212

Saving for retirement in youth does not make sense, all you have, spend.

Life in old age Much depends on how he spent his youth. Often people try to save money for the future, because living on only one pension is simply difficult. However, experts who have studied this topic have come to the conclusion that such manipulations do not make sense. Today we will try to find out why you should not save money for carefree old age.

It is necessary to think about old age, but this should not interfere with a normal life in youth. This was confidently stated by a group of scientists from the United States, who studied the problem and put forward their alternative theory of its solution.

There is an opinion that the sooner a person begins to save money, the faster he will feel what it is. compound-interest. Thanks to this, you will be able to earn interest not only from the initial amount, but also from interest savings accrued earlier.

In the States, there is a special pension plan, which acts as an alternative to the standard state pension. This system works simply. A man begins to work, and he appears. pension accountWhere he transfers the funds. Money can also come from the employer.

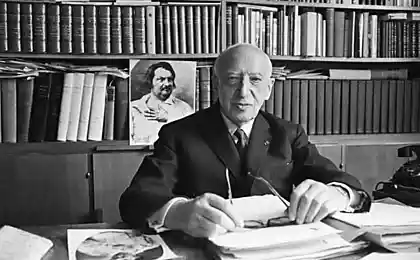

It turns out you're working, and some money is dripping into that. However, a recent study has shown that early savings make no sense. The basis of this study is lifecycle hypothesis. It was worked on by Nobel laureate in economics Franco Modigliani together with Albert Ando and Richard Brumberg.

The essence of the hypothesis is very interesting. Usually people divide income into consumption and savings, based on their current earnings. Relatively speaking, having a salary of $ 600, you can consistently save a certain amount of money every month to a separate account.

Franco Modigliani proposes to rely on all resources for the entire life cycle. Money that a person has managed to save during periods of higher incomes, he can use in times when income decreases. Thus, he will be able to avoid sudden changes in the standard of living.

Is it worth saving money for old age? The question is mixed. And the answer to it depends on many factors. If you have a promising job, your income will grow with the development of your career. In the early stages, when wages are still low, savings will yield little. Moreover, it is no secret that many people live from paycheck to paycheck.

If your income suits you here and now and you have enough funds for a comfortable life, you should carefully study what the state offers the population after retirement. However, the problem is that often in post-Soviet countries with social guarantees everything is very tight.

American researchers have found that people value money more when they are less wealthy and younger. So, at 25, when the career path is just beginning, earning $1,000 means much more than at 45.

According to a study, if a person is happy with their low income, they just don’t tend to earn more. But at the same time, he is unlikely to save, since he will not be able to live on a smaller amount of money. In addition, many do not want to think about the future, preferring to fully use today’s income.

To save money at interest, you need to take into account the state of the economy in the country. During inflation, interest rates are likely to be 0. However, it is worth saving. At the very least, it makes young people a good habit.

In youth, not everyone thinks about how to live in old age. Many people live one day, and to what extent is it right? But especially enterprising people ask such questions at the start of their careers. Financial literacy is especially important today.

People often invest money in real estate. There are pensioners who receive passiverenting out your apartment. Of course, to buy it, it took a long time to work. And then wait until all the costs are paid off. In this way, people have a stable standard of living.

I wonder what you think of that? Is it worth saving money for old age in your youth?

It is necessary to think about old age, but this should not interfere with a normal life in youth. This was confidently stated by a group of scientists from the United States, who studied the problem and put forward their alternative theory of its solution.

There is an opinion that the sooner a person begins to save money, the faster he will feel what it is. compound-interest. Thanks to this, you will be able to earn interest not only from the initial amount, but also from interest savings accrued earlier.

In the States, there is a special pension plan, which acts as an alternative to the standard state pension. This system works simply. A man begins to work, and he appears. pension accountWhere he transfers the funds. Money can also come from the employer.

It turns out you're working, and some money is dripping into that. However, a recent study has shown that early savings make no sense. The basis of this study is lifecycle hypothesis. It was worked on by Nobel laureate in economics Franco Modigliani together with Albert Ando and Richard Brumberg.

The essence of the hypothesis is very interesting. Usually people divide income into consumption and savings, based on their current earnings. Relatively speaking, having a salary of $ 600, you can consistently save a certain amount of money every month to a separate account.

Franco Modigliani proposes to rely on all resources for the entire life cycle. Money that a person has managed to save during periods of higher incomes, he can use in times when income decreases. Thus, he will be able to avoid sudden changes in the standard of living.

Is it worth saving money for old age? The question is mixed. And the answer to it depends on many factors. If you have a promising job, your income will grow with the development of your career. In the early stages, when wages are still low, savings will yield little. Moreover, it is no secret that many people live from paycheck to paycheck.

If your income suits you here and now and you have enough funds for a comfortable life, you should carefully study what the state offers the population after retirement. However, the problem is that often in post-Soviet countries with social guarantees everything is very tight.

American researchers have found that people value money more when they are less wealthy and younger. So, at 25, when the career path is just beginning, earning $1,000 means much more than at 45.

According to a study, if a person is happy with their low income, they just don’t tend to earn more. But at the same time, he is unlikely to save, since he will not be able to live on a smaller amount of money. In addition, many do not want to think about the future, preferring to fully use today’s income.

To save money at interest, you need to take into account the state of the economy in the country. During inflation, interest rates are likely to be 0. However, it is worth saving. At the very least, it makes young people a good habit.

In youth, not everyone thinks about how to live in old age. Many people live one day, and to what extent is it right? But especially enterprising people ask such questions at the start of their careers. Financial literacy is especially important today.

People often invest money in real estate. There are pensioners who receive passiverenting out your apartment. Of course, to buy it, it took a long time to work. And then wait until all the costs are paid off. In this way, people have a stable standard of living.

I wonder what you think of that? Is it worth saving money for old age in your youth?

A test that tells you a lot about your personality, just answer what you see here.

I look 70 at 60, people, when I became a grandmother, how to stay forever young