535

The Federal Reserve

"If the American people allow private banks to control the issue of currency, sooner or later they will take away from him all his property" - Thomas Jefferson.

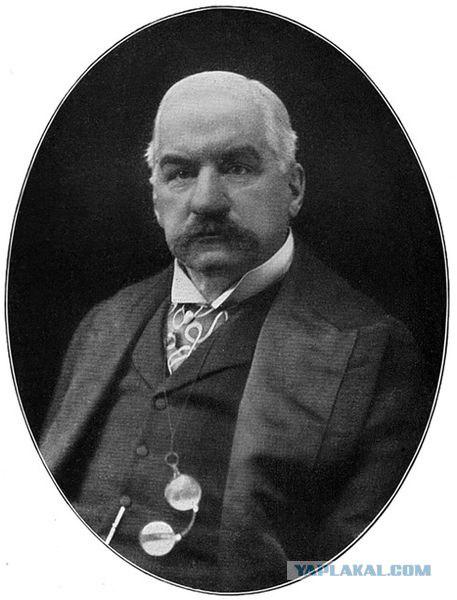

The history of the Fed, has its origins in 1912, when John Morgan (one of the largest bankers of the time) published in a private newspaper the news that the largest US bank is on the brink of ruin, the people fearing for their money are beginning to take them out of the banks, banks have to demand money from their debtors, nem have to sell their property ... The result is a mass hysteria. The government, of course, concerned about this issue. In response to this concern is a Audric Nelson, who has family ties with the banking cartel, recommends the establishment of the so-called central bank. And, Woodrow Wilson became president in 1913, agreed to sign the so-called Federal Reserve Act in exchange for financing his election campaign, years later he sincerely repenting, wrote in his memoirs: "We were the most spineless, the most powerless and most puppet government, the civilized world, we are not the government of the popular will, we are under the authority of the Government of a small group of very powerful and virtuoso players ».

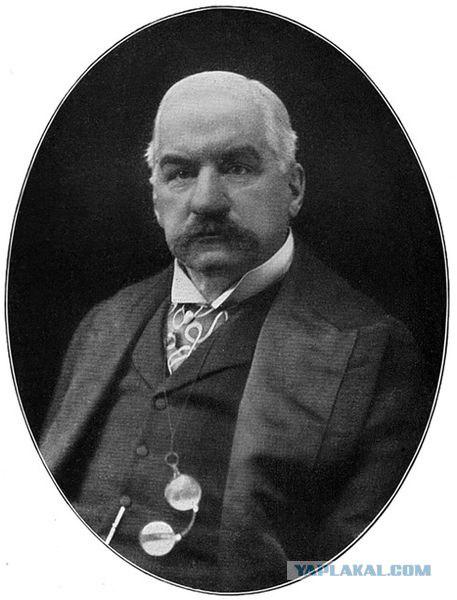

John Morgan (1837-1913)

In 1929 (the beginning of the Great American Depression) Congressman Luis Makferen requires urgent resignation of the Fed, "International bankers deliberately create a crisis that would gain control over all of us." But after two failed attempts, he will be poisoned, and not having to pass a law about the resignation of the Fed.

In 1933, the gold standard was abolished. Under the pretext of combating depression it was declared a mass confiscation of gold. Every American should have to hand over all its available gold bullion to the Treasury, in the opposite case he faces 10 years in prison. And now, the dollar is now the only "legal means of payment" that is, he has not provided any anything. The only thing that gives it value is the number of dollars in circulation worldwide.

The dollar until 1933

At the moment, the Fed includes the largest commercial banks, which account for 70% of all deposits of the US credit system. Fed's independence is also expressed in the fact that the US president has no right to give the Fed any order or shift its control.

The essence of this system is the same, that the central bank has a monopoly on issuing currency. And if the government takes one dollar, it shall have to return the dollar and a few cents. There is a logical question, and where to get the money that would have to repay the debt? That's right, from the Central Bank.

Article 1, Section 8 of the US Constitution, "" Congress has the power ... to print money and control their cost, ... Congress has no right to delegate this authority to any third party »

Thank you for attention.

Source:

The history of the Fed, has its origins in 1912, when John Morgan (one of the largest bankers of the time) published in a private newspaper the news that the largest US bank is on the brink of ruin, the people fearing for their money are beginning to take them out of the banks, banks have to demand money from their debtors, nem have to sell their property ... The result is a mass hysteria. The government, of course, concerned about this issue. In response to this concern is a Audric Nelson, who has family ties with the banking cartel, recommends the establishment of the so-called central bank. And, Woodrow Wilson became president in 1913, agreed to sign the so-called Federal Reserve Act in exchange for financing his election campaign, years later he sincerely repenting, wrote in his memoirs: "We were the most spineless, the most powerless and most puppet government, the civilized world, we are not the government of the popular will, we are under the authority of the Government of a small group of very powerful and virtuoso players ».

John Morgan (1837-1913)

In 1929 (the beginning of the Great American Depression) Congressman Luis Makferen requires urgent resignation of the Fed, "International bankers deliberately create a crisis that would gain control over all of us." But after two failed attempts, he will be poisoned, and not having to pass a law about the resignation of the Fed.

In 1933, the gold standard was abolished. Under the pretext of combating depression it was declared a mass confiscation of gold. Every American should have to hand over all its available gold bullion to the Treasury, in the opposite case he faces 10 years in prison. And now, the dollar is now the only "legal means of payment" that is, he has not provided any anything. The only thing that gives it value is the number of dollars in circulation worldwide.

The dollar until 1933

At the moment, the Fed includes the largest commercial banks, which account for 70% of all deposits of the US credit system. Fed's independence is also expressed in the fact that the US president has no right to give the Fed any order or shift its control.

The essence of this system is the same, that the central bank has a monopoly on issuing currency. And if the government takes one dollar, it shall have to return the dollar and a few cents. There is a logical question, and where to get the money that would have to repay the debt? That's right, from the Central Bank.

Article 1, Section 8 of the US Constitution, "" Congress has the power ... to print money and control their cost, ... Congress has no right to delegate this authority to any third party »

Thank you for attention.

Source: