331

Foreign exchange banking: exchange, rates, branches of a financial institution

In banking, foreign exchange operations are considered the most time-consuming and difficult to perform. These are sales/purchase of foreign currency. The currency can be used to pay foreign economic bills. It is a means of payment for the import, export, transportation of currency values from abroad. On the website of the bank https://en.ipakyulibank.uz/physical/obmen-valyut there is a calculator of the dollar and other popular foreign money exchange rate, allowing you to quickly make calculations.

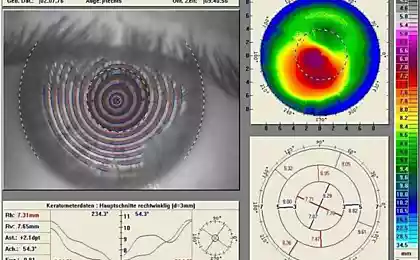

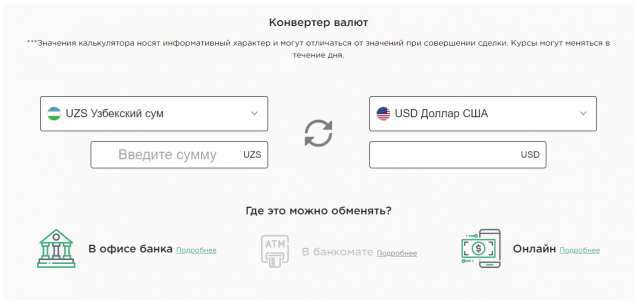

Currency exchange – calculation of final cost

The following banking procedures are considered to be operations of this type:

- import, transfer to and from the country of currency values;

- transactions where foreign currency is used as payment;

- settlements between residents of the country and non-residents;

- production of international financial transfers;

- operations performed in cases of transfer of property rights, other duties, to values in currency.

Here you can find https:/ /en.ipakyulibank.uz/physical/obmen-valyut/kursy current dollar exchange rate in the bank today.

In a commercial financial institution, the following transactions are carried out in currency:

- opening, maintenance of customer accounts (legal entities, residents, individuals, non-residents);

- provision of overdrafts;

- interest rate calculation;

- conducting non-trading operations by the bank (purchase/sale, collection, issue and service of cards).

In branches of banks dealing with currency, such as the website https://en.ipakyulibank.uz/pages/obmennye-punkty, similar transactions can also be carried out.

In addition, financial commercial institutions carry out the formation of relations with foreign partners conducting similar activities. They make conversion operations, international payments for services and goods. Banks and processes that attract, place currency funds on deposit, issue loans to legal entities and individuals.

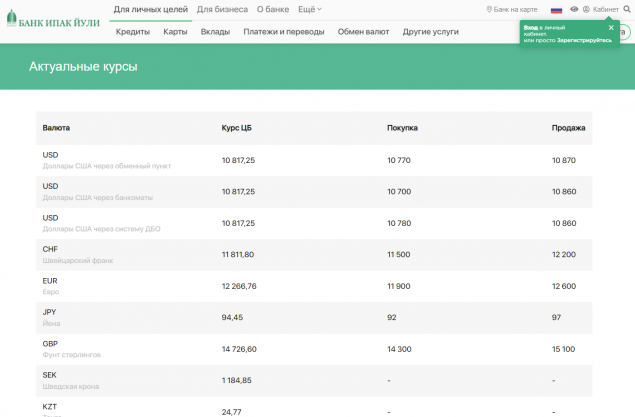

Current exchange rates

In financial institutions, exchange rates change even during the day. When making a transaction at the time of transferring funds, the indicators may be different from those calculated on the online calculator.

The formation of the rate occurs in bidding between buyers and sellers. Accordingly, the indicator will directly depend on the number of those wishing to purchase, sell funds. The rate can also be set by the state and fixed.

The process of formation of this indicator in the country is directly related to the convertibility of the national currency, its ability to freely change to other currencies. The reversibility of the currency depends on the restrictions imposed by the state of the bank. A freely convertible currency has no restrictions or is minimal.

Outsourcing in Ukraine for IT industry - for and against

How to choose a gold chain as a gift to a man