154

Financial literacy tips that lie on the surface, but many don’t even know

Childish financial literacy It is not presented in schools as a separate subject. And if parents are teaching kids how to interact with money, that’s a big success. Unfortunately, this does not happen in every family. As adults, we often don’t know how to do better in some financial matters.

Today's edition. "Site" will tell you how make friends And never be in debt again. They won't teach you that in school.

How many children in life useful higher mathematics? Units. Everyone has to deal with money every day throughout their lives. So why isn’t financial literacy taught from an early age? Perhaps because it is not good for the economy.

I leave you to think and sketch my versions of this question, and I myself go to sensible ones. Financial Literacy CouncilsWhich I found on the Alexandra Posnova Channel. At the bottom of the article will be the video itself with these lifaks.

View this post on Instagram

Publication from Financial Investment (@fadina_prodengi)

Spend less than you earn. Try to delay! Even 100 rubles set aside monthly will bring results.

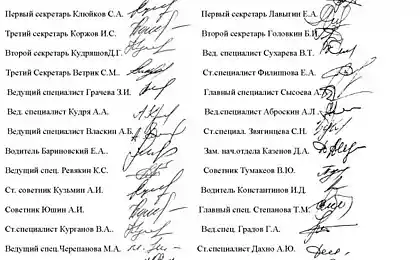

Fix income and expensesTo keep track of where the money goes. It is enough to keep this table for several months to understand what is going on and track your unnecessary spending and impulsive purchases.

View this post on Instagram

Publication by GLOBAL COFFEE (@global_coffee_kz)

When receiving a salary or income, immediately save money for the most necessary monthly payments, you can by category. For example, for utility payments, for food, for travel, for payment of a loan, if any.

Use the card when paying, it is really more convenient and profitable. And don't forget about loyalty systems and cashbacks. Many banks have cashback offers.

View this post on Instagram

Publication from Income/Work/Instagram (@olga.samysheva)

Make conscious purchases. Going to the store, explain to your child why you take so much sausage, milk or cookies. Why do you choose one of the three types of sour cream? Discuss with your child the quality and cost of purchased products, the need to buy them. Pay attention to the date of manufacture, so as not to buy expired goods.

Set yourself goals for accumulation. Then your actions will make sense! Ask yourself questions: Why do you need money? What are your goals? It is very important to respond in writing.

View this post on Instagram

Publication from Tax Consultant (@nika.ta)

“Money is evil,” “big money comes with a lot of hard work,” “I can’t put a high price for work, I’m not worthy,” “big money can’t be earned with honest labor,” “you had to be born into a rich family to be rich.” All this. limitingwho often come from childhood.

Or maybe one of the phrases you heard from a colleague or a friend, and it got into your head. Often it is our thinking that determines the quality of our lives.

What do I suggest? Get rid of these harmful thought viruses! Take time so that no one distracts you, sit in a cozy atmosphere and write down all these beliefs. Analyze where they come from, and then write the opposite attitude next to them.

View this post on Instagram

Posted by the Vedas Astrologer, Psychologist, Coach (@daria_lachinova)

If you read this aloud every day, the brain will already focus on new attitudes, creating new neural connections. Reading should not be mechanical, but conscious of every word with the mind and with the whole heart. Gradually, life will really begin to change.

Of course, along the way, there may be treacherous examples proving the truth of the old attitudes, but we should not forget that this is only part of reality. It's not fast, but forever!

And at the end of the installations, write: "I get rid of all the limiting installations!"

View this post on Instagram

Publication from Psychology | Neurology (@openheart.psychology)

Avoid pyramid schemes. They can drain all the accumulated money at a time. Remember that the risks must be justified.

“Pay yourself!” is one of the main phrases of the best-selling book The Richest Man in Babylon. It's about saving money for a dream or a goal. Put at least 5-10% on yourself. Yes, it is a small percentage, but if you do it regularly, the result will exceed your expectations!

View this post on Instagram

Publication by Evgeny Smirnovna (@nenenezhenka)

And also advice from personal experience: turn off advertising everywhere, so as not to buy extra.

I want to end with advice about life. A job you enjoy will make you a lot more money in the long run. You don't burn out in a job like that. You learn more, you learn and over time, something that cost 20,000 can cost 200,000 or even 500,000! You’ll never make a million dollars at your favorite job.

View this post on Instagram

Publication from WITH ME Dreams come true (@elena_blinovskaya)

To get acquainted with these life hacks in detail, watch the video with canal Alexandra Posnova. There's a lot of wise advice!

about:blank

I also suggest reading 6 really important tips, adhering to which you can improve your financial condition. Maybe not immediately. And there will certainly be some effort to make. But the result is definitely worth it!

View this post on Instagram

Publication from Thought. MONETISATION OF TALENTS (@feyka_pro_money)

The phrase "we come from childhood" reveals the secrets of many failures of adults. Children’s financial literacy is just a necessary subject that should be taught to the baby from an early age.

