846

Elon Musk and Tesla proposed to merge SolarCity

The Tesla stores will be a new item:

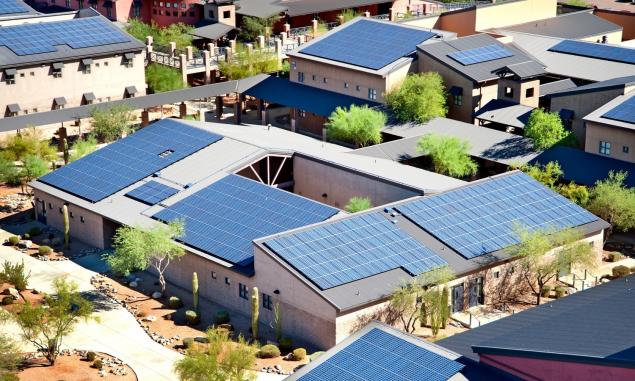

solar panels

Elon Musk - CEO and largest shareholder of Tesla Motors and SolarCity - proposed to combine the assets of the two companies at the expense of the share exchange. According to experts, is shuffling the deck in the technology and energy empire Elon Musk makes economic sense.

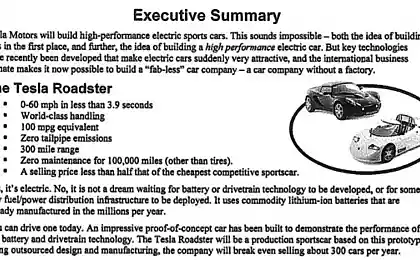

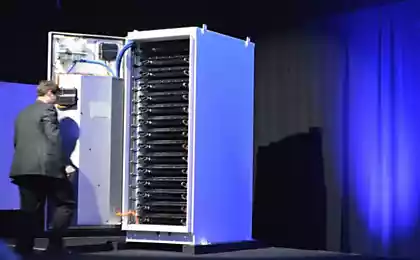

In March 2015 the company Tesla Motors has launched a subsidiary company Tesla Energy, which offers household lithium-ion batteries Powerwall and Powerpack to power homes and businesses from renewable energy sources. One of the leaders in the global market SolarCity solar energy - an element missing in this picture

. Energy company SolarCity is engaged in designing, financing and installation of solar energy systems. The company employs more than 13 000 people. The company was founded in 2006 by brothers Peter and Lyndon Raivo, who implemented the idea of his cousin Elon Musk. Elon himself became head of the company and helped with the launch of the project.

For ten years, SolarCity keeps leadership in the service sector to install solar panels in California, ranking second in the United States the number of plants.

SolarCity's main business - selling private homeowners solar panels on leasing (ie practically free installation) so that the monthly payment on the lease is less than the bill for electricity from utility companies

. In addition to private households in the number of customers SolarCity include large organizations such as Walmart, Intel and the US Army.

Tesla has offered shareholders SolarCity exchange of shares at the rate of 0, 122 and 0, 131 shares of Tesla per share SolarCity, ie with a premium of 21% or 30% in relation to the market price, based on yesterday's stock price SolarCity ($ 21, 19) and the five-day weighted average price of shares in Tesla.

Following the announcement of the sentence corrected market, based on new estimates and the probability of the transaction: Tesla shares fell by 15%, SolarCity shares rose 12%

. "That's what we thought and that discussed for many years, - commented on the future deal Elon Musk. - But a good time seems to come right now. " Elon Musk has in mind that in a month comes into operation Gigafabrika Tesla to manufacture lithium-ion batteries that will be used for the manufacture of household lithium-ion batteries Powerwall and Powerpack to power homes. These devices are ideally combined with solar power plants, which are installed on the roofs of homes the company SolarCity.

The deal must approve the company's shareholders. Himself Elon Musk, the main shareholder, withdrew from participation in the vote, as well as chairman of the board of directors of both companies Antonio Gracias (Antonio Gracias).

If the shareholders approve the transaction, the post-merger combined company staff of 30 000 people, and all the products are united under a single brand Tesla. It will include electric vehicles, batteries and solar panels for the consumer market.

Financial experts have expressed some concerns about the financial stability of the business. For example, Gigafabrika Tesla worth $ 5 billion, will begin to make a profit no earlier than 2020, and Tesla recently announced the sale of additional shares to raise another $ 1, 7 billion for capital expenditure.

Tesla's market capitalization is $ 32, 7 billion and a market capitalization SolarCity - $ 2, 1 billion

. In 2014, the net loss of Tesla Motors were $ 294 million, in 2015 -. Almost $ 900 million net loss SolarCity also doubled in 2015 to $ 769 million

. Besides these two companies, Elon Musk is also the executive director and major shareholder of another company - Space Exploration Technologies (SpaceX). That's SpaceX company in 2014 made the largest buyer of bonds in the amount of $ 214 million, which released SolarCity.

Since 2013, Tesla Motors shares rose more than 500%, although the company has not yet turned a profit. Investors are anxiously watching spending Tesla, in which one sees "signs of burning money»

. Personally, Elon Musk owns 22,160,370 shares of SolarCity. If the shareholders approve the exchange of shares with premium to the market price, the value of the asset Elon Musk will increase from $ 587,249,805 to $ 631 570 545.

Elon Musk

Elon Musk financed their companies, when they needed money to buy their shares, and open private lines of credit secured by their remaining shares. Possible financial destabilizaiya in such a situation threatens to margin calls, that is, the forced closing position. In other words, if SolarCity shares continued to decline, then additional funding would be required for open lines of credit, or ... well, you do not want to even think about it.

Exchange shares Tesla solves the problem with a reduction SolarCity shares. Exchange shares also solves the problem with more debt before SolarCity SpaceX.

