170

Objective reviews about scam brokers will help traders avoid a sad fate

Any commercial sphere is not at all guaranteed against the invasion of it by unclean people. There is no exception to the Forex market, which attracts fraudsters by the apparent simplicity of obtaining unfairly obtained profits. An effective barrier to fraud is provided by the IAFT, which regularly publishes on its portal current reviews about fraud brokers, the objectivity of which is supported by “black” lists of fraudsters fundamentally checked by various parameters of Forex brokers.

Principle of formation of “black” lists

The company, collecting data on fraud brokers for more than 10 years of operation in the market, forms lists of them on the basis of the main features that allow us to attribute these financial adventurers to one of three types:

- One-day brokers, with the usual calls for traders to invest profitably and make good money on it. For a fraudster, motivation, its reliability is not at all important - the main task is to collect deposits as much as possible, after which the scam site is urgently closed, sometimes informing gullible depositors about bankruptcy, and more often without any explanation;

- Forex kitchen, which is a more refined and requires more thorough preparation type of fraud, while bringing adventurers higher profits. Creating a full-fledged platform with a duplicate of the functionality of leading Forex brokers, the cheater forces the trader to play not with the functionality of the global interbank market, but with a number of other traders registered, unfortunately, on the same platform, or even with the platform itself. Is it necessary to specify that the forex kitchen is exposed to such conditions, under which it constantly remains a winner to the detriment, of course, its overly trusting partners;

- financial pyramids belonging to the most famous type of fraud, used not only in the Forex market, but also everywhere. At the same time, the fraudster company, posing as a broker, does not even bother imitating interbank activity, but simply replacing it with irresponsible promises, collects trading deposits.

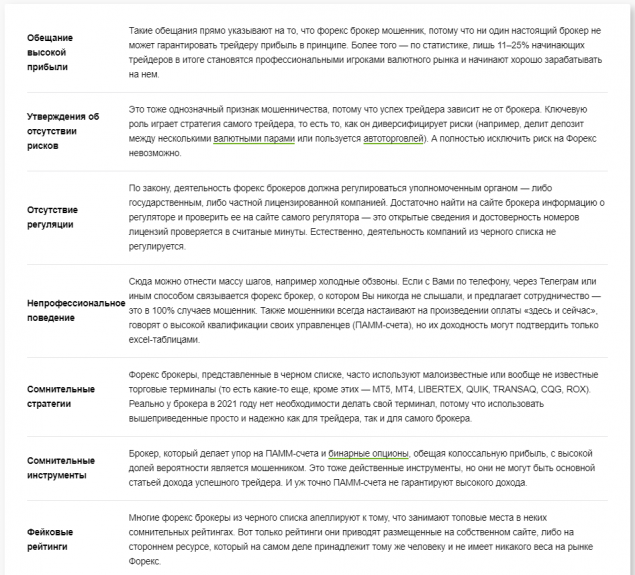

The main features of a broker-shuler

The ITF experts, who have quite sufficient experience in exposing fraud brokers, distinguish their main features, consisting in:

- Promises of high profits;

- statements about the absence of risks;

- Lack of regulation by the competent authority;

- unprofessional behavior (“cold calls” etc.);

- dubious strategies and tools;

- Fake ratings;

- No SSL certificate, etc.

Guided by the information of the ITF and the advice of its experts, a trader can rarely “get hooked” by broker-shulers and suffer financial damage because of this.

10 secrets of eternal youth, which are known only in Hollywood

Volcano - gambling club and its specificity