"Yikes!" The story of how Nassim Taleb has made the inevitable disaster in the investment strategy

Bashny.Net

Bashny.Net

Black Swan

Malcolm Gladwell, 2002

Once, in 1996, the year, a trader on Wall Street called Nassim Nicolas Taleb went to visit Victor Niderhoffer. Niderhoffer at the time was one of the most successful money managers in the country. He lived and worked in an estate of 13 acres in the State of Connecticut, and when Taleb get to the venue from his home in Larchmont, he was asked to introduce themselves when entering into possession Niederhoffer. Then he has come a long way along the winding road past the tennis courts, squash courts, swimming pools, until arrived at the huge mansion, where literally every inch was covered with pieces of American folk art of the 18th and 19th centuries.

In those days Niderhoffer often played tennis with George Soros. Recently, he published his book "Universities Stock Operator," which the author dedicated to his father, Artie Niderhoffer, police from Coney Island, and became an instant bestseller. Niderhoffer possessed a vast and eclectic library and looked like a man insatiable desire to know. When Victor was studying at Harvard, he was the first ever played squash and immediately said that would be the best in the sport. Needless to say, that soon he was able to beat the legendary Shariff Khan, thus taking first place in the US Open squash. All these facts are well characterized Niederhoffer personality. Until he heard rumors about the success of Taleb in options trading, and he invited him to Connecticut. Taleb was delighted.

"We talked a little, basically, I just watched him - says Taleb, - I spent seven hours staring as Niderhoffer works. He was fifty, and everyone else in his office - a little over twenty, and yet Viktor looked energetic all together. After markets closed, he went to the tennis court, where rescued about a thousand balls, training backhand. " Nassim Taleb comes from a Christian Lebanon, and his mother tongue - French, so the name of Niderhoffer its pronunciation sounds more exotic, much like Der Nai Hoffer. "This guy lived in a huge mansion stuffed with thousands of books, just like in my childhood dream! - He continues - Niderhoffer belonged to another world, the world of scientists, and I sincerely voskhschalsya them ».

However, there was one problem, and just as it is the key to understanding the strange way that chose Taleb, and why it currently takes place, "the chief dissident Wall Street." Despite the envy and admiration, he never for a moment I would like to be like Niderhoffer - not then, not now, not ever in my life. Because, as he looked around at all this wealth, library, tennis court, art on the walls, all the countless millions who Niderhoffer done for many years - he could not escape the thought that all this could be the result of pure luck .

Despite the envy and admiration, Taleb never for a moment I would like to be like Niderhoffer - not then, not now, not ever in my life. Because when he looked around, all these countless millions who Niderhoffer done for many years - he could not escape the thought that all this could be the result of pure luck. h4> Taleb knew that this would be his idea sounded heretical, he said it out loud. Wall Street has always rested on the principle that qualities such as skill, experience and expertise in the investment of the same value, such as surgery or operate aircraft. Those who were astute enough to suggest how important is to have the software in the future, Microsoft shares bought back in 1985 and made a fortune. Those who guessed the vulnerability of the dot-com in 1999, sold shares of technology companies and avoid the collapse of Nasdaq. Warren Buffett has acquired worldwide fame and the nickname "Sage of Omaha" for a reason: it is obvious that if someone started from scratch and amassed billions, it must be smarter than all others, with a lot.

Malcolm Gladwell, 2002

Once, in 1996, the year, a trader on Wall Street called Nassim Nicolas Taleb went to visit Victor Niderhoffer. Niderhoffer at the time was one of the most successful money managers in the country. He lived and worked in an estate of 13 acres in the State of Connecticut, and when Taleb get to the venue from his home in Larchmont, he was asked to introduce themselves when entering into possession Niederhoffer. Then he has come a long way along the winding road past the tennis courts, squash courts, swimming pools, until arrived at the huge mansion, where literally every inch was covered with pieces of American folk art of the 18th and 19th centuries.

