197

Wise women know that you need to start saving money from the first paycheck.

I've told you before about my Aunt Lube, whose wise thoughts inspire me. And recently, she and I were talking about how to save money and why it's so important. She told me a simple formula that will help me not to stay in a broken trough.

Today's edition. "Site" He shares with you the thoughts of a wise woman over the years.

Now young people increasingly prefer to live one day, here and now. I don’t think it’s bad because it makes life feel better. Many people live as if tomorrow doesn’t exist. Receiving money, people invest it in expensive equipment and branded clothes, leaving nothing in stock. Aunt Luba believes that this is the main mistake.

If you spend all the money you earn on expensive things, when you have an income crisis, you become poor. Anything can happen: a job loss, a family illness. This creates a hole in the budget. And if it is not closed, hard times come. Such situations should be avoided.

Of course, you can say that you should strive to earn more, then there will be no crisis. I only agree halfway. You should always strive for more. But it’s also important to stick to a simple and ancient formula: spend less than you earn. And not just save money for a big purchase, but to accumulate capital from month to month.

You have to be honest with yourself and admit that you won’t always be able to work and earn as you would in the best moments of your life. Sometimes there are ups, but often downs. And it is better to prepare for them in advance. That way you will know that even if you lose your job, you will not have to work in a low-paying position because there will be no good offers in your field.

Separately, Aunt Lyuba noted that such savings are primarily important for women. It often happens that, getting married and having a child, a woman becomes financially dependent on her husband. There is nothing wrong with being a good and reliable person. But there are different situations. If you have a financial cushion, you can be more independent and free of circumstances.

If you are imbued with this idea, then you should learn to save money. At first, it can be difficult, because money is always tempting to spend it. But here, as in other areas, it is important to form a habit. You must become the master of your finances and manage them wisely. Make it a habit to save a certain amount first, and only then spend the rest. The savings from what's left are not working.

Often, everyone is advised to save 10-15% of income. However, it may be too much in the beginning. Start with a smaller percentage, such as one or five. This will help to form a habit of procrastination. When you receive some large amounts, such as a bonus, you can try to save even more interest.

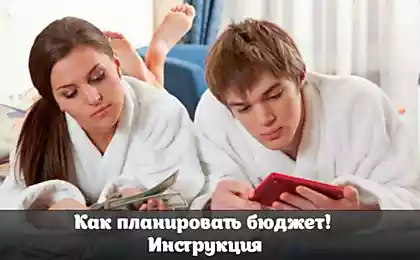

If you used to spend everything, now you may miss this amount. To do this, you need to understand your expenses a little. Start keeping records of everything you buy: groceries, utilities and regular payments, entertainment. Analyze what the money is going on. So you can understand where you can spend less and without what you can do in favor of savings. Try to plan your budget ahead and set spending limits.

The deposited money can be put into a bank account, so that interest is gradually dripping there. They will help offset inflation. How much should I save? It's up to you, it depends on your goals. But if it is an airbag, then it should be an amount that will cover from 3 to 6 months of your stay.

We hope you've figured out how to save money. If you develop your scheme and develop a habit, it will work out. No bigotry. Previously, we shared the thoughts of Aunt Lyuba about what a mature woman can not save. I think this should be done as a rule. Do you manage to save money?

Today's edition. "Site" He shares with you the thoughts of a wise woman over the years.

Now young people increasingly prefer to live one day, here and now. I don’t think it’s bad because it makes life feel better. Many people live as if tomorrow doesn’t exist. Receiving money, people invest it in expensive equipment and branded clothes, leaving nothing in stock. Aunt Luba believes that this is the main mistake.

If you spend all the money you earn on expensive things, when you have an income crisis, you become poor. Anything can happen: a job loss, a family illness. This creates a hole in the budget. And if it is not closed, hard times come. Such situations should be avoided.

Of course, you can say that you should strive to earn more, then there will be no crisis. I only agree halfway. You should always strive for more. But it’s also important to stick to a simple and ancient formula: spend less than you earn. And not just save money for a big purchase, but to accumulate capital from month to month.

You have to be honest with yourself and admit that you won’t always be able to work and earn as you would in the best moments of your life. Sometimes there are ups, but often downs. And it is better to prepare for them in advance. That way you will know that even if you lose your job, you will not have to work in a low-paying position because there will be no good offers in your field.

Separately, Aunt Lyuba noted that such savings are primarily important for women. It often happens that, getting married and having a child, a woman becomes financially dependent on her husband. There is nothing wrong with being a good and reliable person. But there are different situations. If you have a financial cushion, you can be more independent and free of circumstances.

If you are imbued with this idea, then you should learn to save money. At first, it can be difficult, because money is always tempting to spend it. But here, as in other areas, it is important to form a habit. You must become the master of your finances and manage them wisely. Make it a habit to save a certain amount first, and only then spend the rest. The savings from what's left are not working.

Often, everyone is advised to save 10-15% of income. However, it may be too much in the beginning. Start with a smaller percentage, such as one or five. This will help to form a habit of procrastination. When you receive some large amounts, such as a bonus, you can try to save even more interest.

If you used to spend everything, now you may miss this amount. To do this, you need to understand your expenses a little. Start keeping records of everything you buy: groceries, utilities and regular payments, entertainment. Analyze what the money is going on. So you can understand where you can spend less and without what you can do in favor of savings. Try to plan your budget ahead and set spending limits.

The deposited money can be put into a bank account, so that interest is gradually dripping there. They will help offset inflation. How much should I save? It's up to you, it depends on your goals. But if it is an airbag, then it should be an amount that will cover from 3 to 6 months of your stay.

We hope you've figured out how to save money. If you develop your scheme and develop a habit, it will work out. No bigotry. Previously, we shared the thoughts of Aunt Lyuba about what a mature woman can not save. I think this should be done as a rule. Do you manage to save money?

Learned to cook appetizing zrazes, now they are for breakfast, lunch and dinner, home do not complain.

I study the names of icons and their true meanings so that my prayers are sent to the right address.