419

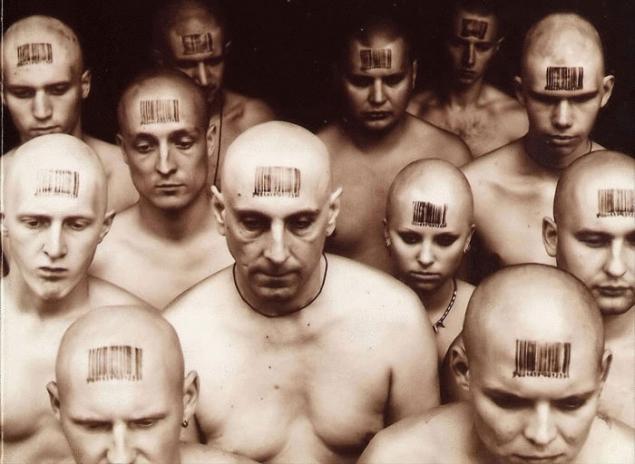

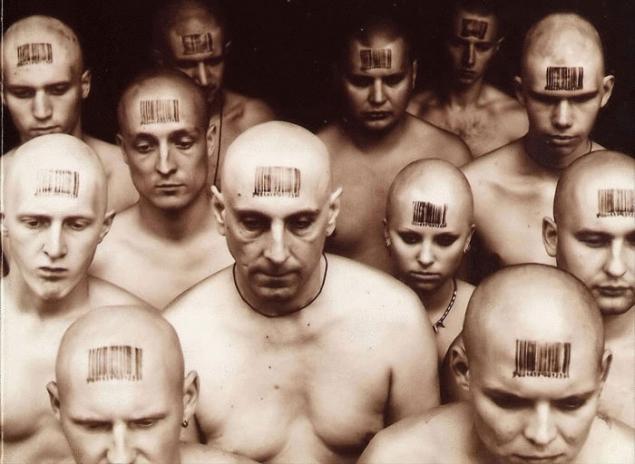

From 2016 all purchases of Russian citizens will be registered by the state

The Ministry of Finance creates the basis for total control of spending – raise taxes and fines for "gray" employment

The government is creating technical and legal framework to control the employment and payment of taxes by the population. This will be done through the personification of all purchases made by citizens. The Ministry of Finance has created a bill in which all cash outlets should be replaced, and the new will register purchases electronically. Cash purchases will be tied to the phone number of the client. This innovation will allow to automatically take into account the costs of citizens, namely, mentioned by the initiators of the laws on penalties and taxes on informal employment: it was about controlling taxes by the population through the matching of mandatory contributions with expenditures.

The draft amendments to the law on application kontrolno-cash technics (KKT), the Ministry of Finance has published for public comment on 9 June. The text of the draft three times longer than the total of the current law on application of cash registers and envisages revolutionary changes in the regulation in this area, first of all the new requirements by the booths, according to RBC.

The idea of the Ministry of Finance, cash registers need to store and transmit fiscal data to tax authorities online (through an authorised dealer). Each office, set in 2016, will be required to retake the paper and electronic checks, and all of the information proposed to be stored in a centralized database.

The business will be empowered not only to issue a check to the buyer as before, but also to register the purchase in his name (phone number) and send a check to the tax authorities in electronic form and send to the buyer if so requested. The law may come into force from 1 January 2016. Old cash register equipment can be used until the expiry of its validity, but not longer than seven years from the date of registration stated in the bill.

The project has already been tested in several regions: in Moscow, the Moscow and Kaluga regions and Tatarstan Republic. According to the NRF, in the experiment on a voluntary basis, participated more than a thousand companies for the six months was connected to more than 4 million new cash registers and punched over 17 million cash checks worth more than 13 billion rubles. In Moscow, the new Fund was tested in networks "Metro cash & carry", "Azbuka Vkusa", "Dixie", "Crossroads", "M. Video" and other.

The rejection of the use of new equipment may result in more significant fines than before. Amendments to the Code of administrative violations provide for, in fact, dimensionless fines. If the seller makes payments by cash, then the penalty will be determined in the amount of from three-fourths to the full amount of these payments, both for legal entities and citizens. The non-use of cash registers, according to the bill, and admits the lack of a record of the calculation in the fiscal memory of the cash register, and submitted to the tax authority information.

Exception the bill provides for traders working in inaccessible, remote from the communication networks areas. If there is no connection, you can use the cash without sending any data. And in remote locations, a list of which regions adopt independently, you do not apply cash under condition of granting to the buyer other proof of payment.

Exemption from the ticket office is also saved for individual entrepreneurs and organizations engaged in certain types of small businesses, such as selling ice-cream, kvass, peddling, selling tickets.