In those days Niderhoffer often played tennis with George Soros. Recently, he published his book "Universities Stock Operator," which the author dedicated to his father, Artie Niderhoffer, police from Coney Island, and became an instant bestseller. Niderhoffer possessed a vast and eclectic library and looked like a man insatiable desire to know. When Victor was studying at Harvard, he was the first ever played squash and immediately said that would be the best in the sport. Needless to say, that soon he was able to beat the legendary Shariff Khan, thus taking first place in the US Open squash. All these facts are well characterized Niederhoffer personality. Until he heard rumors about the success of Taleb in options trading, and he invited him to Connecticut. Taleb was delighted.

"We talked a little, basically, I just watched him - says Taleb, - I spent seven hours staring as Niderhoffer works. He was fifty, and everyone else in his office - a little over twenty, and yet Viktor looked energetic all together. After markets closed, he went to the tennis court, where rescued about a thousand balls, training backhand. " Nassim Taleb comes from a Christian Lebanon, and his mother tongue - French, so the name of Niderhoffer its pronunciation sounds more exotic, much like Der Nai Hoffer. "This guy lived in a huge mansion stuffed with thousands of books, just like in my childhood dream! - He continues - Niderhoffer belonged to another world, the world of scientists, and I sincerely voskhschalsya them ».

However, there was one problem, and just as it is the key to understanding the strange way that chose Taleb, and why it currently takes place, "the chief dissident Wall Street." Despite the envy and admiration, he never for a moment I would like to be like Niderhoffer - not then, not now, not ever in my life. Because, as he looked around at all this wealth, library, tennis court, art on the walls, all the countless millions who Niderhoffer done for many years - he could not escape the thought that all this could be the result of pure luck .

Despite the envy and admiration, Taleb never for a moment I would like to be like Niderhoffer - not then, not now, not ever in my life. Because when he looked around, all these countless millions who Niderhoffer done for many years - he could not escape the thought that all this could be the result of pure luck. h4> Taleb knew that this would be his idea sounded heretical, he said it out loud. Wall Street has always rested on the principle that qualities such as skill, experience and expertise in the investment of the same value, such as surgery or operate aircraft. Those who were astute enough to suggest how important is to have the software in the future, Microsoft shares bought back in 1985 and made a fortune. Those who guessed the vulnerability of the dot-com in 1999, sold shares of technology companies and avoid the collapse of Nasdaq. Warren Buffett has acquired worldwide fame and the nickname "Sage of Omaha" for a reason: it is obvious that if someone started from scratch and amassed billions, it must be smarter than all others, with a lot.

But the question that plagued Taleb: Was the success of people like the result of their amazing abilities, and these abilities were invented after the fact, when it was necessary to find some explanation for such impressive achievements? George Soros once said that made a fortune with the help of some "theory of reflexivity markets", which he himself had invented. However, later, Soros wrote that in most cases, his theory "is so weak that it can be ignored." Taleb former business partner, Jean-Manuel Rozan once spent the whole day talking to Soros about the stock market. Soros has categorically stated that he is on the market - "bear" and launched a complex theory about why always prefer to play on the slide. The stock market boomed. Two years later, he faced with Rosanne Sorosm tennis tournament and reminded him of the conversation, but at the same time asked how to live bear. "Yes, I remember, I remember well! You know, I changed my mind. I began to trade on the increase, and my amazing luck. " He changed his mind! Perhaps most importantly, you need to know about Soros, once told his son Robert:

"My father sits down and immediately give you a bunch of theories of why he does what he does. But I'll tell you this: at least half of that - nonsense. In fact, it changes the position in the market when it begins to feel instinctively that something went wrong. It has nothing to do with rationality. It's kind of instinct, feed alerts ».

