203

What is the stability of the exchanges for trading

One of the promising directions for traders is the cryptocurrency market. Although for the sake of objectivity, it is worth noting that this segment belongs to the category of high-risk.

What you need to know about exchanges offering cryptocurrency trading

Not always the time of foundation of such exchanges will guarantee the reliability of work. Often there is a situation when exchanges that have been operating steadily for more than 5-10 years become less reliable, there are delays in withdrawing money and so on. Therefore, it is better to consult thematic resources with reviews in advance. For example, you can learn more about dsx and other similar sites.

As a rule, mostly do not withstand the onslaught of time and competitors of the exchange, which were founded 1-3 years ago. The first years are considered the most “turbulent” period in the life of such sites. Features:

- Sometimes users are alarmed by the fact that a particular platform is focused on working with a particular segment, for example, with players from Eastern Europe, but the company itself is registered in the UK or offshore zones.

- Minimum deposits and leverage are important. If approached wisely, then leverage can provide more opportunities for traders.

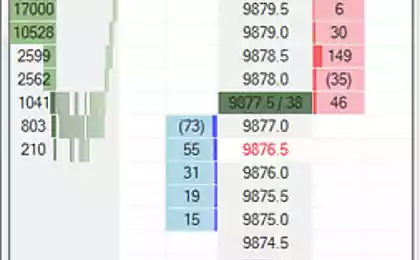

- It is important what tools are offered, what is the efficiency of the trading platform itself.

Stability of work and other factors

Yes, it is the stability of functioning that many traders call the key point. It manifests itself in many ways:

- Efficiency of reception and consideration of applications, including on weekends, holidays.

- The site is always available, it does not lie.

- Information is regularly updated and updated. These can be quotes, analytical reviews, graphs, schemes, diagrams, expert advice.

A big plus will be the ability to conduct oral and written negotiations with technical support in their native language, even if such a platform is registered, for example, in the UK. It is worth assessing the geography of customers, the bonuses offered, to learn more about the regulator. Since working with cryptocurrencies, as well as with other instruments, belongs to the category of risky types of trading, it is worth choosing such platforms that offer a reasonable minimum deposit. For example, it could be $100 or more. And then, as you accumulate personal experience of cooperation with the platform, you can increase the deposit.

If problems are noticed in the stability of the work of a broker, then there is no doubt that almost immediately these nuances will be reflected in reviews on independent thematic sites devoted to trading and investment. Moreover, you should view not only websites in Russian or Ukrainian, but also in English. Especially if the brokers are registered in the UK and other English-speaking countries.