1333

The book "How to play and win at the stock exchange"

In the sensational at the time the book, Alexander Elder Trading legend talks about his vision of trade in the foreign exchange market, at the bottom of the page there is a link to where you can download free.

The book is divided into 10 sections:

In this chapter, we are talking about the negative impact of emotions trader to trade and how to control them. Alexander Elder opens the method developed in conjunction with a psychologist.

Here we consider the collective psychology of participants speculation. Mass action are distinguished by their primitivism in relation to the actions of each trader. Understand the psychology of the crowd, you can make a profit from the change in her mood.

It is about how the graphs quotes predict future price movements of the exchange tool.

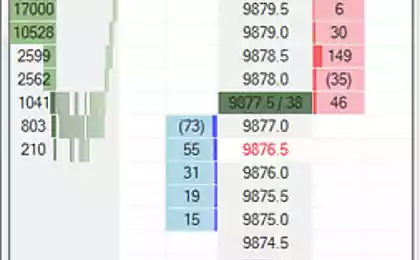

Discusses methods of technical analysis and some indicators. Describes in detail the types of indicators.

In this section of the book Alexander Elder explains the meaning of trade indicators such as the volume of transactions and the number of outstanding transactions.

In the book "How to play and win at the stock exchange" is about the most profitable methods of analyzing the stock exchange. The greatest benefit of this part of the book will bring speculators trading options and futures stock indices.

We are talking about the psychological indicators. This type of indicator measures the mood of the crowd when it moves in one direction, it makes sense to join. They also suggest, when it's time to get out from the crowd.

Tells of two indicators: Elder-ray and force index. They both appreciate the power of bears and bulls.

This chapter discusses a number of trading strategies, including Alexander Elder's own method, called "Triple choice».

Perhaps the most important part of the work by Alexander Elder. It says on the management of trade funds. Almost all new traders do not pay enough attention to this aspect of the trade.