The question of why someone has achieved success in the financial markets, irritated Taleb. Simple arifmiticheskie calculations give a clear picture of the case in the area of money management. Suppose in the world there are ten thousand of investment managers. Completely random half of them by the end of the year to make money, and, at least casually, the second half of their lost. Assume further that after the losers emerge from the market, the game is replayed again between those who remained. In five years we will have 300 managers, casually successfully completed financial year, ten - nine of them remain. Nine people, who made a fortune by winning ten consecutive years as a result of a simple good luck! Niderhoffer like Buffett and Soros undoubtedly was an outstanding person. He was a doctor of economic sciences at the University of Chicago and the first to propose the idea that using a mathematical analysis of market anomalies can identify profitable model. But how to prove that Niderhoffer was not at the same time one of those nine lucky? And who can assume that the eleventh year, he suddenly lost everything, absolutely everything, destroy more than 130-million fund, and as they say on Wall Street, "burst»? ..

Taleb recalls his childhood in Lebanon, a country that, as he puts it, made its way "from heaven to hell" in just six months. His family once owned vast estates in the north of Lebanon. Now all this has disappeared as a result of a prolonged civil war. Santa Nassim was deputy prime minister and the son of the Deputy Prime Minister; a man of great personal dignity, he lived out his days in the inferior flat in Athens. Taleb came to the conclusion that the blame for these events lies in the unfortunate event, dropped out of his home. In a world of so much uncertainty ... you can never be sure that all the really important things in life will not collapse overnight, when Fortune suddenly turn away from you.

Some of what Taleb nevertheless learned from Niederhoffer. For example, in his example, he decided to go in for sports, and regular visits to the gym. But the main thing was that Niderhoffer, a staunch empiricist, who believed that "everything that can be verified, should be checked" infected Taleb this idea, to the point that when he started his own hedge fund a few years later, he called his "Empiricus." But that was all. Nassim Taleb has decided that he will never use risky strategies that have had the slightest chance to destroy his foundation.