Note that in the Finance bill solely motivated by the good of the consumer. The transfer will allow you to create an automated system to monitor and protect the rights of buyers. Electronic documents will be available at any time, which distinguishes them from paper checks, which may be irretrievably lost, stated in the explanatory Memorandum to the bills. At the same time never explained the reason for this transformation is to accept that the enormous costs of creating and debugging a unified database and information exchange system about shopping population provides only for the comfort of consumers and greater protection of their rights. As well as saving retailers ("M. Video" during the experiment calculated that a single TC can save more than 14 million rubles for the inspection and maintenance of the new offices).

It appears that the project of the Ministry of Finance is part of the complex of fiscal measures developed by the government, including the introduction of new taxes, increased old and increase their collection. Other measures information in the media received in the last month. In particular, we are talking about two laws: the penalties for parasitism (from the St. Petersburg legislative Assembly) and the project of the Fes on the tax on the "unofficial" unemployed.

The Fes was proposed to impose a tax on those who work without formal employment. This "social contribution" (in the formulation of Department) have to pay all adult citizens who are not officially employed, not registered as unemployed and are not representatives of privileged categories: students, disabled, pensioners and so forth. Characteristically, individual entrepreneurs were not listed as exceptions. Among those whom the Agency wants to burden the tax, and includes "labor migrants" – citizens of Russia, who work under contract abroad and fishers of different directions.

"Currently, at the Federal level, discusses a number of measures aimed at the reduction of illegal employment" – announced the Deputy head of Rostrud Mikhail Ivankov in late may and late winter.

In addition, Fes has proposed to calculate and to punish those who work "smart casual", that is, formally receiving only the minimum wage. The Deputy head of Rostrud Mikhail Ivankov at the end of may said that "unreliable" citizens of both categories will be calculated through the comparison of their expenses with taxes and social contributions paid in GRP and fiscal authorities the citizens themselves and their employers. In that moment, when it was announced zamglavy Fes, this proposal caused some confusion is how the government and the fiscal authorities in particular are going to take into account the expense of the population. The legislative proposal, released by the Finance Ministry, dot the i.

However, the expert community considers the prospects of total control over the employment of the population through financial control is very vague prospect. Maintain a nationwide database of spending and automatic comparisons of their tax deductions and social charges appear to be a daunting task. Especially at the example of how to operate the database in smaller areas. For example, the Ministry of interior for many years not able to bring together all regional databases of ballistic examination, but even to introduce a single standard for this procedure. Moreover, the government has still not created a uniform standard for data exchange and single specimen documents – even allowing for the functioning of such mechanisms as the Single portal of public services. Not consolidated and base on, traffic police, Rosreestr and other agencies.

To monitor transactions of citizens would be able to use existing banking arrangements for accounting and exchange of such information, but such systems even within a single large Bank are a big problem. Given the fact that the Bank of Russia on average 1-2 times per year amends the rules of Bank reporting, this method is the implementation of the plans of the Ministry of Finance can also be attributed to region dystopia.

In addition, registration of the purchaser as a natural condition for the issuance of an electronic check may be subject to various legal collisions, and the higher courts will have to force the government to abandon or cut back the conditions of the system.published

Author: Alexei Usov

P. S. And remember, only by changing their consumption — together we change the world! ©

Source: newdaynews.ru/finance/535480.html

The government is creating technical and legal framework to control the employment and payment of taxes by the population. This will be done through the personification of all purchases made by citizens. The Ministry of Finance has created a bill in which all cash outlets should be replaced, and the new will register purchases electronically. Cash purchases will be tied to the phone number of the client. This innovation will allow to automatically take into account the costs of citizens, namely, mentioned by the initiators of the laws on penalties and taxes on informal employment: it was about controlling taxes by the population through the matching of mandatory contributions with expenditures.

The draft amendments to the law on application kontrolno-cash technics (KKT), the Ministry of Finance has published for public comment on 9 June. The text of the draft three times longer than the total of the current law on application of cash registers and envisages revolutionary changes in the regulation in this area, first of all the new requirements by the booths, according to RBC.

The idea of the Ministry of Finance, cash registers need to store and transmit fiscal data to tax authorities online (through an authorised dealer). Each office, set in 2016, will be required to retake the paper and electronic checks, and all of the information proposed to be stored in a centralized database.

The business will be empowered not only to issue a check to the buyer as before, but also to register the purchase in his name (phone number) and send a check to the tax authorities in electronic form and send to the buyer if so requested. The law may come into force from 1 January 2016. Old cash register equipment can be used until the expiry of its validity, but not longer than seven years from the date of registration stated in the bill.

