How Apple Pay affect the market of mobile payments?

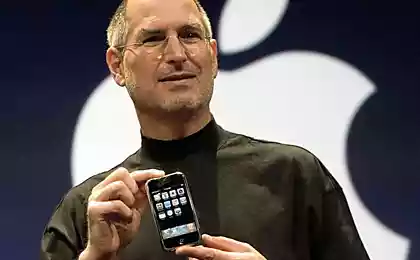

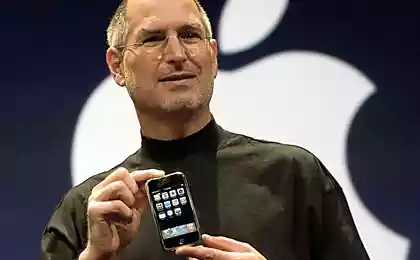

Since that day, many goods and services will be paid directly to the devices Apple, reading the billing information from the display via smartphone or tablet technology NFC (Near Field Communication) with user authentication through fingerprint sensor Touch ID. However, this nuance inlet eliminates a huge number of users of older iPhone models and the iPad (on the iPhone 5 and iPad mini 2 inclusive), dividing the many millions of users of Apple mobile gadgets into 2 camps.

However, this course Apple itself kills two birds - introduces the most powerful payment system, which is already at the stage of starting a serious competitor market leaders mobile payments and encourages users to buy new models of its iPhone and iPad.

Talking about the new service Apple launched in September. From the moment when the Cupertino tech giant announced its intention to enter the market of mobile payments with its own payment system with Apple expressed a desire to work more than 500 banks and financial institutions, among which the Bank of America, Citibank, JPMorgan Chase and Wells Fargo.

Meanwhile, not all of the major players in the market of payment services took this news with enthusiasm. Some, such as Visa, Mastercard and American Express, without hesitation agreed to cooperate with the new player in the market, while others are preparing to oppose him. For example, PayPal, which, in order to fully prepared to confront Apple Pay, separated from eBay.

What do people think about Apple Pay analysts, which, in their opinion, the "apple" of the corporation chance to conquer new markets for themselves, for supremacy on which many years struggling, many companies, including such major players as PayPal and Google?

Most speak on this occasion experts believe that the introduction of a new payment system will give the world of digital payments powerful impulse, and small businesses is recommended to look at the Apple Pay closely, as it has every chance of shaping the future of mobile payments.

"Digital Wallet» Apple is, in fact, a fragment of code, activated via a mobile application that provides consumers with access to credit and debit cards as well as your bank account to make purchases.

Starting today, with the help of Apple Pay can pay off in more than 200,000 retail outlets. Among the retailers who are among the first began to collaborate with the new payment system - restaurants McDonald's, Walgreen drugstore chain and department stores Target and Macy's.

«If you want to come to the market and attract the mass market, you need to immediately start with the major scale, and that Apple has done," - said vice-president of MasterCard James Anderson. I> blockquote>

Users of the iPhone 6 and 6 Plus will be able to upload data to your smartphone up to 8 different credit cards that have the new iPhone 6 will be able to load up to eight different credit cards, in addition, with the help of Apple Pay you can pay for your purchases in your applications.

Anderson believes that for small businesses last point is particularly important, as it will allow to sell their products directly to the application without any intermediaries that besides the obvious convenience, improve brand positioning.

An equally important aspect in Apple Pay are security measures that Apple has used in its mobile wallet - experts say that Apple Pay payments will be safer than plastic cards. Biometric fingerprint reader will make sure the payment is carried out exclusively smartphone owners. NFC chip transmits payment information via encrypted tokens, not your bank account information cardholder "plain text».

«Innovations related to tokenization and biometric identification, put Apple Pay apart from other market offerings, such as Google Wallet and Softcard», - says the director of research at the CEB TowerGroup Andy Schmidt. I> blockquote>

Although too early to judge the potential of the service prior to its launch, these benefits can be a serious trump Apple in entering the fast-growing market of payment systems. Currently, the market for e-commerce in the US is about $ 260 billion, of which the mobile sales account for $ 115 billion. However, according to some estimates, in the next five years, these numbers could triple.

reported in the Western media i>

Source: habrahabr.ru/post/240985/