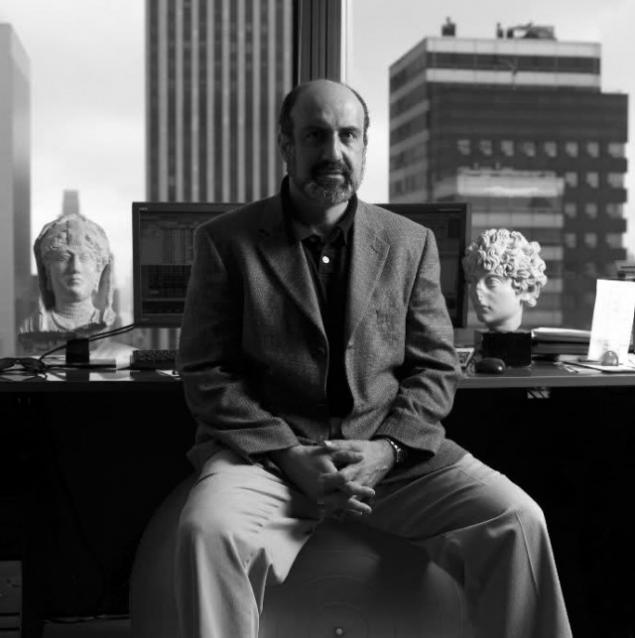

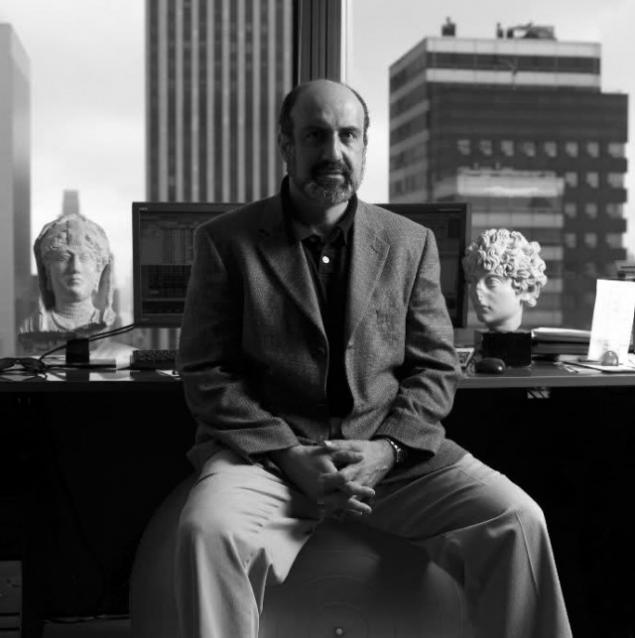

Nassim Taleb - tall muscular man in his early forties, with graying beard beginner. His heavy bushy eyebrows and aquiline nose. His skin Lebanese olive hue. Taleb - man of moods, and when the eyebrows begin to arrive to the bridge of his nose, and his eyes narrowed, as if electrified air around. Some friends were in his face resemblance to Salman Rushdie, and colleagues in the office swear that he lost at birth, twin brother of Mulla. Taleb asserts himself (quite wrongly) that looks like Sean Connery.

He lives in a house with four bedrooms, twenty-six Russian Orthodox icons, nineteen busts of ancient Romans and four thousand books. Taleb gets up at dawn to devote time to writing. He wrote two books, one of which is dedicated to working with derivative financial instruments (and highly appreciated by the community of economists), the second is, "Fooled by Randomness", published last year, has become a Wall Street about the same, that "Ninety-five theses "of Martin Luther for the Catholic Church. Sometimes after dinner, he goes to the city and attended lectures on philosophy. During the school year, Taleb teaches evening classes at the graduate school at New York University finance, after which it can be found in the bar "Odeon cafe" in Tiberike ranting about, for example, or the subtleties of stochastic volatility creative Greek poet Cavafy.

Taleb Office in Manhattan consists mainly of sales area the size of a studio apartment. The owner is sitting in the corner behind a laptop surrounded by his team: Mark Spitsnegela, chief trader Danny toast, another trader, programmer Martin Wynne and postgraduate students Pallopa Ansipana. Of these, only Mark can give thirty, and Vin, Danny and Pallop more like high school graduates. The room also has a sitting area with a bookshelf and a TV tuned to a single channel CNBC. Some Greek bust adorns the table Taleb, one is perched next to the front door. On the wall hangs a poster with a slightly shabby exhibition of ancient Greek artifacts, photos and Mullah small ink sketch mental patron "empiricists", the philosopher Karl Popper.

This spring morning staff "empiricists" concerned about solving complex problems with the square root of n. Taleb, furiously squeaking marker writing on the chalkboard range of possible solutions, and Spitsnegel and Pallop closely watching him. Spitsnegel, blonde, comes from the West, yoga looks (unlike Taleb) is very balanced. Pallop, who arrived from Thailand for a good education, received a doctorate in economics at Princeton. He had long black hair and a bit absent-minded look. "Pallop very lazy" - says Taleb several times during the day to no addressing, however, he says it with such love, like "lazy", in his understanding, is synonymous with "genius". Pallop not touch your computer and turns in his chair farther rolling away from the table. He recently read a book on cognitive psychology and Daniel Amos Tversky Kannemana and found it "somewhat disappointing" due to the fact that the arguments of psychologists "totally unverifiable».

Trinity strives to solve the problem on the board and comes to the conclusion that the choices made by Taleb, may be wrong, however, markets are about to open, so the owner of the office back to the table and picks from Spitsnegelom dispute about what music to play on office boombox. Spitsnegel knows how to play the piano, and for this reason, appointed himself a DJ "empiricists." It offers Mahler, but Taleb does not approve: "Mahler is not suitable for volatility! Perhaps Bach? .. Matthew Passion? "Taleb points to Spitsnegela dressed in gray wool turtleneck:" Just look at him. Look at that von Karajan. He obviously created to live in a castle. By the way, the best technician with all of us, not talkative and excellent skier. This is our mark! "Spitsnegel rolls his eyes, and the man to whom Taleb refers is the mysterious Dr. Wu from a nearby hedge fund at the other end of the corridor. Dr. Wu is very thin and always wears dark glasses. We asked his opinion about the problem with n, but he refused to answer. Dr. Wu came here to conduct intelligent conversations, borrow books and chat with Mark about music, says Taleb, when their visitor leaves.

