1052

America was the world more dangerous for the collider

Treasury continues to fly in the "black hole»

America was the world more dangerous for the collider

"Ordinary citizens of the financial crisis should not be afraid, the state guarantees all deposits," - Vice-Premier and Finance Minister Alexei Kudrin made a special statement to calm agitated Russians. The government has already had a banking system of financial aid - in need of environment could "bite" of the one and a half trillion rubles, which provided financial power.

But is the problem of the banks does not mean that we will have a hard time with you? "News" decided to give its own answer to this question.

With Fannie Mae and Freddy Mac started it all - they eventually took custody of the US authorities. With "help» Lehman Brothers and Merrill Lynch continued - these banks moved away cheaply to their more successful colleagues. That's just how it ends - is not known. Strange but true: until recently the names of these companies would not have told the ordinary Russian citizens, but today they are on everyone's lips. Still, after all Fanny and the company we have been responsible for the problems we have.

On Wednesday, in the morning as an institution officials repeated: the problem of time, citizens do not worry, as the banks, which, because of financial disaster in America suddenly found themselves without money to help. Indeed. The Ministry of Finance and the Central Bank provided all the bankers to continue their work without any problems, the unprecedented size amount. But they only got three largest banks - Sberbank, VTB and Gazprombank. As conceived by the Ministry of Finance, they must distribute the money in the economy, refinancing other banks. But "Krupnyakov" Wednesday extra money shared with other very reluctantly.

Hastened to correct the situation the Central Bank. On Wednesday unscheduled going to the Board of Directors of the Central Bank and decided to go for the most radical in recent history measures lowering reserve requirements (as in the Central Bank should keep the bankers for a rainy day), 4%. The unprecedented nature of the current head of the Central Bank Sergei Ignatyev explained by the fact that banks have an acute shortage of liquidity and the need to defuse the situation. According to estimates of the Central Bank, due to emergency measures for banks to release more than 300 billion rubles, which may be in the accounts on Friday. Will the money and run when the problems in the banking market?

- I hope that in the next few days, perhaps within the next week. The problem with liquidity there, and serious, but we will almost certainly decide - given its forecast Sergei Ignatyev.

Well, that is all of these problems do not relate to bank customers. But what happens next? Do we not have, in 1998, to stand in queues to get from their accounts at least something? "News" tried to understand how the current crisis has repercussions in the rates on loans, the price of flats and the dollar.

If you share ...

Advice - just do not panic and hold fast to what you have. If you bought the stock, leave them at home until the market starts to grow again. As it now is hard to believe, but there was no stock market crash, which was not followed by a boom. Especially that sell they are now nowhere - suspended trading. But when the market starts to grow?

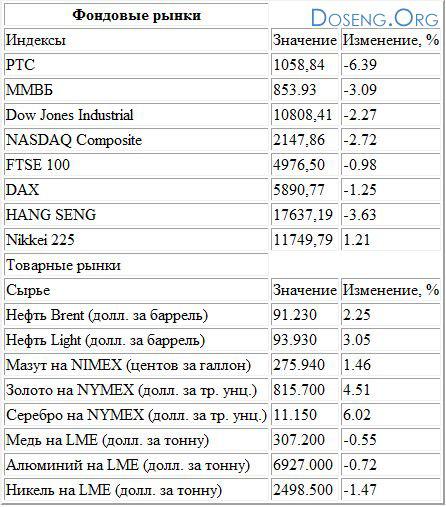

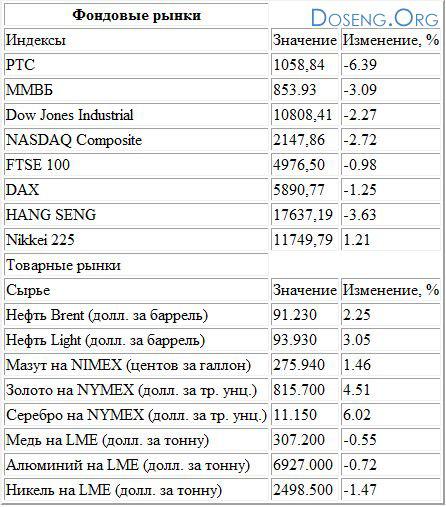

- We expect to soon see the MICEX index at 1050 points. In the worst case, it will not fall below 700 points, because then it will be enough to maintain only Russian money - shares his predictions asset manager of IR "Finam" Andrei Sapunov.

How strong ruble?

