979

Is Bitcoin threat to the global banking system?

A significant number of critics have found for Bitcoin and other digital currencies that are easy to ostracize. However, if the digital currency and payment system will rank equal in force at the present time, we even can not imagine how to change our world. For example, remember the early days of mobile phone use when a video call or geolocation is not something that did not exist, and their was impossible to imagine. Moreover, it was believed that the appearance of the camera in your phone will cause the ruin of Eastman Kodak. At the time, the assumption seemed delusional. Exactly up to 2012, when the company filed for bankruptcy.

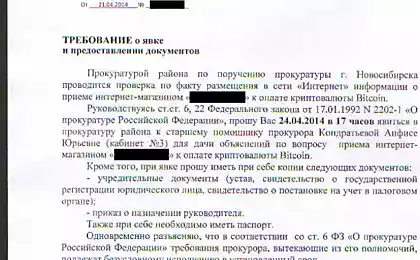

Similarly, the situation with Bitcoins, when supporters Cryptocurrency said that with proper distribution, it will cause the end of the banking business in the sense that we have now. Many just laughed in response - how can a toy in the hands of currency-nerds geek compete with the biggest and most powerful industry now? Laughing all but the banks themselves. Powerful Wall Street, City stoic about the emergence of competitors, even invested in digital currency. And now the British Bankers' Association officially declares that Bitcoin is a threat to the banking industry.

All who stand on either side of the fence, make this statement of its findings. At first, the opponents of Bitcoins will pray veiled power to ban digital currency. Those who support the spread of Bitcoins, consider this statement a serious warning to banks. As the current world would exist without the banks? Of course, these organizations "suck" the money from the economy, but they do commerce civilized. So, how serious a threat is actually Bitcoin for banking institutions.

Theoretically, of course, Bitcoin could destroy the world banking system, provided that all the polls in the world will be used for calculations Cryptocurrency. However, there are no specialists who would consider this scenario seriously. Although, of course, the number of non-cash transactions according to the Boston Consulting Company, will grow by 2023 to 780 trillion dollars that catches horror on banks that received a serious competitor.

However, even with the widespread introduction of equal conditions for Bitcoin currency is not mortal danger for banks. Total revenue for non-cash transactions amounted to about 425 billion dollars for 2014, but the Bank Of America in the same period received revenue of $ 95 billion. The impressive difference that allows us to understand how small a part of income from operations by bank transfer, how uncompetitive this struggle.

Thus, we come to believe that widespread Bitcoin digital currency or another does not lead to the collapse of the banking system, though seriously shake her, forcing to reconsider the policy, which was based, inter alia, upon receipt of the "light" of income - from translation fees for the operation of private individuals and so on. Thus, banks will have to make up for the loss of revenue. Using a risky credit policy, adhering to high risk trading strategies.

Source: geektimes.ru/company/matbea/blog/248638/

Similarly, the situation with Bitcoins, when supporters Cryptocurrency said that with proper distribution, it will cause the end of the banking business in the sense that we have now. Many just laughed in response - how can a toy in the hands of currency-nerds geek compete with the biggest and most powerful industry now? Laughing all but the banks themselves. Powerful Wall Street, City stoic about the emergence of competitors, even invested in digital currency. And now the British Bankers' Association officially declares that Bitcoin is a threat to the banking industry.

All who stand on either side of the fence, make this statement of its findings. At first, the opponents of Bitcoins will pray veiled power to ban digital currency. Those who support the spread of Bitcoins, consider this statement a serious warning to banks. As the current world would exist without the banks? Of course, these organizations "suck" the money from the economy, but they do commerce civilized. So, how serious a threat is actually Bitcoin for banking institutions.

Theoretically, of course, Bitcoin could destroy the world banking system, provided that all the polls in the world will be used for calculations Cryptocurrency. However, there are no specialists who would consider this scenario seriously. Although, of course, the number of non-cash transactions according to the Boston Consulting Company, will grow by 2023 to 780 trillion dollars that catches horror on banks that received a serious competitor.

However, even with the widespread introduction of equal conditions for Bitcoin currency is not mortal danger for banks. Total revenue for non-cash transactions amounted to about 425 billion dollars for 2014, but the Bank Of America in the same period received revenue of $ 95 billion. The impressive difference that allows us to understand how small a part of income from operations by bank transfer, how uncompetitive this struggle.

Thus, we come to believe that widespread Bitcoin digital currency or another does not lead to the collapse of the banking system, though seriously shake her, forcing to reconsider the policy, which was based, inter alia, upon receipt of the "light" of income - from translation fees for the operation of private individuals and so on. Thus, banks will have to make up for the loss of revenue. Using a risky credit policy, adhering to high risk trading strategies.

Source: geektimes.ru/company/matbea/blog/248638/