653

Tesla in 2016 plans to sell electric drives larger than the entire volume of the US market in 2015

In accordance with loud promises of the data at the beginning of last year (one, two), to the end of the year Tesla company in addition to the sale of electric vehicles started deliveries of stationary storage systems of electricity on the basis of lithium batteries: Tesla Powerwall for domestic use by private customers and Tesla Powerpack for commercial and industrial use .

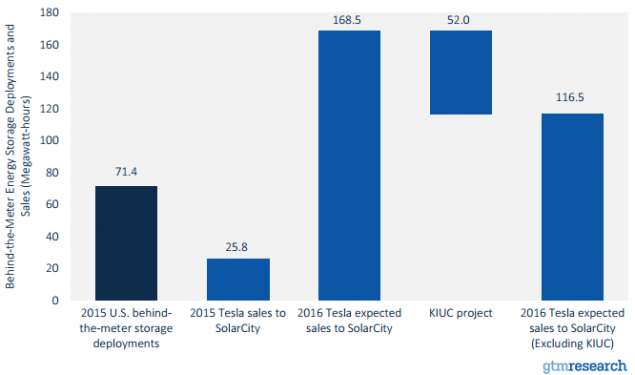

Apparently sales start was very good, at least at the recent Board of Directors and the reports provided by the company to the Securities and Exchange Commission USA (SEC) was voiced forecast that sales in the direction of stationary energy storage in 2016 will increase by almost 10 times the 2015. In financial terms, this corresponds to an increase in revenue to $ 4.9 million in 2015 to $ 44 million in 2016. Source (page 44). And this is the minimum score - in this case we are talking only about the supply of equipment through one affiliated company (SolarCity), without regard to other sales channels. But even in this one direction as the analysts considered, in physical terms, this corresponds to a total supply of storage capacity of 116.5 MWh, which is higher than the entire volume of the relevant US market amounted to only 71.4 MWh by the end of 2015.

Under the cut a few details and information about the beginning of construction in Hawaii, one of the world's largest energy storage on the basis of these batteries. And as a supplement brief analysis of the question "and whether the lithium reserves will last for such a large-scale use of batteries based on it?", Which usually occurs in the deliberations of such news.

First, let's make a small clarification: this title is not the energy storage market as a whole, but only of one of its segments, the so-called «Behind-The-Meter» (BTM), «after the counter" in a literal translation. It refers to drives installed by end users of electricity (or in a situation where the consumer and the producer is the person - ie, autonomous and semi-autonomous power supply system, usually on the basis of renewable energy sources) and not energy producers or centralized network supplier companies. As can be seen from the chart at the beginning of the article, the volume of this market in 2015 amounted to 71.4 MWh for all vendors combined, including, including the very Tesla will receive an end of the year the market share of 36% of the index of 25.8 MWh. And in 2016 Tesla drives sales forecast is already 116.5 MWh (163% of the previous year's volume of the market) and 52 MWh storage devices will be further delivered to a major project implemented jointly with the company SolarCity and misses the BTM category. < br>

We are talking about industrial solar power capacity of 13 MW on the island of Kauai in the Hawaiian Islands archipelago. One such station by 12 MW was there built and put into operation as early as 2014 and since then provides a production of about 5% in the energy consumption of the island. Currently under construction, the second such SES capacity of 13 MW, but this time with her will be built one of the world's largest energy storage capacity of 52 MWh based Tesla Powerpack supplied modules. The corresponding agreement was signed in the autumn of last year, the construction should be completed by the end of this year. The ultimate cost of electricity including both the generation of solar energy and storing it on a prisoner for 20 years, the agreement will be 14.5 cents per kWh, which is already lower than the cost of energy derived from conventional sources, which in the case of Hawaii accounted for almost entirely imported (mainly this liquefied natural gas and diesel). All this will help to implement the ambitious plan adopted by the government of Hawaii, according to which the share of electricity from local renewable sources, should be at least 30% by 2020, 50% by 2025 and to reach the full 100% no later than 2045.

So in the end the promised information on lithium, in relation to production and reserves which often arouses questions in light of the news about the plans / projections for the rapid growth of production and sales of electric vehicles and energy storage. It does not break the bullish trend of the banal lack of raw materials in the first place itself lithium?

All who are interested in this issue, it is recommended to download a good report Mineral Commodity Summaries annually updated the US Geological Survey (USGS) which are briefly discussed prices, export / import volumes, the total volume of production of proven reserves and immediately all the major types of industrial raw materials. Including Lithium course - in the last report in 2016, compiled based on the data of 2015, we desired section is on pages 100-101. All data in this report, other than the average prices shown in terms of pure (metal) Li.

For readers, time-saving or having difficulty with English short squeeze on lithium facts from the survey and other sources:

- despite the rapid growth in the production of electric vehicles and energy storage devices in recent years, the share of the production of the batteries until there are only 35 % consumption of extracted lithium, with particular strength in the battery is less than half of this section, and large leaves on various electronic gadgets (mobile phones, laptops, tablets, etc.), which, although they have very small capacity battery unit, but produced billions of pieces annually;

- the current global rate of production is 32 500 tons per year;

- the current reserves in the major supplying countries is estimated at 14 million tons, and we are talking about already explored reserves and extraction of which it is possible and economically feasible with the current development of technology and stacked the average level of commodity prices, and a very rough estimate of the total available resources is still much higher - about 40 million tons;.

- lithium consumption in the manufacture of electric accumulators Now is not more than 200 grams of metal per 1 kWh capacity, and with the improvement of technology may still fall substantially further, because currently achieved in practice, the efficiency of its use does not exceed 35-40% of the theoretical maximum;

- the average price of lithium "battery" quality wholesale batches of 34 $ per 1 kg in 2015 (at the rate of $ 6400 per ton of lithium carbonate, which on itself lithium to about 19% by weight) or $ 7 per kWh battery capacity, when the market value of the finished product is not less than $ 300 per kWh < /The conclusions one can make their basis of these data. For me personally, they will be:

At current rates of production of already known and studied enough reserves for more than 400 years, it is one of the highest levels of coverage in the mining industry. Of course production rate will grow quite rapidly following the increasing demand (eg "gigafabrika" battery, which is now building a Tesla after reaching full capacity will consume about 10 000 tons of lithium per year), but in any case is now a shortage of lithium reserves are not worth it at all . And it will not be for at least another ten years, and after tens of years, the main source of lithium would have already become not its primary production and recycling disposal of the old battery operation. Construction of the first plant for recycling and recovery of valuable resources (lithium, cobalt, nickel) is now.

It is quite possible problems not in terms of stocks, and with sufficient extraction rates. But these problems are easily solved through normal market mechanisms: a temporary jump in prices in the commodities market if production growth will begin to significantly lag behind the growth of consumption - & gt; wave of major investments in the expansion of capacity of mining companies - & gt; jump in output - & gt; prices fall back, perhaps even below the initial level. Given the very small share attributable to lithium in the final cost of lithium batteries (at the moment only about 2.5%), a possible increase in prices for raw materials the development of this industry will not hurt. Rather, in this case, the first to suffer other lithium consumers, who will be forced to reduce the time of its use and the development of electric vehicles and batteries will go on without slowing the pace.

Source: geektimes.ru/post/275616/