Himself Elon Musk said that the new deal does not increase the financial risk for the shareholders of Tesla, but only "multiplies the opportunities for both companies»

. The main thing is to have enough finances to start serial production of mass model electric Tesla Model 3, which is due out on the market in the second half of 2017 at a price of $ 35,000 and which has already received more than 400,000 pre-orders.

Source: geektimes.ru/post/277598/

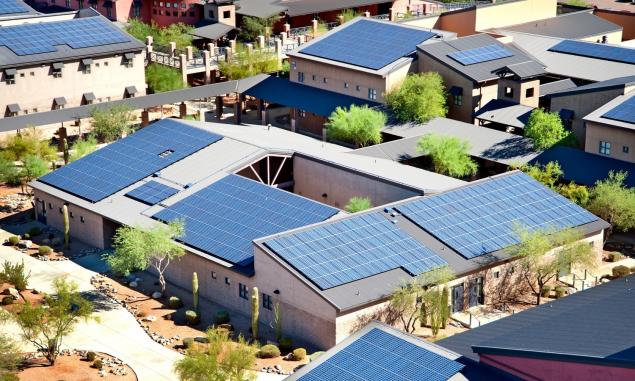

solar panels

Elon Musk - CEO and largest shareholder of Tesla Motors and SolarCity - proposed to combine the assets of the two companies at the expense of the share exchange. According to experts, is shuffling the deck in the technology and energy empire Elon Musk makes economic sense.

In March 2015 the company Tesla Motors has launched a subsidiary company Tesla Energy, which offers household lithium-ion batteries Powerwall and Powerpack to power homes and businesses from renewable energy sources. One of the leaders in the global market SolarCity solar energy - an element missing in this picture

. Energy company SolarCity is engaged in designing, financing and installation of solar energy systems. The company employs more than 13 000 people. The company was founded in 2006 by brothers Peter and Lyndon Raivo, who implemented the idea of his cousin Elon Musk. Elon himself became head of the company and helped with the launch of the project.

For ten years, SolarCity keeps leadership in the service sector to install solar panels in California, ranking second in the United States the number of plants.

SolarCity's main business - selling private homeowners solar panels on leasing (ie practically free installation) so that the monthly payment on the lease is less than the bill for electricity from utility companies

. In addition to private households in the number of customers SolarCity include large organizations such as Walmart, Intel and the US Army.

Tesla has offered shareholders SolarCity exchange of shares at the rate of 0, 122 and 0, 131 shares of Tesla per share SolarCity, ie with a premium of 21% or 30% in relation to the market price, based on yesterday's stock price SolarCity ($ 21, 19) and the five-day weighted average price of shares in Tesla.

Following the announcement of the sentence corrected market, based on new estimates and the probability of the transaction: Tesla shares fell by 15%, SolarCity shares rose 12%

. "That's what we thought and that discussed for many years, - commented on the future deal Elon Musk. - But a good time seems to come right now. " Elon Musk has in mind that in a month comes into operation Gigafabrika Tesla to manufacture lithium-ion batteries that will be used for the manufacture of household lithium-ion batteries Powerwall and Powerpack to power homes. These devices are ideally combined with solar power plants, which are installed on the roofs of homes the company SolarCity.

The deal must approve the company's shareholders. Himself Elon Musk, the main shareholder, withdrew from participation in the vote, as well as chairman of the board of directors of both companies Antonio Gracias (Antonio Gracias).

If the shareholders approve the transaction, the post-merger combined company staff of 30 000 people, and all the products are united under a single brand Tesla. It will include electric vehicles, batteries and solar panels for the consumer market.

Financial experts have expressed some concerns about the financial stability of the business. For example, Gigafabrika Tesla worth $ 5 billion, will begin to make a profit no earlier than 2020, and Tesla recently announced the sale of additional shares to raise another $ 1, 7 billion for capital expenditure.

Tesla's market capitalization is $ 32, 7 billion and a market capitalization SolarCity - $ 2, 1 billion

. In 2014, the net loss of Tesla Motors were $ 294 million, in 2015 -. Almost $ 900 million net loss SolarCity also doubled in 2015 to $ 769 million

. Besides these two companies, Elon Musk is also the executive director and major shareholder of another company - Space Exploration Technologies (SpaceX). That's SpaceX company in 2014 made the largest buyer of bonds in the amount of $ 214 million, which released SolarCity.

Since 2013, Tesla Motors shares rose more than 500%, although the company has not yet turned a profit. Investors are anxiously watching spending Tesla, in which one sees "signs of burning money»

. Personally, Elon Musk owns 22,160,370 shares of SolarCity. If the shareholders approve the exchange of shares with premium to the market price, the value of the asset Elon Musk will increase from $ 587,249,805 to $ 631 570 545.

Elon Musk

Elon Musk financed their companies, when they needed money to buy their shares, and open private lines of credit secured by their remaining shares. Possible financial destabilizaiya in such a situation threatens to margin calls, that is, the forced closing position. In other words, if SolarCity shares continued to decline, then additional funding would be required for open lines of credit, or ... well, you do not want to even think about it.

Exchange shares Tesla solves the problem with a reduction SolarCity shares. Exchange shares also solves the problem with more debt before SolarCity SpaceX.

Himself Elon Musk said that the new deal does not increase the financial risk for the shareholders of Tesla, but only "multiplies the opportunities for both companies»

. The main thing is to have enough finances to start serial production of mass model electric Tesla Model 3, which is due out on the market in the second half of 2017 at a price of $ 35,000 and which has already received more than 400,000 pre-orders.

Source: geektimes.ru/post/277598/