192

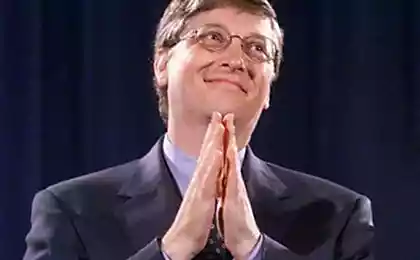

Warren Buffett made 99% of his fortune after 50 years.

The story of a great investor who proved that financial success has no age limit.

Early Years: The First Steps to the Billions

Warren Buffett began his investment career at a young age. At the age of 11, he bought his first shares, and at 13 he filed a tax return as an entrepreneur. However, despite his early start, his real wealth came much later.

The Secret to Wealth After 50

According to analysts, 99% of his fortune Buffett saved after 50 years. This is due to the principles of long-term investment:

Buffett's Principles of Investment

Its strategy is based on:

Buffett’s story proves that successful investing is possible at any age. The key is patience, knowledge and long-term vision.

Early Years: The First Steps to the Billions

Warren Buffett began his investment career at a young age. At the age of 11, he bought his first shares, and at 13 he filed a tax return as an entrepreneur. However, despite his early start, his real wealth came much later.

The Secret to Wealth After 50

According to analysts, 99% of his fortune Buffett saved after 50 years. This is due to the principles of long-term investment:

- Compound percentage effect Buffett reinvested the income, increasing the capital.

- Choosing reliable companies Investing in Coca-Cola, Apple, American Express.

- Iron discipline He did not panic in the stock market.

Buffett's Principles of Investment

Its strategy is based on:

- Long-term purchase Avoiding speculation.

- Conservative approach - risk minimization.

- Focus on value Acquisition of assets below their real value.

Buffett’s story proves that successful investing is possible at any age. The key is patience, knowledge and long-term vision.

Iris Apfel: “I’m the oldest teenager in the world!”

Billionaire Sam Altman: from a young nerd-geek to the founders of the IT empire