1668

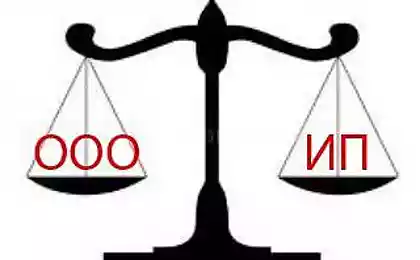

Business Valuation - an important stage in the sale and acquisition of a legal entity

Modern business activities is fraught with many legal nuances, the ignorance of which is fraught with the most negative consequences for the owners of the legal entity. Quite often businesses are faced with serious problems when it is necessary to redistribute the share, sell or buy a business. With this task perfectly cope business valuation, carried out by highly qualified professionals with extensive knowledge in the legal industry.

Service

assessment This service is represented as a very time-consuming and painstaking work that requires special skills, education, and most importantly - experience. Valuation of business includes:

- The calculation and analysis of asset / liability;

- The calculation of cash flows;

- Conduct comparative works on the basis of findings;

- The definition of the total cost in terms of money.

This service may need any entrepreneur at different stages of the business, so it is very important to find a reliable company with experienced professionals.

methods of business valuation

Calculation of assets is carried out in several steps, most of which can be considered a count total monetary value of the equipment, property, product / services and finance. In addition, there is such a thing as goodwill, which plays an equally important role in the evaluation. That is why this service can be done in several ways, including которых:- Сравнительный;

- Доходный;

- Затратный. Ol>

Any of the above methods has its advantages and disadvantages, but what exactly will be relevant in each case only an expert will decide. If there are assets in securities, bonds and shares, the total cost can be quite changeable. In this case, usually resort to dynamic monitoring over a period of time, after which it is concluded on the basis of the average cost of securities over time. This allows you to achieve maximum efficiency and to sell the entity on favorable terms.