221

Which bank do users find attractive?

There are many modern banks, but it cannot be said that each of them fully satisfies the needs of users. Someone evaluates quality by the efficiency of technical support, the presence of attractive mortgage programs and so on.

Which banks are the primary focus of users

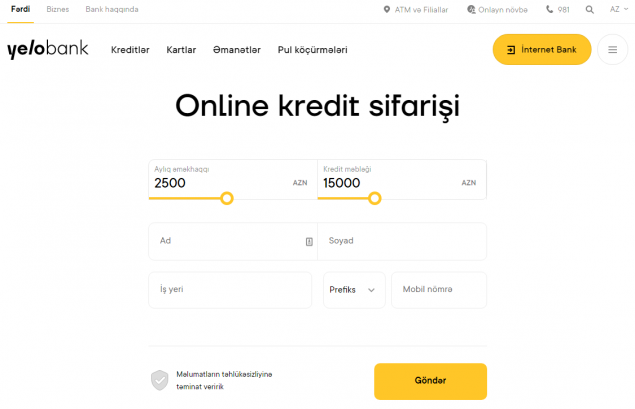

Of course, much depends on the presentation, the ability of the resource to emphasize not only the benefits offered to customers, but also the difference from other similar structures. Almost immediately you can calculate on the calculator, how much will cost the loan order, what are the interest, terms. Features:

- If the bank provides a virtual calculator, it will be possible to immediately find out the data by entering, for example, a monthly salary, the amount of the loan.

- If the conditions are suitable, then a request can be made in a few clicks.

- If you need additional information or want to get acquainted with the loan, mortgage offers of a financial institution in more detail, then in a few clicks you will be able to make a request to consultants or order a call back at the right time.

What other clients value in the work of banks

Interestingly, according to numerous survey results, it was found out that customers appreciate the ability to quickly access the website of the selected bank not only from desktop computers, but also from mobile devices, various gadgets. This is especially appreciated by the youth audience. And, as survey respondents noted, this fact makes financial institutions even more attractive. In addition,

- It is always possible to compare the loan, mortgage programs of a particular financial institution and its competitors. This will allow you to clearly verify the feasibility of choosing certain proposals from banks.

- Many people are interested in bank loans with the ability to get money without leaving home. This is usually necessary to pay for a mortgage or to make other major purchases.

- Offering a particular program, a financial institution should remember that the most profitable users consider those proposals that allow you to restructure, change the repayment schedule, including the ability to repay it early without the need to pay so-called “fines”.

People are also interested in the possibility of deposits that allow you to invest for different periods, for example, for a period of 12 months. Standard deposits can be called deposits that imply a period of 12, 24 or 36 months with the payment of interest monthly or at the end of the reporting period. As you can see, modern banks offer really interesting solutions for both those who want to take a loan and those who are interested in opening a deposit.