179

Favorable conditions for obtaining a cash IP loan secured by real estate from OftinBank

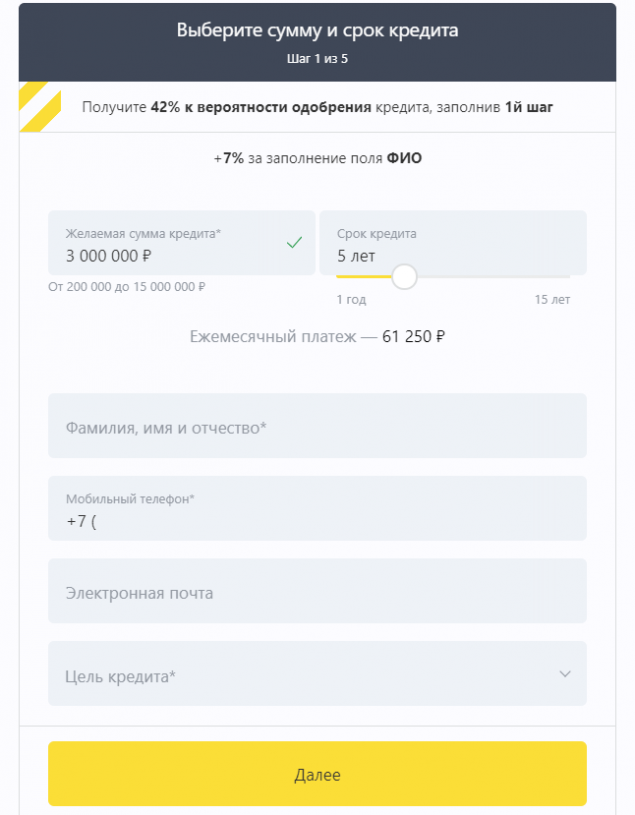

A person who wants to take a loan in cash and promptly for any needs, it is quite difficult to implement this, due to the abundance of banking institutions and the need to prepare a lot of documents to solve this problem. And this despite the fact that in some cases he may receive a refusal for one reason or another. In a particularly difficult situation in this case is an individual entrepreneur, for whom any delay can result in the omission of profitable contracts, and even serious financial losses. The optimal solution to the problem is offered by Tinkoff Bank, where a cash loan for IP secured by real estate can be issued in the shortest possible time (even within one day), but subject to rather stringent conditions, which are due to great risks for the bank when performing this operation.

OftinBank, providing business owners, in particular IP, a cash loan secured by real estate, can receive as collateral:

- premises or buildings owned by the borrower, which is a loan for commercial real estate;

- a new premises for the purchase of which the entrepreneur receives a loan, in this case it is issued as a commercial mortgage;

- own property of the entrepreneur.

Guarantees of payment of the loan for the bank can be real estate represented by a commercial or residential premises, warehouse, office, land, shop or shopping center. At the same time, the borrower must, in addition to providing documents on the activities of the company, also confirm his ownership of the mortgaged real estate.

Giving preference to obtaining a loan secured by real estate, namely, Tinkoff Bank, IE takes into account the main advantages of applying to this banking institution, consisting in:

- ease of registration with the presentation of a minimum package of documents;

- the possibility of sending them online;

- receiving cash in rubles, dollars or euros without visiting a bank branch;

- individual selection of credit conditions for each borrower;

- the possibility of convenient choice of payment schedule and savings due to debt repayment in advance.

The requirements for the borrower from the administration of OftinBank are quite loyal, and the possibility of approving the application and receiving cash within one day is another significant advantage of this financial institution. They also do not provide for the confiscation of property and eviction of tenants from the mortgaged apartment, which allows the entrepreneur to be sure of no risk of losing his home. If necessary, with the consent of the bank, the apartment can be sold or leased to pay the debt.

Is it possible to learn to make accurate predictions for sports using the tips of the Marathon casino?

Rates of Sport and Casino in BK PariMatch