1153

Shale gas

Today let's talk about the trends of shale oil and gas in Texas, and a look at one of the biggest shale USA - Eagle Ford. Write about how everything is good or bad, I will not only give you the obvious statistical facts and statistics, as we know, do not know good or bad, it just figures that can only argue stupid student.

WE WILL go on drilling rigs located throughout south Texas, and look at the trend in oil production in shale formations in the last 6 years. But for lovers of the industry - a lot of photos under the cut drilling rigs and beyond.

Traditionally, I'll start with history. The field got its name from a small town located about 20 miles east of Dallas, where the shale layer comes to the surface and can be seen such as seen by geologists, examining samples of rocks raised during drilling.

Eagle Ford field richly both gas and oil. But unlike this field from other is that the impact of hydrocarbons is much higher, up to 70% of the total volume produced.

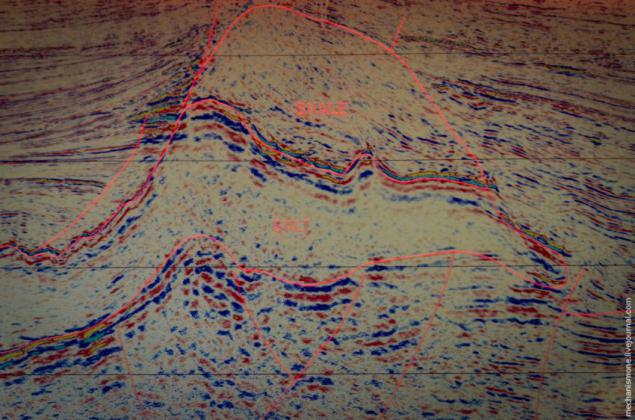

The deposit is located in the south of Texas and covers an area of about 100 km from north to south, and 1,000 km from east to west, following the shape of the coast of the state. The thickness of the oil-saturated layer is from 100 to 250 meters. This is what is known exploration to date.

Closer to the coast is rich in pure gas field north of gas begins to mix with oil and impurities, and the northernmost areas of the deposit only rich in oil. The depth of the wells ranges from 3500 meters on the Gulf Coast, and up to 1000 meters in the northern part of the field.

Land in the United States in most cases private, so oil companies lease land for drilling and production of oil from private individuals, paying dividends to holders of the land. In addition to large companies, land rent, and drilling is carried out by the owners, in their own land.

Drilling need to get permission from the Texas Railroad Commission, which deals with land issues. After obtaining permits for drilling, land called Liz, regardless of whether it is private or rented.

The first well was drilled in the field in 2008, and was designed for gas production. Returns wells was approximately 215,000 cubic meters of gas per day. The well has a horizontal depth of about 1000 meters, and the length of the horizontal section was about 2000 meters.

Now follow the dynamics of the leased premises (dongle takes) from the field. In 2009, throughout the deposit is located 40 dongle takes, in 2010 - 72, in 2011 - 368, in 2012 - 1 262.

What is the number of wells have been drilled respectively in these lands? In 2009, 94 wells were drilled in 2010 - 1010, 2011 - 2826, 2012 - 4143, 2013 - 4416, 2014 (as of May 31) - 2 172 wells.

Now look at the statistics on the volume of gas production from the field. In 2009, the deposit was mined 1.47 million. Cubic meters of gas per day in 2010 - 9.11 in 2011 - 34.8 in 2012 - 73.2 in 2013 - 107.1, in 2014 (as of May 31) - 101.6. It is worth noting that during the five months of this year, almost mined annual previous year.

How much oil is extracted from the field? Daily production in barrels made: in 2009 ode - 843, in 2010 - 15,149, in 2011 - 129 795 2012 - 403 999 2013 - 717 953, in 2014 (as of May 31) - 838 293. Here, just pay attention to the fact that during the current half-year production volume surpassed last year.

In 2013, the company has invested more than $ 30 billion. In drilling and infrastructure development in the field. Locally, Texas, through the development of drilling, the area received about 120 000 jobs, and the total cash flow for the state amounted to about $ 60 billion.

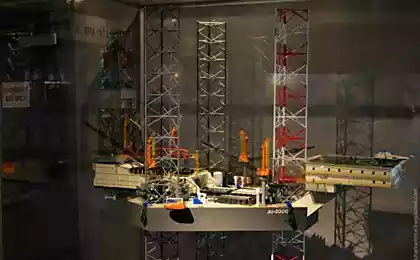

At the moment, the field has more than two hundred rigs and development are about 110 companies of various sizes, from giants in the face of BP and Shell, to small companies, consisting of a single family, which owns the land.

One of the most active companies are BHP, which has about 25 drilling on the field and produce gas in the amount of 170 thousand barrels of oil equivalent. In 2014, out of a total budget of US, which is $ 3.9 billion., Has been allocated $ 3 billion. On the development of shale drilling.

Over the past year, thanks to the development of non-traditional fields, the company increased gas production by 75%, and by 2017 the company plans to increase gas production to 200,000 barrels of oil equivalent.

In addition, the company spends an additional $ 1.5 million approximately. On optimizing operational equipment that increase the impact of wells by about 20%. By the way, BHP is not one to develop and expand the pace of shale gas and oil, many other companies have come on their heels.

Argue about the harmful effects of shale drilling on the environment can be long. But we must remember that any development of the industry has its price, whether it's Chernobyl nuclear power plant or tanker "Exxon Valdis." In the near future I will write a review about the problems associated with hydraulic fracturing, and answer many interesting question why in Texas and Dakota is booming shale production, whereas in the New York court freezes the issuance of permits for shale drilling.

Source: mechanismone.livejournal.com