225

How stock broker ratings are formed and the nuances of the right choice

Users who choose a broker are strongly advised to cooperate only with those who are in the top. Like the top 10. Being in the top depends on the popularity of the site, reliability, stability.

What reliable sites offer

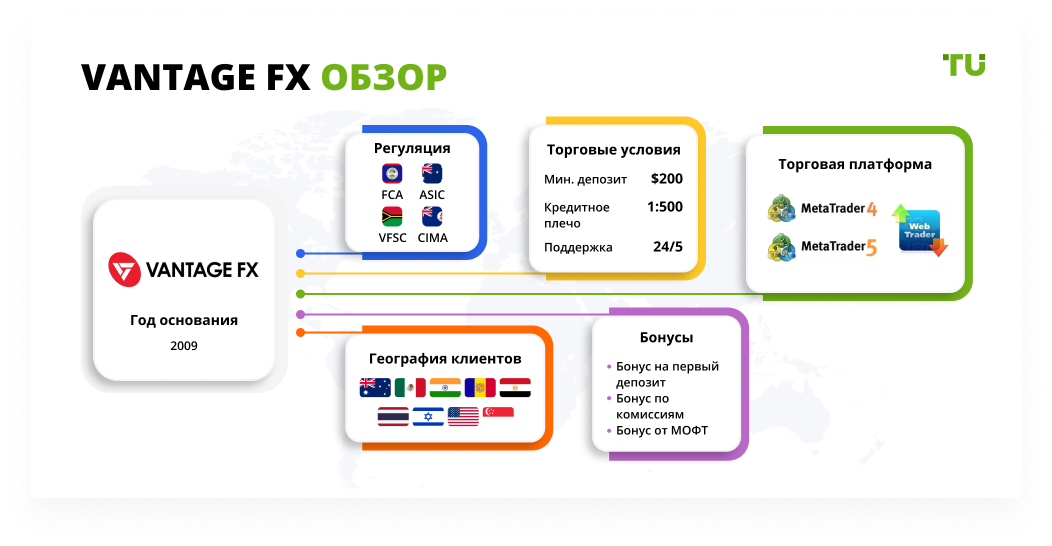

Of the positive aspects, it is worth noting the different levels of deposit. For example, in some cases the minimum deposit is $10,000, but some brokers lower the minimum entry threshold to just a few hundred dollars. You can see more reviews, get acquainted with the functionality. For example, learn about vantage fx and its closest competitors. Also, good brokers are ready to offer the following:

- Reasonable leverage indicators, a great choice for both currency pairs and stocks.

- A good set of tools: indices, currency pairs and not only.

- Reasonable spread figures.

Of course, you need to weigh the strengths and weaknesses of any site. For example, if training is not provided or information about trading is scarce, it is better to turn to the competitors of this platform.

How the platform rating is formed

Often on independent portals you can find information about the platform, which is formed in an automatic non-biased mode. Both reviews of independent traders and ratings assigned to the broker are analyzed. For example, activities are assessed on a ten-point scale. If the overall rating, depending on such estimates, is less than 7-8 points, then this should already be alarming. The following points should also be remembered:

- One of the main factors traders call the speed of withdrawal of funds.

- Great confidence is caused by platforms that provide complete information about their registration, including address, license number, contact telephone numbers, email address.

- Efficiency of processing applications in sapport. Sometimes users note that on a particular site there is an increase in spreads for no reason or there is a discrepancy in quotes on accounts within the company itself.

Video reviews and opinions of independent analysts are very helpful in the selection. Everything is evaluated: the volume of investment instruments, the specifics of order execution, the speed of withdrawal of funds, the stability of the trading platform, the ability to communicate with technical support in their native language and much more.

There are a variety of investment programs, portfolios that open up various options. Sometimes clients who plan to invest large amounts (for example, from $ 10,000) are offered special terms of cooperation and get VIP-client status. A variety of partner programs are also being developed, offering a solid reward depending on the number of attracted customers and other conditions.

What are hardware wallets with the function of crypto exchanges

The soul is calm for the insulation, the rodents escaped, smelling the sharp aromas of home remedies