36% for American Express -12%, to Discover - 6%. The position of these cards on the international scene was somewhat different: Visa had 60% of the world market, MasterCard - 28%, American Express - 10.5%, JCB - 0.9%, Diners Club - 0.5%.

Washington ProFile

Source: rokfeller