541

11 harmful money habits that never should learn your children

To teach a child to thrift, the ability to count and not to waste money, not so easy. Some warnings and educational conversations in this case can not do. Children first of all pay attention not to the words of parents, and in their actions. Therefore, in order to accustom the child to the financial discipline necessary to carry out the work. Analysts are advised to erase from his life some bad money habits, which in any case should not adopt children.

Bad habit number 1. Do not generate bugetele you are not used to form the budget, record income and expenses, most likely, the money funneling out of your wallet. The habit of spending left and right, buying everything you want, of course, pleasant. However, this practice negatively impact on the personal financial condition in the first place, not allowing you to make savings.

Bad habit No. 2. To live in dalgate perhaps one of the biggest problems of modern families (and entire countries) – life in debt. We constantly buy things that are not in a position to pay immediately. A life in debt implies a reduction of income in the future. It's quite an unhealthy approach. Therefore, it is important to talk with your children about debt and why it's bad.

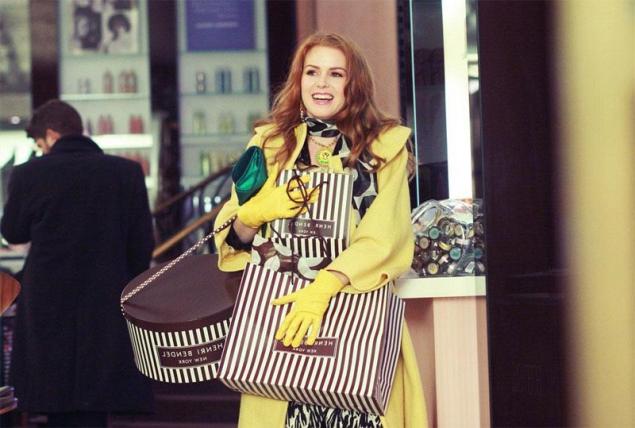

Bad habit No. 3. "Do like others"If you have friends there, then we certainly need to buy it. If you are coming from this rule, then, without noticing, teach children to rely on the opinion of strangers, and allow strangers to indirectly control your wallet and affect costs.

Bad habit No. 4. Pay only cartagenerian cash deprives the "feeling of money" and hinders precise control spending, I am sure Jeff Rose. If the child sees that the parents are constantly paying a certain credit card, he ceases to remember about real paper money and, consequently, does not learn to consider and appreciate. The logic is simple: the child will remember the bills, if the parents are constantly paying a "magic map".

Bad habit No. 5. Buy because deserve was autogolous possible that you bought a thing because I say to myself "I deserve it"? Probably, Yes, because we all love to treat ourselves. However, it is very important to the cause "I deserve it" does not arise too often, and even occasionally gave way to more modest "can I afford it".

Bad habit No. 6. Never talk about money"Why do kids talk about money, because they are still small?" — suggested by some parents. This approach is fundamentally wrong, I'm sure Jeff Rose. The kid never talked about what money is and where they come from, the risks grow up the big spender. And, most interestingly, this will not be his fault.

Bad habit No. 7. To live one namizni short, so live it must be bright. And to spend as much money as possible. Many people justify this statement, your unnecessary expenses, says financial expert. Children demonstrating this approach to money, you thereby teach them to live one day and not think about the future.

Bad habit No. 8. Save money and not to vladimirjankelevitch in anything or "save" is not your way? Rest assured, the children will take note of that too. So, in adult life will not be able to take care of tomorrow and think about the future. After all, investing is a long-term goal. But can they be interested in a man who from childhood accustomed to everything here and now?

Bad habit No. 9. Always walk on raspredilit perhaps the most common myth that is used by marketers to get people to buy as much as possible. Maybe sometimes (a big exception), the sales do save, but in most cases they are just a trap for unsuspecting customers.

Bad habit No. 10. To lie about dangerclose that you bought something, and then asked the child not to tell the spouse? At first glance it may seem that nothing dangerous there: think, asked the child to lie about money to avoid conflict situations... According to Jeff rose, the habit to involve their children in "financial secrets" is fraught with that child then he'll start to lie and spend money behind loved ones.