The project has already been tested in several regions: in Moscow, the Moscow and Kaluga regions and Tatarstan Republic. According to the NRF, in the experiment on a voluntary basis, participated more than a thousand companies for the six months was connected to more than 4 million new cash registers and punched over 17 million cash checks worth more than 13 billion rubles. In Moscow, the new Fund was tested in networks "Metro cash & carry", "Azbuka Vkusa", "Dixie", "Crossroads", "M. Video" and other.

The rejection of the use of new equipment may result in more significant fines than before. Amendments to the Code of administrative violations provide for, in fact, dimensionless fines. If the seller makes payments by cash, then the penalty will be determined in the amount of from three-fourths to the full amount of these payments, both for legal entities and citizens. The non-use of cash registers, according to the bill, and admits the lack of a record of the calculation in the fiscal memory of the cash register, and submitted to the tax authority information.

Exception the bill provides for traders working in inaccessible, remote from the communication networks areas. If there is no connection, you can use the cash without sending any data. And in remote locations, a list of which regions adopt independently, you do not apply cash under condition of granting to the buyer other proof of payment.

Exemption from the ticket office is also saved for individual entrepreneurs and organizations engaged in certain types of small businesses, such as selling ice-cream, kvass, peddling, selling tickets.

Note that in the Finance bill solely motivated by the good of the consumer. The transfer will allow you to create an automated system to monitor and protect the rights of buyers. Electronic documents will be available at any time, which distinguishes them from paper checks, which may be irretrievably lost, stated in the explanatory Memorandum to the bills. At the same time never explained the reason for this transformation is to accept that the enormous costs of creating and debugging a unified database and information exchange system about shopping population provides only for the comfort of consumers and greater protection of their rights. As well as saving retailers ("M. Video" during the experiment calculated that a single TC can save more than 14 million rubles for the inspection and maintenance of the new offices).

It appears that the project of the Ministry of Finance is part of the complex of fiscal measures developed by the government, including the introduction of new taxes, increased old and increase their collection. Other measures information in the media received in the last month. In particular, we are talking about two laws: the penalties for parasitism (from the St. Petersburg legislative Assembly) and the project of the Fes on the tax on the "unofficial" unemployed.

The Fes was proposed to impose a tax on those who work without formal employment. This "social contribution" (in the formulation of Department) have to pay all adult citizens who are not officially employed, not registered as unemployed and are not representatives of privileged categories: students, disabled, pensioners and so forth. Characteristically, individual entrepreneurs were not listed as exceptions. Among those whom the Agency wants to burden the tax, and includes "labor migrants" – citizens of Russia, who work under contract abroad and fishers of different directions.

"Currently, at the Federal level, discusses a number of measures aimed at the reduction of illegal employment" – announced the Deputy head of Rostrud Mikhail Ivankov in late may and late winter.

In addition, Fes has proposed to calculate and to punish those who work "smart casual", that is, formally receiving only the minimum wage. The Deputy head of Rostrud Mikhail Ivankov at the end of may said that "unreliable" citizens of both categories will be calculated through the comparison of their expenses with taxes and social contributions paid in GRP and fiscal authorities the citizens themselves and their employers. In that moment, when it was announced zamglavy Fes, this proposal caused some confusion is how the government and the fiscal authorities in particular are going to take into account the expense of the population. The legislative proposal, released by the Finance Ministry, dot the i.

However, the expert community considers the prospects of total control over the employment of the population through financial control is very vague prospect. Maintain a nationwide database of spending and automatic comparisons of their tax deductions and social charges appear to be a daunting task. Especially at the example of how to operate the database in smaller areas. For example, the Ministry of interior for many years not able to bring together all regional databases of ballistic examination, but even to introduce a single standard for this procedure. Moreover, the government has still not created a uniform standard for data exchange and single specimen documents – even allowing for the functioning of such mechanisms as the Single portal of public services. Not consolidated and base on, traffic police, Rosreestr and other agencies.

To monitor transactions of citizens would be able to use existing banking arrangements for accounting and exchange of such information, but such systems even within a single large Bank are a big problem. Given the fact that the Bank of Russia on average 1-2 times per year amends the rules of Bank reporting, this method is the implementation of the plans of the Ministry of Finance can also be attributed to region dystopia.

In addition, registration of the purchaser as a natural condition for the issuance of an electronic check may be subject to various legal collisions, and the higher courts will have to force the government to abandon or cut back the conditions of the system.published

Author: Alexei Usov

P. S. And remember, only by changing their consumption — together we change the world! ©

Source: newdaynews.ru/finance/535480.html