The collapse rublin no one seriously believes professionals. President of the Association of Russian Banks Garegin Tosunyan Generally speaking, the whole hype around the situation in the financial market in Russia "psychological." As is known, the rate is determined rublin inventory reserves. "Russia has sufficient reserves, no major fluctuations will not" - said the Minister of Finance and promises that the central bank will keep the rate within the band, which he defined.

And Alexander Osin of "Finam" says that the ruble will support capital inflows into the country. To do it will be from the sale of oil, the export of which has not been canceled. And the interest in buying assets in Russia among foreigners, in spite of everything, remains - just money now they do not have.

Where to now uskachet inflation?

It is understood that the injection of trillions of rubles to the banks it is unlikely to slow down. And the authorities understand this.

- For ordinary citizens the situation does not change, the greatest risk - this is inflation, - says Alexei Kudrin.

This opinion is shared by Sergei Ignatiev:

- Inflation will rise, but not much. Rather, even slowing its pace is not as fast as we expected.

Nevertheless, the head of the Central Bank believes that the inflation rate will not be 11% (the latest estimates of the Bank of Russia), and up 1%, ie 12%.

So slow down the price will now be more difficult. But our industry and agriculture can develop quietly and even "add tempo" - money for it now will be enough.

Do not stop banks to lend?

Well, it's just unlikely. Because the loans - for banks is the first source of profit. Although if the money is in short supply, the part with them more reluctant. For example, for six months as banks have become much stricter in their assessment of their future borrowers. Now it can grow and lending rates.

- On consumer loans to raise rates heavily, they are already up 15-20%, - says Alexander Osin. - Therefore, banks try to recoup and raise mortgage rates. Now they make up 14-15%, and is likely to grow.

Well, if you have already taken out a loan, it does not change anything. Will continue to quietly pay, as spelled out in the contract.

Apartments are now further rise?

The paradox of the liquidity crisis consists precisely in the fact that real estate is usually cheaper. Even last year, when the US mortgage crisis began, many in Russia had hoped to buy a home cheaply. And now their hopes come true.

- Although the fall in house prices always rise, they now are in place and some items went down. Many sellers feel that prices may fall further, and began to hurry to get rid of flats, - says head of the Moscow department of the real estate investment center Sergei pieces. - I think prices will continue to decline slowly.

In the US, home prices in the last year fell by 20%, says Alexander Osin. If the lack of cash flow continues, a decrease in apartment prices is very likely we have. Therefore, you may be a good chance to buy an apartment cheaper or improve their living conditions.

"KIT Finance" is looking for an investor

Difficulties in attracting cheap money can quickly and "naturally" to weed out many financial institutions. The first problem is grasped "KIT Finance" - a major Russian bank, standing in 30th place by the size of their assets. The fact that "China" is not all right, the whole country became known on Tuesday, when the bank was unable to redeem its financial obligations by about 6-8 billion rubles. And on Wednesday, there came the statement: "In order to overcome the difficulties that have arisen here in connection with the sharp fall in the stock market," KIT Finance "in talks with a strategic investor to join the bank's capital».

Russian Finance Minister Alexei Kudrin believes that no special measures to support the tottering bank is not required. "They have enough assets for which they are now completing negotiations for the sale and mobilize the necessary resources," - the minister said in a televised interview.

America was the world more dangerous for the collider

"Ordinary citizens of the financial crisis should not be afraid, the state guarantees all deposits," - Vice-Premier and Finance Minister Alexei Kudrin made a special statement to calm agitated Russians. The government has already had a banking system of financial aid - in need of environment could "bite" of the one and a half trillion rubles, which provided financial power.

But is the problem of the banks does not mean that we will have a hard time with you? "News" decided to give its own answer to this question.

With Fannie Mae and Freddy Mac started it all - they eventually took custody of the US authorities. With "help» Lehman Brothers and Merrill Lynch continued - these banks moved away cheaply to their more successful colleagues. That's just how it ends - is not known. Strange but true: until recently the names of these companies would not have told the ordinary Russian citizens, but today they are on everyone's lips. Still, after all Fanny and the company we have been responsible for the problems we have.

On Wednesday, in the morning as an institution officials repeated: the problem of time, citizens do not worry, as the banks, which, because of financial disaster in America suddenly found themselves without money to help. Indeed. The Ministry of Finance and the Central Bank provided all the bankers to continue their work without any problems, the unprecedented size amount. But they only got three largest banks - Sberbank, VTB and Gazprombank. As conceived by the Ministry of Finance, they must distribute the money in the economy, refinancing other banks. But "Krupnyakov" Wednesday extra money shared with other very reluctantly.

