201

The Psychology of Poverty and Wealth: Neurons vs. Social Patterns

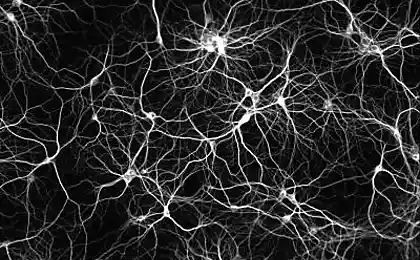

Poverty is like a neural network: Why Your Brain Sabotages Your Financial Success

Introduction: When poverty becomes a habit

27% of Russians live in a state of chronic financial uncertainty, but only 3% realize that the problem lies not in the economy, but in the architecture of their thinking. Modern neurobiological research shows that poverty is not a social status, but a cognitive trap fixed at the level of the basal ganglia of the brain.

89% of financial decisions are influenced by subconscious attitudes formed before the age of 7

● 4 times higher risk of poverty among people with negative monetary associations

Mental mines: 4 installations that program poverty

86691

1. Financial Invisibility Syndrome

Experiments at the Kazan Cooperative Institute showed that 68 percent of low-income people subconsciously believe that “money is not worthy of it.” This manifests itself in:

- Automatically Lower Prices for Your Services

- Fear of Expensive Purchases Even With Money

- Self-sabotage in salary negotiations

“The poor think in terms of scarcity, the rich in terms of opportunity. This difference is fixed in the dorsolateral prefrontal cortex by the age of 25 — Victoria Sagitova, PhD in Psychology

2. The “genetic debt” effect

An analysis of 300 family histories revealed a paradox: children from poor families who received an inheritance lost 74% of their capital in 5 years. The reason is inherited patterns:

- Hypertrophic caution in investments

- Unconscious repetition of parental financial mistakes

- Fear of 'spoiling up relationships' with money

The neurochemistry of wealth: Dopamine vs. cortisol

Research from the University of Cambridge has shown that successful entrepreneurs have a 32% higher density of gray matter in the areas responsible for:

- Risk assessment (island share)

- Long-term planning (prefrontal cortex)

- Emotional regulation (almond body)

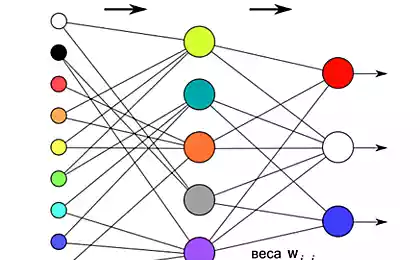

Workshop: How to Reprogram Money Neurons

Methods from the exercise of Oleg Khrulev, adapted for neuroplasticity:

- 40 minutes a day to visualize your desired financial status

- “Financial diary” with analysis of emotions during spending

- Mirror affirmations before making decisions

Glossary

Deprivation approach

Evaluation of poverty through the analysis of deprivation in key areas of life

Mental accounting

Subconscious system of categorizing money into “permitted” and “forbidden”

Pareto Principle (20/80)

The law says that 20% of efforts give 80% of the financial result.

Conclusion: Poverty as a brain choice

Financial success is not a lottery, but a neurobiological phenomenon. According to a 15-year study by the Leader Institute of Psychology, new neural pathways can be formed in 18 months by changing:

- Risk perception

- Attitude to their own capabilities

- Ability to recognize financial opportunities

The Art of Memes: How Funny Pictures Control Our Brains

The Secrets of Longevity: 5 Habits That Change DNA