684

Tesla has placed an additional 2 million shares

Today, Tesla объявила about placing the stock market an additional stake size 2 100 000 pieces. Given yesterday's price of $ 283.17 at the close of trading on the securities Tesla company may receive additional capitalization of $ 492.6 million. Underwriters were a number of reputable investment companies and banks: Goldman Sachs & Co., BofA Merrill Lynch, Morgan Stanley, JP Morgan, Deutsche Bank Securities and Wells Fargo Securities.Za left them the right to a 30-day option to repurchase additional 315,000 shares, potentially able to increase the capitalization of Tesla for $ 566.5 million.

About a week ago, it became known that a number of financial analysts were asked a series of questions Elon Musk and Chief Financial Officer (CFO) Tesla Deepak Ahuja (Deepak Ahuja) regarding the future plans of the company and how it is going to realize its position in the market. Around the same time, the media profile reported that sales of electric vehicles Tesla is actually a loss-making business, as the company completed second fiscal quarter a loss of $ 47 million. In this regard, Musk and Ahuja said experts in the sense that the company feels comfortable enough to raise its capitalization and may make sense in terms of reducing potential risks. Whether this additional issue a sufficient number of shares to Tesla conversation took place is unknown. Meanwhile, if at the end of 2014 the amount of funds in the accounts of the company is estimated at approximately $ 1.9 billion by the end of the second quarter of this year, the amount was reduced to $ 1.15 billion.

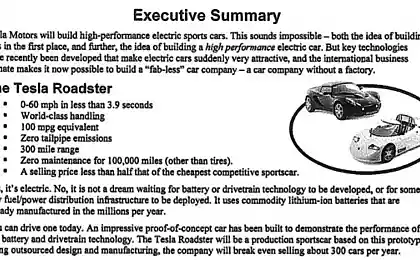

In the published application Tesla says about the purpose for which will be issued securities. The company plans to use the proceeds to support its growth in the United States, as in the rest of the world, creating new stores, service centers, construction of a network of chargers Supercharger, development and production of a new model of the electric vehicle Model 3, as well as the construction of & quot; Гигафабрики & quot; batteries.

Issue of new shares Tesla is generally to ordinary event, especially considering the modest size of the issue, if not the reputation of CEO Elon Musk and traditional attention to his actions. In 2012, Facebook held IPO, selling 421.2 million shares at $ 38 each, which actually brought Facebook's capitalization of $ 104.8 billion and made Mark Zuckerberg one of the richest men in the world.

Source: geektimes.ru/post/260226/

About a week ago, it became known that a number of financial analysts were asked a series of questions Elon Musk and Chief Financial Officer (CFO) Tesla Deepak Ahuja (Deepak Ahuja) regarding the future plans of the company and how it is going to realize its position in the market. Around the same time, the media profile reported that sales of electric vehicles Tesla is actually a loss-making business, as the company completed second fiscal quarter a loss of $ 47 million. In this regard, Musk and Ahuja said experts in the sense that the company feels comfortable enough to raise its capitalization and may make sense in terms of reducing potential risks. Whether this additional issue a sufficient number of shares to Tesla conversation took place is unknown. Meanwhile, if at the end of 2014 the amount of funds in the accounts of the company is estimated at approximately $ 1.9 billion by the end of the second quarter of this year, the amount was reduced to $ 1.15 billion.

In the published application Tesla says about the purpose for which will be issued securities. The company plans to use the proceeds to support its growth in the United States, as in the rest of the world, creating new stores, service centers, construction of a network of chargers Supercharger, development and production of a new model of the electric vehicle Model 3, as well as the construction of & quot; Гигафабрики & quot; batteries.

Issue of new shares Tesla is generally to ordinary event, especially considering the modest size of the issue, if not the reputation of CEO Elon Musk and traditional attention to his actions. In 2012, Facebook held IPO, selling 421.2 million shares at $ 38 each, which actually brought Facebook's capitalization of $ 104.8 billion and made Mark Zuckerberg one of the richest men in the world.

Source: geektimes.ru/post/260226/

Koreans have created a battery that can be printed on 3D-printer

Samsung also wants to distribute Internet through microsatellites