1011

Banks "online only" - the innovators of the future world of finance

What is a bank in our minds? Several offices with ATMs serving varying degrees smiling in uniform, scoreboard exchange rates. Hollywood movies about financial fraud suggest that somewhere there must be another storage box with a huge safe doors. Innovation in the form of the electronic-queue until it reached to all Russian banks.

In recent years, funds online account access and associated mobile applications are developing rapidly and acquire functional. This is convenient for the bank and the customer. And how viable banks, which do not have a physical presence?

First Direct was one of the first banks to implement in 1989 the concept of non-stop service through the call center, in the absence of a network of branches. Over the past 26 years there have been several striking examples - SFNB, First-e, Egg Bank, OCBC, all with varying degrees of success.

In early January, the Chinese Tencent , one of the world's largest IT-companies, launched its "just-online" private bank - WeBank . In China, the majority of banks - state. Tencent shares rose 13% during the week. Analysts называют this is a new era of expansion in emerging markets. Chinese Premier охарактеризовал the situation as follows: "One small step for WeBank, one giant step for financial reform».

Let's try to analyze what changes may entail such innovations.

1. Serious market transformation

Reducing the cost of rent and staff will increase investment in business development. Traditionally, banks will be more difficult to compete. This is true only in the case of sufficient demand for such services, of course. And demand is likely to be. A recent study of young (18 to 39 years old) American millionaires revealed that 37% of them are ready to deal with financial matters to Facebook, and 28% - in Twitter. For example, for the generation of "boomers" (1946-1964) is completely irrelevant. On the other hand, the willingness to use modern channels of communication and a willingness to pay a few million in the virtual bank - two big differences. Therefore, to attract and retain customers require considerable effort. Partnership with the traditional bank with a reputable brand can be one of the outputs.

2. Banks cosmopolitan

"Online only" banks - more flexible. They will be able to quickly change the "place of residence" without business interruption. This allows you to select a country with a softer regulation in the financial sector. In addition, customers can potentially get a wider range of services. Examples from other industries - gaming. Companies-operators of online casinos are registered in countries where such activities are permitted, but serve clients from all over the world. On the other hand, when at stake significant sums haven in the Caribbean - not the safe haven.

3. New business opportunities

The development of "online only" banks will lead the creation of new or existing rapid development of niche markets at the junction of online and offline. For example, in the absence of its own ATM network will become popular independent operator serving several of these banks at the same time.

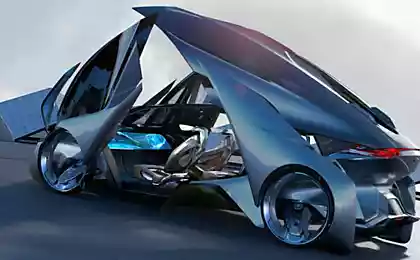

4. Natural innovators

Being originally from the world of "Digital", these financial institutions are more open to innovation, and additional functionality will not take long. In other words, if the bank decided to work only online, its management is not necessary to prove that the world market a little wider than the & quot; примерно five computers & quot ;.

5. Technological risks and threats

Large computer break-ins last year cast doubt on the readiness of the industry to such changes. The objectives of hacker attacks in 2014 has становились at least five US banks, including JPMorgan Chase. Even modern banking giants are victims of cyber criminals. So innovators who are planning to do business "online only" should pay particular attention to combating hackers and fraudsters. The demand for specialists in the field of computer security and development of specialized software will only grow.

Image - Flickr / 401 (K) 2012 sub> You would be ready to use the bank without the physical infrastructure, "online only"? Yes No Difficult to answer Voted 281 people. 35 people abstained. Only registered users can vote in polls. Sign , please.

Source: geektimes.ru/post/245112/

In recent years, funds online account access and associated mobile applications are developing rapidly and acquire functional. This is convenient for the bank and the customer. And how viable banks, which do not have a physical presence?

First Direct was one of the first banks to implement in 1989 the concept of non-stop service through the call center, in the absence of a network of branches. Over the past 26 years there have been several striking examples - SFNB, First-e, Egg Bank, OCBC, all with varying degrees of success.

In early January, the Chinese Tencent , one of the world's largest IT-companies, launched its "just-online" private bank - WeBank . In China, the majority of banks - state. Tencent shares rose 13% during the week. Analysts называют this is a new era of expansion in emerging markets. Chinese Premier охарактеризовал the situation as follows: "One small step for WeBank, one giant step for financial reform».

Let's try to analyze what changes may entail such innovations.

1. Serious market transformation

Reducing the cost of rent and staff will increase investment in business development. Traditionally, banks will be more difficult to compete. This is true only in the case of sufficient demand for such services, of course. And demand is likely to be. A recent study of young (18 to 39 years old) American millionaires revealed that 37% of them are ready to deal with financial matters to Facebook, and 28% - in Twitter. For example, for the generation of "boomers" (1946-1964) is completely irrelevant. On the other hand, the willingness to use modern channels of communication and a willingness to pay a few million in the virtual bank - two big differences. Therefore, to attract and retain customers require considerable effort. Partnership with the traditional bank with a reputable brand can be one of the outputs.

2. Banks cosmopolitan

"Online only" banks - more flexible. They will be able to quickly change the "place of residence" without business interruption. This allows you to select a country with a softer regulation in the financial sector. In addition, customers can potentially get a wider range of services. Examples from other industries - gaming. Companies-operators of online casinos are registered in countries where such activities are permitted, but serve clients from all over the world. On the other hand, when at stake significant sums haven in the Caribbean - not the safe haven.

3. New business opportunities

The development of "online only" banks will lead the creation of new or existing rapid development of niche markets at the junction of online and offline. For example, in the absence of its own ATM network will become popular independent operator serving several of these banks at the same time.

4. Natural innovators

Being originally from the world of "Digital", these financial institutions are more open to innovation, and additional functionality will not take long. In other words, if the bank decided to work only online, its management is not necessary to prove that the world market a little wider than the & quot; примерно five computers & quot ;.

5. Technological risks and threats

Large computer break-ins last year cast doubt on the readiness of the industry to such changes. The objectives of hacker attacks in 2014 has становились at least five US banks, including JPMorgan Chase. Even modern banking giants are victims of cyber criminals. So innovators who are planning to do business "online only" should pay particular attention to combating hackers and fraudsters. The demand for specialists in the field of computer security and development of specialized software will only grow.

Image - Flickr / 401 (K) 2012 sub> You would be ready to use the bank without the physical infrastructure, "online only"? Yes No Difficult to answer Voted 281 people. 35 people abstained. Only registered users can vote in polls. Sign , please.

Source: geektimes.ru/post/245112/