980

Strange taxes

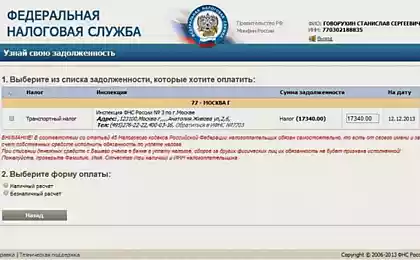

1) Tax card

Cards tax - just an example of how people can be taxed for something very popular and brings a lot of fun. In the 16-17 centuries been incredibly popular card game after dinner (not surprising, because there was no TV and computer games). Therefore, the king of England, James I realized how easy it is of the people lure money.

Tax card and whimsical images from the manufacturer's logo on the Ace Peak, have appeared during this English monarch who ruled in the early 17th century. He issued a law that required special point icon on the map, which argued that the duty has been paid. Until 4 August 1960, a deck of cards printed and sold in the UK are taxed, and Ace Peak also flaunted the name of the manufacturer and print that duty has been paid.

2) Tax on sweets

In September 2009, in Illinois it was decided to impose a tax on sweets, which was more than a tax on other foods. Illinois Department of Taxes carefully explained that "if the product contains flour, it must be frozen", ie it is not sweet and it will not be taxed.

In this scenario, the law raisins, covered with yogurt - a sweetness and drying, coated with yogurt - unsweetened product. Or, "Snickers" - a sweet and "Twix" - no.

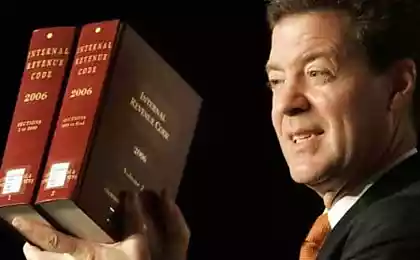

3) Tax on income of athletes

In the US, the tax paid by those who come in another city or state, and earn money there. Since the state government can not afford to follow all persons who do business in another area, it is mostly stop their attention on the very rich and famous people, in particular to professional athletes.

Famous athletes are forced not only to show the public their work schedule, but no one could hide their income. State collects the data, while spending a minimum of time, effort and money, and gets quite a decent amount.

4) Tax cowardice

Tax cowardice (known as a tax for exemption from military service) was a special tax levied on people who did not want to fight for the King, which was considered cowardice. This tax existed in England during the reign of King Henry I (1100-1135 years) and was initially relatively low, but King John (John) Lackland raised it to 300 percent and began to remove him from all the knights in the years when there were no wars .

This partly led to the Magna Carta. Tax cowardice existed for about 300 years and was then replaced by other ways to replenish the treasury at the expense of the troops.

5) Tax hats

Tax levied hats British government from 1784 to 1811 years, and only men. The tax was introduced by Prime Minister William Pitt the Younger was an easy way to raise money for the Treasury in accordance with the relative gross income persons. That is, it was assumed that the richer people would have more expensive hats, while the poor - just a cheap hat or walk at all without it.

Tax hat demanded that retailers have to buy a license, the cost of which for London is £ 2, and in other areas of the country - 5 shillings. Taxes paid by all - from producers to consumers, and for the avoidance of them levied huge fines. The death penalty has been promised to those who forged the seal on the payment of the tax hatter.

6) tax window

The tax on windows was significant social, cultural and architectural force in the kingdoms of England, Scotland, and then in the UK in 17-18 centuries. You may notice that some of the windows in some buildings built at that time, laid the bricks. This was due to taxes.

This tax was introduced in the framework of the Act of good deeds and monetary deficit in 1696 when King William III and was installed in accordance with the relative prosperity of the taxpayer and to the tax on income he had no attitude.

When the tax was introduced, it consisted of two parts: a flat rate of 2 shillings per house and unfixed tax for the amount of windows in it, starting from 10 pieces or more. Very rich family in this case might be different from the moderately rich that can afford to have a home with the highest possible number of windows. Surprisingly, this tax existed until 1851.

7) The tax on beards

In 1535 the king of England, Henry VIII, who himself wore a beard, has introduced a tax on beards. Tax proved a progressive tax, and depended on the social status of the taxpayer. His daughter, Elizabeth I, once again made this tax, and they were subject to only a 2-week beard. The same tax appeared in Russia, but for another reason: it was levied in the first place, not in order to replenish the treasury, and the king thought that the bearded men look like savages. How else to get the people to shave?

Peter I imposed a tax on beards in Russia in 1705. Those who paid the tax, had to wear a special "Borodov sign" - a copper or silver badge with the Russian eagle on either side of the image and the lower face with a beard.

8) Tax on Drugs

This tax was removed from a person for illegal possession of drugs in Tennessee, USA. He was inducted into the Tennessee General Assembly in January 2005 and charged with those who keep such drugs as cocaine, marijuana or hallucinogenic mushrooms.

Traffickers must be anonymous to pay taxes to the department of taxes and duties of the state where they are given stamp proving that they have paid the tax. If a drug dealer arrested without a print, he will have to pay a fine.

9) Tax bunch

Collection of agricultural research secretions (often called "gas tax" or "tax Bunch") - this tax, which was proposed in New Zealand in 2003 as a complement to the Kyoto Protocol. This tax is linked to farm animals release methane gas, which in New Zealand is 50 per cent of all other greenhouse gases.

Should I tell you how agriculture is important for New Zealand, so the tax was eventually rejected by the government, because the idea of taxing cow bunch seemed too absurd.

10) Tax on urine

Pecunia non olet - «Money does not smell." This sentence was the result of the tax on the urine, which is paid at the time of the Roman emperors Nero and Vespasian in the 1st century AD. Representatives of the lower classes of Roman society wrote in pots, which are emptied into special cesspools. All fluids were collected from public latrines and ... used for various purposes, as a valuable raw material.

For example, it was used for tanning, and it was a source of ammonia, which helped clean and whiten woolen clothes. Appears even reported that the contents of the latrines used for whitening teeth. When the son of Vespasian, Titus began to complain about the hideous nature of this tax, his father showed him the gold coins and uttered the famous phrase. This expression is still in vogue. It is also the name of Vespasian still associated with public toilets in France (vespasienne), Italy (vespasiani) and Romania (vespasiene).