302

4 Fatal Habits of the Poor

Description: In this article, we will look at four fatal habits that can contribute to poverty and discuss ways to get rid of them.

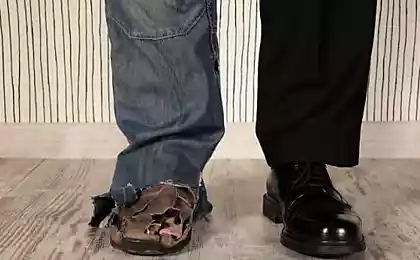

What distinguishes a poor person from one who gradually builds up financial stability and in the long run is able to achieve abundance? There is no unambiguous answer to this question, because factors can be different: from the level of education to the family environment, from life circumstances to psychological attitudes. Nevertheless, psychologists and financial planners identify a number of key habits that fatally hinder the improvement of financial situation. It is important to understand that we are not talking about random mistakes that each of us makes, but about systematic behavioral patterns emanating from a particular type of thinking. In this article, we will look at four of the most destructive habits that are common in people who are financially in short supply for the long term. Knowing your habits is the first step towards positive change.

The Psychology of Poverty and Its Consequences

To begin with, it is worth clarifying that the psychology of poverty is not a sentence, but a socio-psychological phenomenon in which a person is inclined to justify his financial situation and not see opportunities to change the situation. Of course, the economic situation, external circumstances and even the region of residence can play a huge role in the formation of financial barriers. But as research shows (for example, many experts cite behavioral economics), deep thinking and decision-making habits are equally influential. Poverty habits are formed over the years and are often laid in childhood, transforming into stable patterns of behavior. And without changing these patterns, any external resources (even sudden pay rises or gains) are often lost quickly because the person uses them unproductively or returns to old, entrenched patterns of money management.

Main part

1. The habit of justifying inaction

The first “sabotage” pattern is the tendency to justify one’s inaction by external circumstances. Instead of trying to find a job with the prospect of growth, the person convinces himself that all the places are occupied, the market is oversaturated, or that “success is the lot of the few.” This kind of thinking shapes the consumer’s attitude toward the world: “I can’t change anything because everything is already decided.” Thus, any activity aimed at improving life seems useless.

From a psychological point of view, the phenomenon of “learned helplessness” works here, when, due to past failures, a person stops trying. But without action, there is no movement for the better. Personal growth specialists and psychotherapists agree that consistently trying different strategies (search for new skills, contacting mentors, expanding the circle of acquaintances) over time gives results. It is important to get rid of the illusion that any attempt is pointless. The habit of justifying inaction is a dangerous trap that holds a person firmly in place.

2. The habit of living one day

Another critical habit is the inability or unwillingness to plan for the future. Of course, in life there are force majeure when you have to act on the situation. However, the systematic lack of a strategic approach to finance is a direct path to permanent debt and the eternal plugging of holes. People immersed in financial chaos rarely keep records of income and expenses, do not allocate funds to the reserve fund, and about investments and even heard only in theory.

Poor people are more likely to prefer immediate benefits to long-term planning, even if future rewards may be significantly higher. In behavioral economics, this is due to the effect of hyperbolic discounting: the person overestimates the short-term reward and underestimates the long-term benefits. At the same time, creating even a small reserve of funds for the future is a step towards breaking the pattern of poverty. Practice shows that starting small and forming a habit of accumulation, many people reconsider their attitude to money and gain motivation for further development.

3. The habit of constantly complaining

What’s wrong with sharing difficulties? But if negative statements are a constant background of life, it becomes a destructive habit. As a result, a person does not just “splash out emotions”, but forms in himself and others a strong conviction: “Everything is bad and will be even worse.” This attitude blocks opportunities. People seeking growth are statistically less likely to complain and spend more time analyzing problems and finding solutions.

The social aspect should not be underestimated: constant complaints alienate potential allies, partners, and employers. Constant negativity is a kind of “alarm” for others, as they feel that interacting with such a person will be difficult and futile. It is worth noting that complaints often replace constructive actions: there is no point in taking something new, because “nothing will change.” Overcoming the habit of complaining begins with mindfulness: keep track of when and how often you express discontent, and try to replace negative comments with specific plans of action or neutral statements.

4. The habit of avoiding financial literacy

Last, but not least, is the habit of not learning how to handle money. It is amazing how many people can own modern gadgets, master complex computer programs, but ignore the elementary principles of financial literacy. This is not just an inability to make a budget, but also a complete misunderstanding of such basic tools as bank deposits, insurance, pension plans, investment opportunities.

Often behind this is a subconscious fear of the complexity of financial schemes or the belief that “money is dirty and not for me.” This position ensures a long stay in the poverty zone: without realizing the mechanisms of accumulation, distribution and increase of funds, it is difficult to count on a serious breakthrough. According to experts, even a basic level of financial literacy gives a powerful advantage: a person learns to manage their income, avoid credit traps and form sustainable earning strategies. At the same time, there are many available sources of information: books, video courses, master classes, free webinars that help you easily master fundamental knowledge.

Conclusion

Poverty is not always caused by external factors alone. Yes, the system, the social environment, and the opportunities of the world around us can pose serious obstacles. However, internal installations also play an important role. The habit of justifying inaction deprives a person of a chance for progress, the habit of living one day blocks the possibility of saving and investing, constant complaints form a negative halo around, and the avoidance of financial literacy does not allow you to manage money effectively. These four habits can be called fatal, because they not only increase poverty, but form a “closed circle”. The good news is that each one can be adjusted. The first step is to become aware of the problem, the second is to search for knowledge and specific strategies for behavior change. People who have decided to reformat their thinking and overcome the habits discussed, over time, notice a gradual increase in income and quality of life in general. Change does not happen instantly, but each small result strengthens self-confidence and stimulates progress.

Glossary

Psychology of poverty A set of beliefs and habits that form an inefficient attitude towards money, often leading to long-term financial deficits.

Behavioral economics A branch of economics that studies the influence of psychological and cognitive factors on people’s financial decisions.

Consumer attitudes Thinking in which a person expects ready-made goods from the surrounding world, without putting sufficient effort into independent development.

Learned helplessness A psychological state when a person after a series of failures stops trying to change the situation, believing that his actions are meaningless.

Financial chaos A situation in which there is no accounting of income and expenses, money is spent impulsively, without planning.

The habit of accumulation Regular practice of saving part of income in order to form a financial “safety cushion” or investment.

Hyperbolic discounting The tendency to prefer quick and small benefits to larger but more distant rewards.

Earning strategies a set of decisions and actions aimed at increasing income (career growth, business, investments, etc.).