485

Property deduction: what is, how to, what documents are required

Property deduction is the ability to return income tax to be paid after the purchase of property or land, construction of a private house, paying mortgage interest. In the case of a positive answer to the applicant compensate up to 260 thousand rubles.

Features of the calculation

Property deduction is 13% of the amount paid for the property. Also included for the following expenses:

Filing of documents

The refund can be obtained in two ways: submit an application to the tax office or contact your employer. All the nuances of the procedure can be found in the article “Tinkoff”. It is important to note that in the first case, the applicant will receive the major portion of the immediately. The second option provides for the payment of salaries without holding monthly 13% personal income tax.

An appeal to the tax

First, fill out Declaration 3-pit. In the accounting work necessary to obtain a certificate 2-pit. This should be accompanied by copies of documents confirming the payments made and the right of ownership:

Clearance through an employer

If you want to use a property deduction before the end of the year, contact your employer. It should be:

What to choose

To choose a suitable option, it is worth examining the pros and cons about them in detail in the article “National Advisor”. The main advantage of a property deduction through an employer is the promptness of payments. Sometimes the financial situation does not allow to wait a few months to get the amount in full. In this situation, a stable increase in salary is the best option.

But there is a serious lack. The calculation of the produce of the filing of the application. If it happened in the middle of the year, you will receive a refund of 13% for the remaining months. Thirty days lost waiting notification. Get the rest will be in next year, by submitting the Declaration 3-NDFL. That is, to make a deduction through the tax would have in any case.

Features of the calculation

Property deduction is 13% of the amount paid for the property. Also included for the following expenses:

- the design of the project and cost estimates;

- consumables;

- additional repairs;

- connection to utilities (water, gas, electricity) or installation of Autonomous systems;

- costs payment of interest at the target credit.

Filing of documents

The refund can be obtained in two ways: submit an application to the tax office or contact your employer. All the nuances of the procedure can be found in the article “Tinkoff”. It is important to note that in the first case, the applicant will receive the major portion of the immediately. The second option provides for the payment of salaries without holding monthly 13% personal income tax.

An appeal to the tax

First, fill out Declaration 3-pit. In the accounting work necessary to obtain a certificate 2-pit. This should be accompanied by copies of documents confirming the payments made and the right of ownership:

- extract from the unified state register (in the construction/purchase of new housing, the registration of the land plot);

- the contract of purchase/sale (for flat/room or part);

- the contract on the mortgage or the trust loan, the repayment scheme of the loan (when interest payments on the loan);

- proof of expenses (receipts, checks, statements, etc.);

- evidence of repayment of interest.

Clearance through an employer

If you want to use a property deduction before the end of the year, contact your employer. It should be:

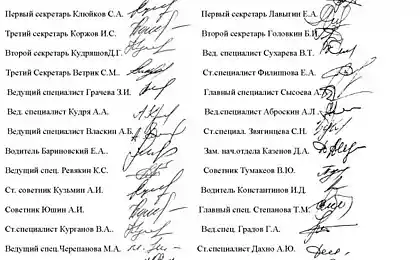

- write to the tax office statement, attaching copies of the documents;

- to receive a notification confirming the right to the deduction (issued within one month);

- to present a document to the employer.

What to choose

To choose a suitable option, it is worth examining the pros and cons about them in detail in the article “National Advisor”. The main advantage of a property deduction through an employer is the promptness of payments. Sometimes the financial situation does not allow to wait a few months to get the amount in full. In this situation, a stable increase in salary is the best option.

But there is a serious lack. The calculation of the produce of the filing of the application. If it happened in the middle of the year, you will receive a refund of 13% for the remaining months. Thirty days lost waiting notification. Get the rest will be in next year, by submitting the Declaration 3-NDFL. That is, to make a deduction through the tax would have in any case.