Hastened to correct the situation the Central Bank. On Wednesday unscheduled going to the Board of Directors of the Central Bank and decided to go for the most radical in recent history measures lowering reserve requirements (as in the Central Bank should keep the bankers for a rainy day), 4%. The unprecedented nature of the current head of the Central Bank Sergei Ignatyev explained by the fact that banks have an acute shortage of liquidity and the need to defuse the situation. According to estimates of the Central Bank, due to emergency measures for banks to release more than 300 billion rubles, which may be in the accounts on Friday. Will the money and run when the problems in the banking market?

- I hope that in the next few days, perhaps within the next week. The problem with liquidity there, and serious, but we will almost certainly decide - given its forecast Sergei Ignatyev.

Well, that is all of these problems do not relate to bank customers. But what happens next? Do we not have, in 1998, to stand in queues to get from their accounts at least something? "News" tried to understand how the current crisis has repercussions in the rates on loans, the price of flats and the dollar.

If you share ...

Advice - just do not panic and hold fast to what you have. If you bought the stock, leave them at home until the market starts to grow again. As it now is hard to believe, but there was no stock market crash, which was not followed by a boom. Especially that sell they are now nowhere - suspended trading. But when the market starts to grow?

- We expect to soon see the MICEX index at 1050 points. In the worst case, it will not fall below 700 points, because then it will be enough to maintain only Russian money - shares his predictions asset manager of IR "Finam" Andrei Sapunov.

How strong ruble?

The collapse rublin no one seriously believes professionals. President of the Association of Russian Banks Garegin Tosunyan Generally speaking, the whole hype around the situation in the financial market in Russia "psychological." As is known, the rate is determined rublin inventory reserves. "Russia has sufficient reserves, no major fluctuations will not" - said the Minister of Finance and promises that the central bank will keep the rate within the band, which he defined.

And Alexander Osin of "Finam" says that the ruble will support capital inflows into the country. To do it will be from the sale of oil, the export of which has not been canceled. And the interest in buying assets in Russia among foreigners, in spite of everything, remains - just money now they do not have.

Where to now uskachet inflation?

It is understood that the injection of trillions of rubles to the banks it is unlikely to slow down. And the authorities understand this.

- For ordinary citizens the situation does not change, the greatest risk - this is inflation, - says Alexei Kudrin.

This opinion is shared by Sergei Ignatiev:

- Inflation will rise, but not much. Rather, even slowing its pace is not as fast as we expected.

Nevertheless, the head of the Central Bank believes that the inflation rate will not be 11% (the latest estimates of the Bank of Russia), and up 1%, ie 12%.

So slow down the price will now be more difficult. But our industry and agriculture can develop quietly and even "add tempo" - money for it now will be enough.

Do not stop banks to lend?

Well, it's just unlikely. Because the loans - for banks is the first source of profit. Although if the money is in short supply, the part with them more reluctant. For example, for six months as banks have become much stricter in their assessment of their future borrowers. Now it can grow and lending rates.

- On consumer loans to raise rates heavily, they are already up 15-20%, - says Alexander Osin. - Therefore, banks try to recoup and raise mortgage rates. Now they make up 14-15%, and is likely to grow.

Well, if you have already taken out a loan, it does not change anything. Will continue to quietly pay, as spelled out in the contract.

Apartments are now further rise?

The paradox of the liquidity crisis consists precisely in the fact that real estate is usually cheaper. Even last year, when the US mortgage crisis began, many in Russia had hoped to buy a home cheaply. And now their hopes come true.

- Although the fall in house prices always rise, they now are in place and some items went down. Many sellers feel that prices may fall further, and began to hurry to get rid of flats, - says head of the Moscow department of the real estate investment center Sergei pieces. - I think prices will continue to decline slowly.

In the US, home prices in the last year fell by 20%, says Alexander Osin. If the lack of cash flow continues, a decrease in apartment prices is very likely we have. Therefore, you may be a good chance to buy an apartment cheaper or improve their living conditions.

"KIT Finance" is looking for an investor

Difficulties in attracting cheap money can quickly and "naturally" to weed out many financial institutions. The first problem is grasped "KIT Finance" - a major Russian bank, standing in 30th place by the size of their assets. The fact that "China" is not all right, the whole country became known on Tuesday, when the bank was unable to redeem its financial obligations by about 6-8 billion rubles. And on Wednesday, there came the statement: "In order to overcome the difficulties that have arisen here in connection with the sharp fall in the stock market," KIT Finance "in talks with a strategic investor to join the bank's capital».

Russian Finance Minister Alexei Kudrin believes that no special measures to support the tottering bank is not required. "They have enough assets for which they are now completing negotiations for the sale and mobilize the necessary resources," - the minister said in a televised interview.