192

How to organize stock trading

If you analyze the geolocation of many brokerage sites, it becomes clear that most of them are registered in offshore zones, as well as, for example, in the UK, Cyprus. Of course, it is ideal to choose a platform whose office is located in the country of the trader, but this is not always possible.

Trading on the stock exchange with knowledge of nuances

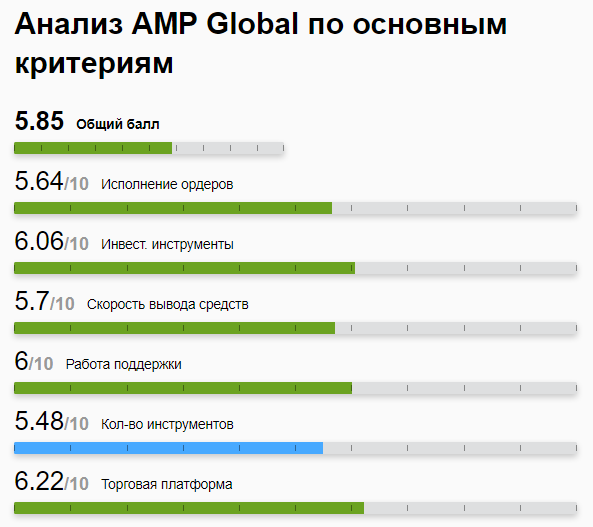

Some people approach the matter relatively simply. They look at the place of a particular site in the ranking, the overall score that the system forms in an automatic format. Such options are available on thematic resources, where a variety of brokers are discussed: registered in offshores, the United States, Europe, Cyprus and elsewhere. This allows you to significantly save time when choosing. So, in a matter of seconds you can form your opinion about the broker amp global and other similar. You can immediately see whether the platform falls into the top 20, top 10, which automatic rating is formed by the system. In addition,

- The broker’s website should indicate who is the regulator. For example, it can be the Cyprus Securities and Exchange Commission, which is quite common.

- The date of foundation matters. As a rule, most of these platforms do not exceed the five-year milestone, but the foundation of 10-15 years ago is also not always a guarantee of reliability.

- A positive point will be if there is segregation of accounts, that is, separate accounts located in banks that are not related to brokerage share capital.

Careful and balanced trading

Yes, it will never be possible to completely neutralize risks, that is, eliminate their impact, but it is possible to minimize them. That is why truly professional independent resources are created, where there is no purpose to promote this or that broker, advertise it or denigrate competitors. Objectivity is highly valued. Plus:

- You can check the activities of such resources that offer reviews on brokers using your feedback. So, if the review did not appear or appeared in an edited version, it will be a signal that the information on the site should not be trusted.

- A good sign would be regular updates. This applies to both the broker’s website and numerous thematic portals devoted to reviews on them.

- It should be alerted if after the description of a broker follows numerous praise reviews, which sounds extremely implausible.

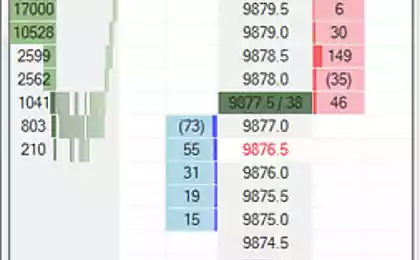

And yet, it is necessary to assess the variety of instruments and the minimum deposit of the exchange itself, the specifics of leverage, spreads, tools. Among the most common tools are energy carriers, exchange futures, stocks, currencies and cryptocurrencies, metals, oil. This is a classic set that interests the vast majority of traders and investors.