Bad habit No. 11. To pretend that money doesn't affect Zdorovaya relationship with money is having an impact on health. It could be stress from thinking about the debt to the Bank or cannot repay on time mortgage or buy something. There is only one proven way to reduce the negative impact of money on their own health – take your finances under control. And, of course, to teach the children.published

P. S. And remember, only by changing their consumption — together we change the world! ©

Join us in Facebook , Vkontakte, Odnoklassniki

Source: www.anews.com/ru/post/32011006

Bad habit number 1. Do not generate bugetele you are not used to form the budget, record income and expenses, most likely, the money funneling out of your wallet. The habit of spending left and right, buying everything you want, of course, pleasant. However, this practice negatively impact on the personal financial condition in the first place, not allowing you to make savings.

Bad habit No. 2. To live in dalgate perhaps one of the biggest problems of modern families (and entire countries) – life in debt. We constantly buy things that are not in a position to pay immediately. A life in debt implies a reduction of income in the future. It's quite an unhealthy approach. Therefore, it is important to talk with your children about debt and why it's bad.

Bad habit No. 3. "Do like others"If you have friends there, then we certainly need to buy it. If you are coming from this rule, then, without noticing, teach children to rely on the opinion of strangers, and allow strangers to indirectly control your wallet and affect costs.

Bad habit No. 4. Pay only cartagenerian cash deprives the "feeling of money" and hinders precise control spending, I am sure Jeff Rose. If the child sees that the parents are constantly paying a certain credit card, he ceases to remember about real paper money and, consequently, does not learn to consider and appreciate. The logic is simple: the child will remember the bills, if the parents are constantly paying a "magic map".

Bad habit No. 5. Buy because deserve was autogolous possible that you bought a thing because I say to myself "I deserve it"? Probably, Yes, because we all love to treat ourselves. However, it is very important to the cause "I deserve it" does not arise too often, and even occasionally gave way to more modest "can I afford it".

Bad habit No. 6. Never talk about money"Why do kids talk about money, because they are still small?" — suggested by some parents. This approach is fundamentally wrong, I'm sure Jeff Rose. The kid never talked about what money is and where they come from, the risks grow up the big spender. And, most interestingly, this will not be his fault.

Bad habit No. 7. To live one namizni short, so live it must be bright. And to spend as much money as possible. Many people justify this statement, your unnecessary expenses, says financial expert. Children demonstrating this approach to money, you thereby teach them to live one day and not think about the future.

Bad habit No. 8. Save money and not to vladimirjankelevitch in anything or "save" is not your way? Rest assured, the children will take note of that too. So, in adult life will not be able to take care of tomorrow and think about the future. After all, investing is a long-term goal. But can they be interested in a man who from childhood accustomed to everything here and now?

Bad habit No. 9. Always walk on raspredilit perhaps the most common myth that is used by marketers to get people to buy as much as possible. Maybe sometimes (a big exception), the sales do save, but in most cases they are just a trap for unsuspecting customers.

Bad habit No. 10. To lie about dangerclose that you bought something, and then asked the child not to tell the spouse? At first glance it may seem that nothing dangerous there: think, asked the child to lie about money to avoid conflict situations... According to Jeff rose, the habit to involve their children in "financial secrets" is fraught with that child then he'll start to lie and spend money behind loved ones.

Bad habit No. 11. To pretend that money doesn't affect Zdorovaya relationship with money is having an impact on health. It could be stress from thinking about the debt to the Bank or cannot repay on time mortgage or buy something. There is only one proven way to reduce the negative impact of money on their own health – take your finances under control. And, of course, to teach the children.published

P. S. And remember, only by changing their consumption — together we change the world! ©

Join us in Facebook , Vkontakte, Odnoklassniki

Source: www.anews.com/ru/post/32011006

Parenting boys: What you have to remember the father

Kazakhstan electric car will be shown in October