636

As the world was on the threshold of a new economic revolution

Read the thoughts of Director of the analytical Department of the Bank. The person all life was engaged in Analytics. He understands what he writes.

Wherever we look, we see that the cycles haunt us, and we follow the cycles behind them or ahead. So, what happened in 2008-2009, is a wonderful thing. This period completed several cycles – economic, social, other. This happens within the activity of one generation, about once in 35 years. With a small milestone of the last century, the formation of the gold standard, then the Great depression and the collapse of the gold standard, the introduction of the Bretton woods system (the system of international payments, which declared the U.S. dollar the world currency. – Slon), then the fall of Bretton woods, then the events of 2008-2009. I think what we are witnessing today in geopolitics – these things, in the most heavily associated with the completion of the cycle which occurred prior to 2008-2009, and associated with the beginning of a new cycle, which is formed now.

Today, the world is still a very serious fracture. And the fracture is not in favor of those systems that continue to live by the laws of the so-called tradition. We in Russia, unfortunately, resist the inevitable and show an example of such a "traditional" relationship in a variety of issues – ranging from moral to tangible things. It is, however, quite common for Russia as for the delay in following cycles, both social and economic. It's a shame, but this is again a reality.

What is changing? We restrict to the extent possible, economy. Change direction, the trends: about the same thing happened during the great depression. Then there were "the gap", a break in the cycle – the Second world war; such conflicts also occur, of course, is not just, is not accidental. Similar faults occurred after the fall of Bretton woods in the early 1970-ies brought us to a new financial system, where we are today – yet – exist. Changes occur in important areas.

The end of the bubble

The first is, so to speak, attitude to business at the macro level – at the level of ideology, of political economy. This time the focus of change relevant to the financial system. We all understand that the crisis has changed the attitude of some financial markets – that which is fraught with bubbles. As we all know, in 2008, the credit bubble exploded, and all was covered. The phenomenon of this bubble was the most heavily linked to the fact that there was a long period of very liberal attitude to Finance. Yes, finances were allowed a lot, and that Finance performed a vital, if not decisive, role in sustaining economic growth. Now, Willy-nilly, their "press". Hence, Basel III, the Dodd – Frank laws, toughening the regulations that will accompany the change period of the cycles. However, it is probably not the most profound change that is happening today, but it is very clear, obvious and predictable, it is on the surface.

Indignation dollar

Following the trend change is not so obvious yet, but rapidly maturing, is connected with the monetary system. During the great depression fell the gold standard. In the early 1970-ies there was a system of floating currencies. What is happening today? Here and there is evident resentment (not always reasonable, but insistent) saying that the dollar is something depressing the economies of other countries that it does not develop, creates additional risks, etc. Where these murmurs again, not always justified? Because there is the feeling: there is a change needed for financial and monetary system. Another issue is that these changes sometimes are not recognized and wrong, if not vulgar, are evaluated.

We raise, for example, a topic that certainly needs to appear some alternative to the dollar reserve currency, as if someone prevents this. A reserve currency is rather an element of scholasticism. If you take in reserves, for example, or the Belarusian ruble, the Moldovan LEU, is your own business, what is the composition of the currencies of your foreign exchange reserves (of course, if you do not appreciate all the possible consequences). Of course, there is the indication that member countries of the IMF should have in reserve currencies, but no more. There is fundamentally no problem that the rouble became reserve currency. It is already so for some countries – for example, Kazakhstan talked about this. The question, apparently, is what the scale of this reserve currency. China, for example, claim to much, we are afraid, we today claim to be quite small. But the yuan or the ruble will be a major reserve currency (if not competing with the Euro, with the British pound) only when it becomes objectively possible.

That, perhaps, is clearly going to happen to the world monetary relations in the near future, is a departure from the international arena, currency pegged to some other, stronger currency: the dollar, the Euro, the basket of these currencies. It was, of course, entirely currency developing and transition economies. And we, too, are known to have set themselves this task. It is clear that the main contender for entry into the "VIP club" – the yuan – is gradually released in the free swimming, becomes fully convertible and freely floating currency.

Bitcoin and the nation of cosmopolitans

Not by accident a bitcoin now. Because there is a more global shift in the organization of the world economy – as the reflection of what is happening with society in General. We are talking about building a national economy based on horizontal, direct links. The policy in this case is quite noticeable behind such processes, developing spontaneously. Central banks around the world continue to be selfish bodies, which they think chiefly contribute to the good of his own native economy, not only thinking about how their activities affect neighbors. For example, when the Federal reserve system of the United States accused that China has developed a bubble in the housing market, it is actually largely the charges.

