508

Mask against the Chinese: who will win in the solar market

Solar energy is a very promising direction. But while these developments are long overdue, there are a number of problems that could not solve it. The two major are the low efficiency of solar panels and their high cost. Without subsidies, in one form or another, working in this industry companies can't exist. But it seems that the situation is beginning to change.

One of the most exciting companies in the solar market, SolarCity, announced its intention to buy its rival Silevo, which will soon provide solar panels with an efficiency (conversion efficiency of the beam energy into electricity) is 24%. Today, a typical rate – 15-16%, above only from the company Sanyo Electric, a member of the Panasonic Group, and SunPower – 17,6%. That is, the solar panel Silevo will be a third more effective than the current leaders and 50% of their own development of SolarCity. The plans for the next two years is to build the biggest solar plant in the world with a capacity of 1 GW.

In solar power, believed by many businessmen and companies, including Warren Buffett, Google, Intel and others. In this industry even noticed Elena Baturina, wife of former mayor of Moscow, which has recently invested about 10 million euros a project for the development of solar energy in Eastern Europe.

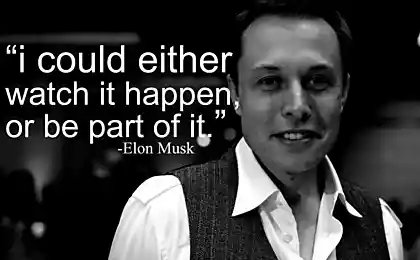

One of the co-founders of the company SolarCity – Elon Musk, the founder of the manufacturer of electric cars Tesla Motors and private space company SpaceX – sets the pace for the development of this business and supports its cousins dealing with the operational management of SolarCity. And the upcoming launch of "megatallica" batteries Mask, which is developing a new generation of batteries will make solar panels even more interesting and accessible to property owners.

SolarCity advantage over other manufacturers of solar panels – a wide range of products that make solar energy available today. One of them is the "solar lease" program of lending, through which the savings from use of solar energy exceeds the monthly payments for the battery. For many consumers it is more attractive than a one-time payment upon purchase. But at the same time with the rapid growth in the volume of orders increases, costs SolarCity, and the company remains unprofitable. Partly because Chinese competitors driving the decline in panel prices, worldwide.

Chinese vs. American "solar" companies are Today's leaders of solar energy industry – the U.S. and China, and in recent years the confrontation between them went far beyond corporate competition. In response to grants from China, through which Chinese companies sell solar panels at below cost, the U.S. government imposed anti-dumping duties in the amount of 20-30%. Similar measures are being considered in the EU, where companies from China are in control of 80% of the market.

Why the interest in solar energy by the Chinese government? First, alternative energy sources – a way to ease dependence on imported hydrocarbons. Second, the environmental situation in China has worsened, and solar panels and wind turbines is another step to solving this problem.

However, China's domestic market is too small to justify significant expenditures on research and development of solar panels. Therefore, it is believed that the subsidy is not only helping the industry, as a deliberate policy, in which Chinese companies can achieve long-term dominance in the global market.

At the same time, there is a risk of overproduction: demand for solar panels from China from the main consumer, the EU is gradually reducing due to the gradual saturation of the market. While the technology is still far from perfect, and the price, despite all the subsidies are quite high.

However, we cannot say that the American "solar" companies are not getting support at the Federal level or the state level. Tax incentives, direct subsidies, and loan guarantees – all this gives certain advantages to us companies, or their business would be economically unjustified, even given the potential profits in the future. However, neither in that, nor in other case calculate the full costs of promotion of the industry is impossible.

Is it worth investing in solar energy today? To plan for the future is difficult: the rate of development of the industry is very high, and large multipliers make problematic an objective assessment of companies. Remember 2010, when growth was high and investors were confident that the solar energy future. However, in 2011, almost all "solar" companies became unprofitable, dropped the price of their shares. The revenue of these companies remained approximately at the same level and the debt burden is growing (see table).

Investing in solar energy company today remains quite risky, but eventually highly profitable. For example, SolarCity shares are traded on the NASDAQ under the Ticker SCTY, has grown 9 times since IPO 12 Dec 2012. And this is not the only example of SunPower stock has grown 7 times since the beginning of 2013.

When choosing an investment object, special attention should be paid to the rate of leverage, because some companies, he rolls over. For example, the indicator debt/EBITDA at Yingli Green Energy – 82 in the normal value of 2.

It is important to understand that innovative firms are not amenable to standard estimation methods. Completely normal for a long time to have losses and be considered effective. Investor, investing today, buy tomorrow's potential. And of course, buying stocks for the long term, you need to invest in a business you understand, or at least in whose potential you believe.

источник:slon.ru

Source: /users/1077

Spasm of the blood vessels of the brain: a treatment of folk remedies

October 1 will be presented a smartphone that does not need to charge