183

Specifics of choosing a cryptocurrency exchange

Perhaps there is not a single person who has not heard the word “cryptocurrency” at least once in his life. This endlessly broadcast business media, numerous Internet platforms, brokers. Someone makes bets, someone fully trades, testing luck and focusing on their own knowledge.

What should be a professional cryptocurrency exchange

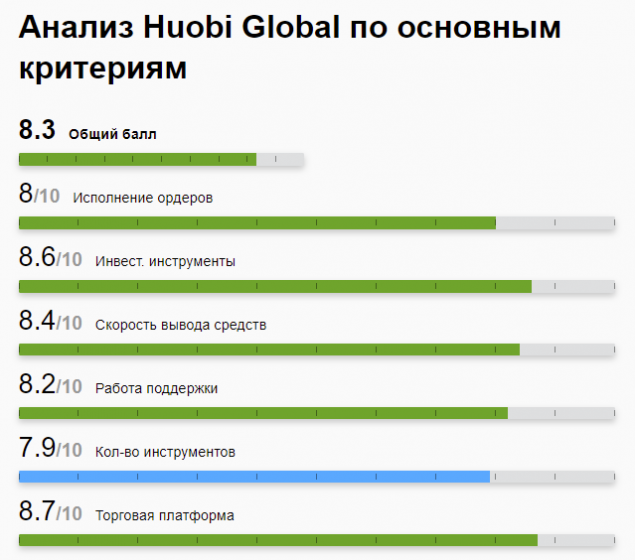

Among all the abundance is to choose those sites that are suitable for many parameters. For example, a minimum deposit. It is believed that requiring a minimum deposit of $10,000 or more is likely to scare off users. And, on the contrary, increased interest is demonstrated by sites with a minimum deposit of up to $ 100. Some even allow you to invest $1. Of course, first of all it is necessary to study reviews, descriptions. So, on specialized sites you can find reviews, for example, about Huobi and many other popular exchanges. You can also learn about how to replenish the account, in which currencies, cryptocurrencies. The following information will also help:

- Tools, for example, currency pairs, cross rates.

- The presence or absence of leverage.

- The presence or absence of spreads and so on.

- The role and date of foundation, as well as the availability of a license and open information about the date of its receipt.

Why international venues are valued

Among all the abundance, sites that position themselves as international, multilingual are highly valued. This means not only the availability of the platform in a particular language, but also the availability of appropriate technical support, speaking, for example, English, Russian, Ukrainian and other languages. A wide range of trading tools, the presence of a demonstration account are also very appreciated. Unfortunately, the demo account is not found at all such sites. Also, you need to pay attention to the following indicators:

- The number of ways to communicate with technical support. Unfortunately, sometimes the exchange has only a phone number or email address. That should alert you.

- The number of investment programs, portfolios not only for active, but also for passive earnings.

- The volume of training materials for both beginners and experienced users. This can be technical, fundamental analysis, graphs, diagrams or ordinary forecasts of experts, analytical articles.

Of course, it is necessary to evaluate the volume and essence of independent reviews. And it is better to look for them on independent thematic platforms dedicated to earnings in the network as a whole or something specific, for example, cryptocurrency, binary options and so on. Of course, you need to pay attention to whether there are segregated accounts, that is, whether customer funds are protected.