In the context of globalization went into the process of establishing horizontal ties in the economic – especially financial – level. From an economic point of view, the world is beginning to govern – almost, as it is considered at the level of a conspiracy theory – not the government and multinational companies that simultaneously contribute to the emergence of new "global nation" – a mobile, cosmopolitan professionals. This is important from an economic point of view, the nation, and this is a special category of consumers, which should count, if you want to achieve sustainable economic growth.

Horizontal communication appears spontaneously: if we have a computer integrated into the global Network, you will have bitcoin. Of course, if you have a computer in the network and, for example, bitcoin, there will be an exchange which will not be enough to be regulated by the government, the bureaucratic authority of any country. This process has begun, it is unstoppable. Accordingly, this leads to a large financial risk. Central banks, which operate in the international financial space, can not ignore these things. Can not and traditional commercial banks. Today people have more options to make deals among themselves, peer to peer is now available literally to millions. And our goal as a Bank is to integrate into the chain so that these people with new opportunities like us to deal with, but keeping in mind that they are now not always necessary to contact us in order to make transactions.

"Kreakly" displace workers

What is this "horizontal international nation", created as an independent network, and multinational companies and, most significantly, USA (the world's magnet for the best frames)? People from Latin America, from Europe, from Africa, from anywhere. They are absolutely cosmopolitan, they are trained in the United States, England, Sweden, Germany, live and work anywhere where more attractive conditions.

In this amazing and very complex world, there are new classes – we only start talking, but we will continue to talk more and more. They are called such unusual terms as salariat (salary salary), precariat (from precarious, risky – that is, workers with no registration). And we also gave them a new word – "kreakly" (derived from "creative class"). As it happens when negative emotions are artificially introduced into the discourse, came the ugly word that brings people face to face. So we meet new.

A new, growing class of the precariat is the fruit of the leaching of industrial workers during the onset of the post-industrial economy and arising out of the redistribution of the labour market. Erosion of the industrial working class is not only because of the Assembly shop in China. According to the calculations of the Americans, since the mid-1970s and 1980s-present in the industrial sector, the U.S. lost three out of five jobs is about 4 million jobs. They disappeared due to the growth of labor productivity. There are whole studies on this subject, and they are called, for example: "Where have all the good jobs gone?" ("Where did the good jobs?"). "Good job" is a relatively high-paying, stable job, which could boast of the middle class in the States, working in industrial enterprises. The surge in the level of education of the worker involved in the industrial production, how many computers in the workplace since then! The result is jobs in the productive sector are reduced. The middle class is getting poorer, losing good jobs and moving to work in lower-paying service sectors.

What is the result? Today in order to stay in the upper layer and obtain the corresponding income, you need to have extraordinary abilities – creativity, that is a special talent that is given not to all people, or a very good education. The majority of people is still rather performers, these are people that perform algorithms that, relatively speaking, are still on the Assembly line, invented by Ford. So now employs millions of Chinese, who took great pleasure and care perform year after year the same operation with a very low-cost labor. But these people are not very interesting for the world that we call post-industrial. Therefore, their income over the last 30 years in real terms declined. Increased revenues from the top layer of creative people, increased the income of American retirees, the notorious baby boomers. But the income of households where the head of the family – 35-year-old man, in absolute terms, has decreased. Against this background, a new layer of people called "precariat".

It's the people that get odd jobs, working at various jobs, including creative, employment contracts. The number of such people in the Western countries is estimated today at more than 20-25 million people. And you perfectly know that in Moscow some people also close to them in its economic essence. Moreover, it capabilities an attached class, called salariat – people just aren't creative professions, largely those known as "office plankton".

Looking at this new class a reality from the standpoint of the banking system, we get the drift in this banking, when the highest income in retail you will receive from VIP customers, from those people who are able to earn thanks to his talent, or very good, expensive education. And, unfortunately, have to deal with a large number of small banking operations, people with low savings and high credit risk, which is associated with the leaching of the middle class. While this is emerging with the retirement of baby boomers trend in many countries, except, of course, China and parts of Southeast Asia. There is a different situation, there is continuing urbanization in the mid 70-ies in China, only 16% of the population lived in cities, and now 53%, and they're going by 2020 to resettle another 200 million people in the city below lived there for more than 60% of the population. The cost of Chinese resettlement programme in the city – neither more nor less, and $7 trillion!