Tell them where you and your husband got the money. Tell them that they do not fall from the sky and that they should be earned, and that you should spend them wisely. Try to use your personal example to show how environmentally and reasonably possible enhance. And I strongly advise you to work out limiting beliefs so as not to pass them on to your children.

I really hope that these tips will help to save and even increase your money!

Today's edition. "Site" will tell you how make friends And never be in debt again. They won't teach you that in school.

How many children in life useful higher mathematics? Units. Everyone has to deal with money every day throughout their lives. So why isn’t financial literacy taught from an early age? Perhaps because it is not good for the economy.

I leave you to think and sketch my versions of this question, and I myself go to sensible ones. Financial Literacy CouncilsWhich I found on the Alexandra Posnova Channel. At the bottom of the article will be the video itself with these lifaks.

View this post on Instagram

Publication from Financial Investment (@fadina_prodengi)

Spend less than you earn. Try to delay! Even 100 rubles set aside monthly will bring results.

Fix income and expensesTo keep track of where the money goes. It is enough to keep this table for several months to understand what is going on and track your unnecessary spending and impulsive purchases.

View this post on Instagram

Publication by GLOBAL COFFEE (@global_coffee_kz)

When receiving a salary or income, immediately save money for the most necessary monthly payments, you can by category. For example, for utility payments, for food, for travel, for payment of a loan, if any.

Use the card when paying, it is really more convenient and profitable. And don't forget about loyalty systems and cashbacks. Many banks have cashback offers.

View this post on Instagram

Publication from Income/Work/Instagram (@olga.samysheva)

Make conscious purchases. Going to the store, explain to your child why you take so much sausage, milk or cookies. Why do you choose one of the three types of sour cream? Discuss with your child the quality and cost of purchased products, the need to buy them. Pay attention to the date of manufacture, so as not to buy expired goods.

Set yourself goals for accumulation. Then your actions will make sense! Ask yourself questions: Why do you need money? What are your goals? It is very important to respond in writing.

View this post on Instagram

Publication from Tax Consultant (@nika.ta)

“Money is evil,” “big money comes with a lot of hard work,” “I can’t put a high price for work, I’m not worthy,” “big money can’t be earned with honest labor,” “you had to be born into a rich family to be rich.” All this. limitingwho often come from childhood.

Or maybe one of the phrases you heard from a colleague or a friend, and it got into your head. Often it is our thinking that determines the quality of our lives.

What do I suggest? Get rid of these harmful thought viruses! Take time so that no one distracts you, sit in a cozy atmosphere and write down all these beliefs. Analyze where they come from, and then write the opposite attitude next to them.

View this post on Instagram

Posted by the Vedas Astrologer, Psychologist, Coach (@daria_lachinova)

If you read this aloud every day, the brain will already focus on new attitudes, creating new neural connections. Reading should not be mechanical, but conscious of every word with the mind and with the whole heart. Gradually, life will really begin to change.

Of course, along the way, there may be treacherous examples proving the truth of the old attitudes, but we should not forget that this is only part of reality. It's not fast, but forever!

And at the end of the installations, write: "I get rid of all the limiting installations!"

View this post on Instagram

Publication from Psychology | Neurology (@openheart.psychology)

Avoid pyramid schemes. They can drain all the accumulated money at a time. Remember that the risks must be justified.

“Pay yourself!” is one of the main phrases of the best-selling book The Richest Man in Babylon. It's about saving money for a dream or a goal. Put at least 5-10% on yourself. Yes, it is a small percentage, but if you do it regularly, the result will exceed your expectations!

View this post on Instagram

Publication by Evgeny Smirnovna (@nenenezhenka)

And also advice from personal experience: turn off advertising everywhere, so as not to buy extra.

I want to end with advice about life. A job you enjoy will make you a lot more money in the long run. You don't burn out in a job like that. You learn more, you learn and over time, something that cost 20,000 can cost 200,000 or even 500,000! You’ll never make a million dollars at your favorite job.

View this post on Instagram

Publication from WITH ME Dreams come true (@elena_blinovskaya)

To get acquainted with these life hacks in detail, watch the video with canal Alexandra Posnova. There's a lot of wise advice!

about:blank

I also suggest reading 6 really important tips, adhering to which you can improve your financial condition. Maybe not immediately. And there will certainly be some effort to make. But the result is definitely worth it!

View this post on Instagram

Publication from Thought. MONETISATION OF TALENTS (@feyka_pro_money)

The phrase "we come from childhood" reveals the secrets of many failures of adults. Children’s financial literacy is just a necessary subject that should be taught to the baby from an early age.

Tell them where you and your husband got the money. Tell them that they do not fall from the sky and that they should be earned, and that you should spend them wisely. Try to use your personal example to show how environmentally and reasonably possible enhance. And I strongly advise you to work out limiting beliefs so as not to pass them on to your children.

I really hope that these tips will help to save and even increase your money!

I used to go to Tatar cooking for chak-chak, but it closed, I deftly cook a honey treat at home.

The best apple pie of all time: dough is few, and apples are many