501

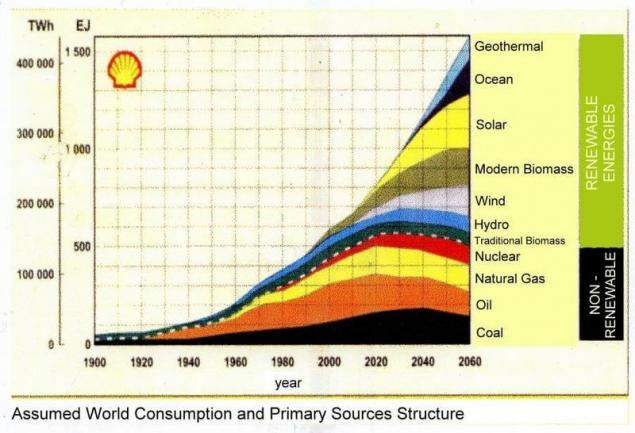

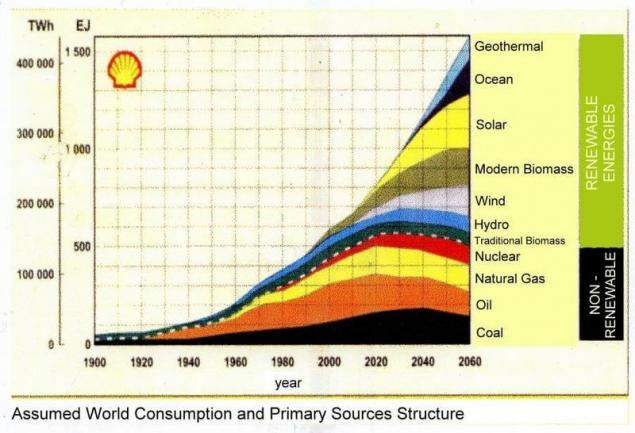

Shell decided to shift to wind energy

Oil giant Shell is investing $1.7 billion in renewable and low carbon energy. To do this, the company created a new division, New Energies. Global investments in green energy continue to grow.

Europe's largest oil company will develop technologies for alternative energy generation, focusing on wind energy. The decision on long-term investment in green energy was made in the Shell after the report of the international Council of experts at Chatham House, based in London. According to this report, the international oil companies must completely transform the business, otherwise they will experience fading during the next decade.

New unit New Energies will use the existing backlog in the research and development of Shell in biofuels, hydrogen energy, etc. however, the main investments in the amount of $1.7 billion will be spent on the use of technology for wind power.

Shell oil company is not alone in attempting the transition from oil to clean energy. Thus, the French company Total owns the operator of the solar energy SunPower. However, environmentalists are not very happy with the Shell and is connected with the fact that the capital costs of the New Energies division is equal to $200 million, which is less than 1% of the total cost Shell oil and gas $30 billion.

Perhaps the first investment Shell will be her salvation in the next few decades, when the energy market is fully transformered and conventional hydrocarbon companies will lose significant market share.

In the segment of solar energy the main struggle was between companies from China and the United States. Chinese companies have long stimulated the development of industry and competition, maximally reducing the production costs of solar panels. As a result, the market was hard to survive, companies from countries with higher costs of specialists. But maybe the Chinese company was too aggressive in pricing, since some of them were difficult to service the debt.

The leader of the U.S. solar energy market is First Solar (FSLR, NASDAQ). The company's capitalization is $4.8 billion, profit of $777 million, the company has excellent prospects for further growth, the long-term trend of revenue and profit growth looks positive.

Green energy development is happening in parallel with the growth of demand for electric cars. The leader in this market is Tesla Motors (TSLA, NASDAQ). The secret development of the electric car also runs Apple; electric cars-creates robots and Google.

With the development of ETFs, a growing number of companies investing in alternative energy. The largest solar energy Fund is the Guggenheim Solar ETF (TAN, NYSE), which follows the MAC global Solar Energy index. In total, the Fund's portfolio of 25 stocks of companies from all over the world. The share of American companies is 38.2%, is 36.9%. Under the management of the Fund the $231 million posted

P. S. And remember, only by changing their consumption — together we change the world! ©

Join us in Facebook , Vkontakte, Odnoklassniki

Source: altenergiya.ru/novosti/shell-orientiruetsya-na-energiyu-vetra.html

Europe's largest oil company will develop technologies for alternative energy generation, focusing on wind energy. The decision on long-term investment in green energy was made in the Shell after the report of the international Council of experts at Chatham House, based in London. According to this report, the international oil companies must completely transform the business, otherwise they will experience fading during the next decade.

New unit New Energies will use the existing backlog in the research and development of Shell in biofuels, hydrogen energy, etc. however, the main investments in the amount of $1.7 billion will be spent on the use of technology for wind power.

Shell oil company is not alone in attempting the transition from oil to clean energy. Thus, the French company Total owns the operator of the solar energy SunPower. However, environmentalists are not very happy with the Shell and is connected with the fact that the capital costs of the New Energies division is equal to $200 million, which is less than 1% of the total cost Shell oil and gas $30 billion.

Perhaps the first investment Shell will be her salvation in the next few decades, when the energy market is fully transformered and conventional hydrocarbon companies will lose significant market share.

In the segment of solar energy the main struggle was between companies from China and the United States. Chinese companies have long stimulated the development of industry and competition, maximally reducing the production costs of solar panels. As a result, the market was hard to survive, companies from countries with higher costs of specialists. But maybe the Chinese company was too aggressive in pricing, since some of them were difficult to service the debt.

The leader of the U.S. solar energy market is First Solar (FSLR, NASDAQ). The company's capitalization is $4.8 billion, profit of $777 million, the company has excellent prospects for further growth, the long-term trend of revenue and profit growth looks positive.

Green energy development is happening in parallel with the growth of demand for electric cars. The leader in this market is Tesla Motors (TSLA, NASDAQ). The secret development of the electric car also runs Apple; electric cars-creates robots and Google.

With the development of ETFs, a growing number of companies investing in alternative energy. The largest solar energy Fund is the Guggenheim Solar ETF (TAN, NYSE), which follows the MAC global Solar Energy index. In total, the Fund's portfolio of 25 stocks of companies from all over the world. The share of American companies is 38.2%, is 36.9%. Under the management of the Fund the $231 million posted

P. S. And remember, only by changing their consumption — together we change the world! ©

Join us in Facebook , Vkontakte, Odnoklassniki

Source: altenergiya.ru/novosti/shell-orientiruetsya-na-energiyu-vetra.html