Energy revolution is close

And the highlight is technological change. It's about what the world will invest in the near future and how to get the most benefits from investment. Look: is absolutely unique coincidence. In the 70 years of the most radical change of monetary-financial system of the world, the floating of the currency with which we are dealing today, is the formation of the financial system. Simultaneously with this, there is an 8080 processor (and later the 8086, 80286 and so on), which, without exaggeration, built our modern post-industrial world. And industrial too. It was a CPU for personal computers, which drastically reduced the price of them, making widely available. He made it possible for today's globalization and modern financial system in particular.

Now, after the peak of the 2008-2009 crisis, there is technically new? This time we are talking about several directions, but not all as there are signs of revolutionary changes. I see only one thing clearly critical for the whole world, is the energy revolution. She definitely has a place, and I am now on very simple numbers will show this. Today proven reserves of conventional, that is, which rises from the earth of oil are 1.5 trillion barrels. In recent years, due to the fact that became available deepwater drilling, shale oil production and production from the so-called oil Sands, to that value added. 1 trillion barrels. It is clear that this situation is changing the rules of the game in the most large extent, but one question remains – the cost of such oil is high. But declining. Approximately one-third, at 330 billion barrels accounts for each of these three new sources in deepwater oil, shale oil and oil Sands. Suppose we will cut off half of the reserves of oil Sands and from shale as may be overvalued or uneconomic – we still get a very good increase: 600 billion barrels, plus the 1.5 trillion that we had before.

In addition, if you take the production of these 1.5 trillion barrels that we had to this technological breakthrough, it turns out that Iran and Libya today is not very active, but has the potential to increase production. Gradually gaining momentum, Iraq and so on. What, by the way, Iran? Iran under the Shah, that is, until 1979, was producing 6 million barrels a day – is today what China needs. And now it produces only 2 million barrels a day. Sanctions will be weakened and power will be quickly restored.

The age of oil will end

What is China from this point of view? Now the amazing thing in this whole situation. China produces much of its own gas. He is only 1/3 of the required gas imports from abroad 42-43 billion cubic meters a year, half of which is liquefied gas. We to Europe through Ukraine has much more to offer. China is no need to sharply increase imports of gas. Especially as it rapidly develops the production of its own, including shale. In China, if you have the aim, it mobilizes everything and everyone, but will do what is planned.

And what we see today? The task is to diversify the energy sector, to move away from fossil fuels. A third of the electricity in China is already from renewable sources! Sun, wind, hydroelectric. And in the States – only about 16% today. Thanks to the Chinese we got a critical reduction in the cost of solar energy for two years – with sky-high values to about the cost of production of electricity from fuel oil. In China in 2013 for the first time statistics – more than half of the total of 91 GW of generating capacity entered had on energy from renewable sources. This same revolution that is going on with your eyes.

And, of course, how could I forget about the Tesla car, which is expensive, but is a complete car! And that's not all. Just learned about batteries, charging per half hour, based on a fundamentally new properties of their component parts. All this global processes that rapidly change the world.

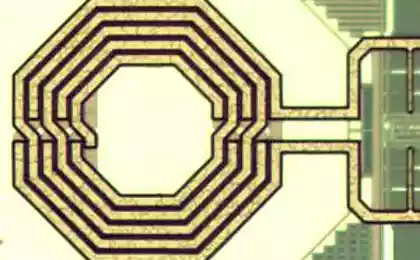

There is, in my opinion, another revolution that has not yet happened, but is ready to happen in the near future – a revolution in computers. Because while we see only the extensive development of computer technology, we see an increase in the number of processors, chips and so on, has already reached the atomic limit for chips, but it is still principles. We expect a new trend breakout – as with the processor 8080. Now this is a new solution that should dramatically increase computer performance and make possible the emergence of a complete and compact artificial intelligence.

Isolation is a failure

Obviously, now the progress is achieved only through the joint efforts of people from different parts of the world. The fruits of this progress have successfully used just because technology and knowledge spill over from one lab to another, from one country to another. These trends continue to objectively work on the development of horizontal global economy. To, for example, or the defense of some scientific laboratories is effectively passed in our daily life, we need two things – the capitalist system, which is based on profit as incentive, and globalization when you can focus... spraying them. For example, through the concept of the cloud, i.e. distributed effort. And it's hard at work and the finances via such techniques and technologies, such as crowdfunding, crowdsourcing and the like.

Shutting, you and I, the Lord, will not get anything is the failure that today I received only a few backward, completely unattractive, low-value economies, which may serve, except that a warning and a negative example to others. Some learn from the mistakes of others and you know who – on their own.

Nikolai Kashcheev

source: petrimazepa.com

Source: /users/1077

For billions of years before animals the oxygen level was 0.1% of the current

Care oral — tips Ayurveda