"Empiricus" holds a unique strategy. There are trading options on stocks and bonds. Imagine, for example, that General Motors shares traded for $ 50 a share, and you - a major investor on Wall Street, in the portfolio which such action is. Comes to you and offers options traders to sell him the right to repurchase these shares within three months if the price at the time drops to $ 45. You see the history of GM shares and it turns out that they are very stable, it is likely that in such a short period of their value fall by 10%, is very small. The deal looks reasonable, does not it? Ok, you say, and clap hands. Do you sell an option to, for example, a million shares at 10 cents apiece, and puts it in his pocket $ 100 000. So, if you find yourself right, and after three months the price of GM shares remain above $ 45, you will not lose anything.

The trader also relies on a very unlikely event, but if this event occurs, it will be a huge profit. For example, if the price falls to $ 35, this cunning will reappear on your doorstep, buy your stocks, and offer to repurchase them back for $ 45 that will make you much poorer, and it - rich.

In the jargon of Wall Street, such a transaction is called out-of-the-money option (vnedenezhny option). Its options are very diverse. For example, you could sell the trader GM-stock options for $ 30, or if you play against GM, at 60. You can trade options on bonds, the index S & P, foreign currencies or mortgage or even to any financial instrument of your choice ; put on the market growth, declining, or that it will remain stable. Options allow investors to play hard and turn the dollar into the top ten. They also help to hedge risks: for example, pension funds do not go bankrupt in the crisis because defending positions by buying options. What is good in options trading is the fact that you can by studying the history of the instrument, to calculate the risk that the price will change in the near future, not in your favor, and see whether it makes sense to invest. This process is very similar to the way in which insurance companies analyze the actuarial tables, calculating the cost of insurance. These calculations are usually investment banks involved in the former physics from Russia, mathematicians and programmers from China from India. On Wall Street, these specialists are called "quanta».

In fact, Taleb and his team in the "empiricists" are quanta. But they flatly deny it, because I do not believe that the risks of the stock markets can be calculated in the same way as the life expectancy of people. The fact that the events of the physical world, such as the death or the result of a poker game, a much more predictable on the basis of mathematical analysis, as have natural limitations. The risks of such events can be calculated, and they will follow a normal distribution curve - the famous bell curve having a bell shape. But unless market developments, all these unexpected highs and tragic fall, fit into this curve? ..

The economist Eugene Fama once investigated changes in stock prices, and came to the conclusion that if they followed a Gaussian curve, sudden jumps would occur approximately every 7,000 years. However, in reality these jumps occur no less frequently than once every 3-4 years, as investors themselves gentlemen - real people from the physical world - did not follow a normal distribution curve. These actions do not observed any regularity, that can be calculated statistically. They change their opinion. They do stupid things. They imitate each other. They panic. Pham came to the conclusion that the events that statisticians call "unlikely" to be left to the Gaussian curve such "fat tails" that would change it beyond recognition.

In the summer of 1997, Taleb predicted that large hedge funds such as Long Term Capital Management, is rapidly moving to the edge of the abyss because they do not understand what "fat tails". About a year later LTCM sold unreasonably large number of options uncoated due to the fact that his computer models predicted a lull in the market. And what?

What for?

Tags

See also

The story of how married guy in England gypsy.

10 stories about how filmed

Stories about how to shoot machine

The story of how scientists searched for it in the mind of the journalist

Got Milk? The story of how boring and nasty milk gained States

15 funny stories about how people made an offer hands and hearts

15 stories about how people realized that there's a love

16 stories about how people realized that there's a love

Nokia tells the story of how your story will be heard in a new way

25 Photos On How To Suffer Forgetful People