633

Hidden taxes paid by all Russians

There is an opinion that Russians pay too little tax, thereby parasitic on the body of the oil-rich state. Indeed, compared with the European countries, where the tax amount is 60-80% of revenues, 13% of our look is very, very poor. However, all is not as easy as it seems at first glance.

In fact, the tax on personal income 13% - this is only the tip of the iceberg, most of which are hidden taxes. In addition to the formal percent payroll citizen of Russia additionally gives a significant share of the money earned by them.

Firstly, in addition to the income tax the state receives 34% as insurance contributions for compulsory pension insurance, compulsory health insurance and compulsory insurance against temporary disability and maternity. It should be noted that despite the fact that both the employer will pay the amount of the agent, it is the money earned by the employee. That is, in the absence of the tax burden wages would be higher by 47%.

It is the citizens pay for all that formally brought into the state budget businessmen. Buy in-store, we pay the value added tax (VAT 18%), excise taxes, import duties, and so on. D. - All that business lay in the price of goods, shifting our burden on end users.

The costs of all entrepreneurs are invariably present rate of interest and the costs of goods and services of natural monopolies. Goods and services of natural monopolies (such as RR) are all economic agents - it is their costs, they will have to lay in their prices. As it turns out layering of additional costs and margins in the economy, for which the end user has to pay. In Russia, the interest rate - one of the highest in the civilized world, and the tariffs of natural monopolies are growing annually at a rate significantly outstripping the official inflation.

Thus, prices for housing and communal services in the national average increased annually by 20-25%, almost four times faster than the economy as a whole. Thus, the tax component of the housing and utility tariffs up to 50%. That is, the population and other consumers of public services (energy) to compensate monopolists all taxes, including 18% VAT; 34% of the wage fund in the form of insurance payments; 13% of the wage fund in the form of tax on income of individuals; 20% of taxable income in the form of income tax; other taxes, including water tax and depreciation on production assets.

But that's not all. We pay state taxes, land tax, real estate tax. In addition, significant taxes to pay the owners of vehicles. Let's start with the fact that the cost of imported vehicles include customs duty plus taxes, which constitute 40-50% of the import value of vehicles. It is considered that the duty paid only by those who buy a foreign car, but indirectly has the duty and the cost of Russian cars. After customs barriers raised the price level by allowing Russian brand to keep prices at a higher level. Also, the car owner pays out of pocket property taxes, insurance, inspection, and a fairly large vehicle tax. Do not forget about the excise tax on gasoline.

By the hidden forms of taxes include levies in kindergartens, schools and hospitals, because in fact this is a tax, not by a long way, through the treasury, and directly from the customer to the contractor. In fact, the so-called social taxes we often pay twice: buying additional health insurance, the second time we pay for something for which he had once paid. The same thing happens if you pay for a school where your children are learning.

All of the above gives only a rough idea of how much tax we pay in addition to the official 13%, deducted from salaries - the list is far from complete. So what can be discarded as untenable the idea that in Russia we live by the grace of the state. Instead, it is worth considering, for example, about the effectiveness of budget spending, which ultimately affects the personal budget of each of us.

Or about the negative impact of deferred taxes on the situation in the social and economic life of the country. After all, the fact that the current tax system hides from people the real size of the tax, entails a significant reduction in the social, political and civic activity of the citizens of Russia, as well as a brake on economic activity, leading to increased inflation, cross-sectoral imbalances in the economy, corruption, economic parasitism and much more.

taken then lf.rbc.ru/recommendation/finance/20...26/222904.shtml

Source:

In fact, the tax on personal income 13% - this is only the tip of the iceberg, most of which are hidden taxes. In addition to the formal percent payroll citizen of Russia additionally gives a significant share of the money earned by them.

Firstly, in addition to the income tax the state receives 34% as insurance contributions for compulsory pension insurance, compulsory health insurance and compulsory insurance against temporary disability and maternity. It should be noted that despite the fact that both the employer will pay the amount of the agent, it is the money earned by the employee. That is, in the absence of the tax burden wages would be higher by 47%.

It is the citizens pay for all that formally brought into the state budget businessmen. Buy in-store, we pay the value added tax (VAT 18%), excise taxes, import duties, and so on. D. - All that business lay in the price of goods, shifting our burden on end users.

The costs of all entrepreneurs are invariably present rate of interest and the costs of goods and services of natural monopolies. Goods and services of natural monopolies (such as RR) are all economic agents - it is their costs, they will have to lay in their prices. As it turns out layering of additional costs and margins in the economy, for which the end user has to pay. In Russia, the interest rate - one of the highest in the civilized world, and the tariffs of natural monopolies are growing annually at a rate significantly outstripping the official inflation.

Thus, prices for housing and communal services in the national average increased annually by 20-25%, almost four times faster than the economy as a whole. Thus, the tax component of the housing and utility tariffs up to 50%. That is, the population and other consumers of public services (energy) to compensate monopolists all taxes, including 18% VAT; 34% of the wage fund in the form of insurance payments; 13% of the wage fund in the form of tax on income of individuals; 20% of taxable income in the form of income tax; other taxes, including water tax and depreciation on production assets.

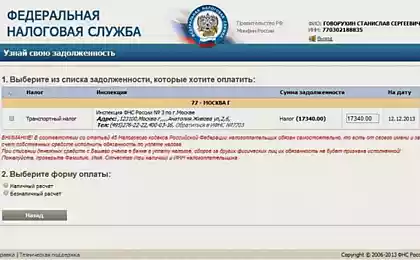

But that's not all. We pay state taxes, land tax, real estate tax. In addition, significant taxes to pay the owners of vehicles. Let's start with the fact that the cost of imported vehicles include customs duty plus taxes, which constitute 40-50% of the import value of vehicles. It is considered that the duty paid only by those who buy a foreign car, but indirectly has the duty and the cost of Russian cars. After customs barriers raised the price level by allowing Russian brand to keep prices at a higher level. Also, the car owner pays out of pocket property taxes, insurance, inspection, and a fairly large vehicle tax. Do not forget about the excise tax on gasoline.

By the hidden forms of taxes include levies in kindergartens, schools and hospitals, because in fact this is a tax, not by a long way, through the treasury, and directly from the customer to the contractor. In fact, the so-called social taxes we often pay twice: buying additional health insurance, the second time we pay for something for which he had once paid. The same thing happens if you pay for a school where your children are learning.

All of the above gives only a rough idea of how much tax we pay in addition to the official 13%, deducted from salaries - the list is far from complete. So what can be discarded as untenable the idea that in Russia we live by the grace of the state. Instead, it is worth considering, for example, about the effectiveness of budget spending, which ultimately affects the personal budget of each of us.

Or about the negative impact of deferred taxes on the situation in the social and economic life of the country. After all, the fact that the current tax system hides from people the real size of the tax, entails a significant reduction in the social, political and civic activity of the citizens of Russia, as well as a brake on economic activity, leading to increased inflation, cross-sectoral imbalances in the economy, corruption, economic parasitism and much more.

taken then lf.rbc.ru/recommendation/finance/20...26/222904.shtml

Source: