1188

Research Yandex: Medium advertising budget on contextual advertising in Russia - 7000 rubles per month

"Yandex" has published a newsletter "Contextual advertising in Russia. Summer 2007 »(PDF). The study is made on the basis of "the Yandex.Direct", the data cover the period from January 2006 to June 2007. goda.V report first published data on the average advertising budget on a "Yandeks.Direkte" and analyzed the causes of decline in the average cost per click.

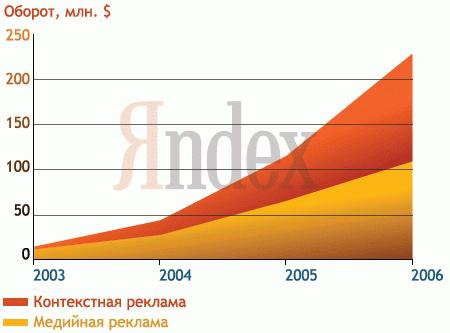

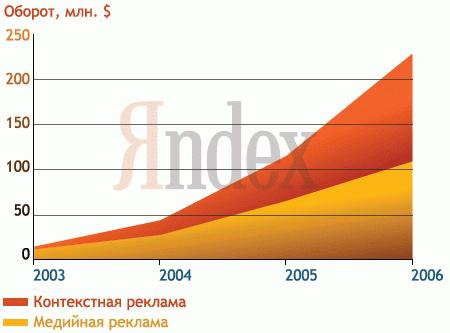

Contextual Internet advertising - the most dynamic segment of today the Russian advertising market. The rate of growth of its volume in terms of money is 150-200% per year, which is several times greater than the rate of sales of advertising in traditional media (no more than 30-36% growth for 2006, according to the ACAR). And the pace of development, and on the absolute sales figures ($ 110 million in 2006 alone), contextual advertising in RuNet ahead banner (+60% in 2006).

Contextual advertising market is becoming more widespread. As of June

2007 in only one system, "Direct" weekday contextual ads displayed 140 million times, and performed more than 1, 2-1, 3 million crossings users to advertisers' websites. From January to December 2006 in the "Direct" it was registered 147 million users transition to advertisers' websites. Overall, the 2006 monthly traffic to the sites of the Russian Internet generated targeted ads increased almost fourfold. In 2006, on the "Direct" campaigns have been more than 30 thousand. Advertisers.

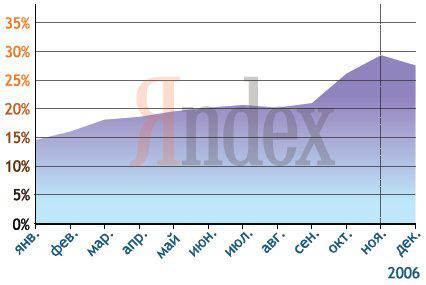

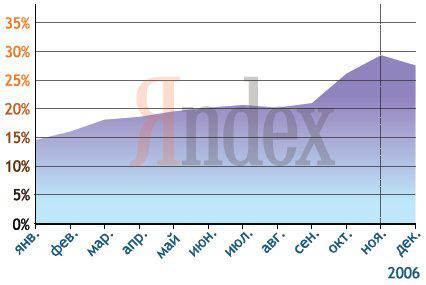

Along with the expansion of the market and increase its coverage and increasing the budgets of advertisers in the contextual advertising. In 2005 and 2006 the monthly budget, releases the middle on their contextual advertiser company during the year nearly doubled, so that in March 2007 exceeded 7,000 rubles.

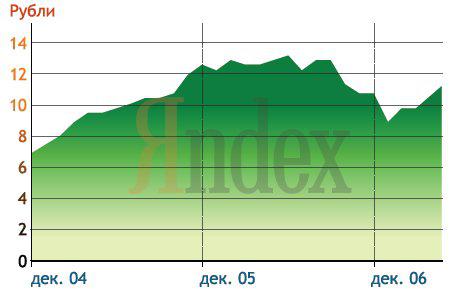

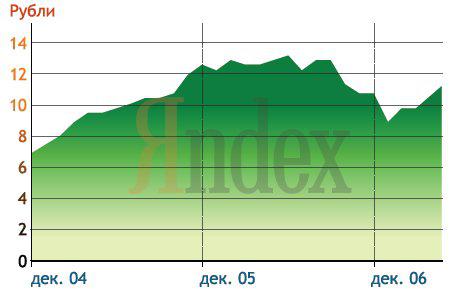

A good illustration of the changes in demand and the corresponding changes in supply dynamics is the average rate per click. During 2005 it grew steadily (+ 65% by the end of the year), but in 2006 the growth rate stopped. This was largely due to the fact that a large number of advertisers could not increase the bid: their business is simply not allowed to pay for each visitor to your site even more.

To attract new customers, which is severely restricted and small size of the rate, "Direct" in late 2006 reduced the minimum rate of 3 rubles and 30 kopecks. As a result, the average rate for the transition from one advertiser by significantly decreased, but began to increase the number of advertisers and advertising campaigns. This, in turn, caused the increase in turnover of contextual advertising due to lower average interest rate. However, after a few months of growth in the average rate resumed as among newcomers start growing competition.

As of April 2007, the average rate for the transition was approximately 10% higher compared to the same period of 2005. Thus, the change in the average rate has stimulated the expansion of the market; opened its advertisers from the regions and low-margin business segments. In the high-margin and highly competitive segments (to what is, for example, is the market of plastic windows), the average rate for the visitor as she was, and has remained high.

The observed decrease in the average rate for the transfer can not be considered a trend common to the entire Russian contextual advertising market: reducing the minimum rates per click spend only "Direct", while the "Runner", and left them at the same level. Money growth of the Russian market of contextual advertising is not only due to the price competition between advertisers (though its influence is undeniable), but also due to the arrival of new advertisers (including those from low-margin businesses), increased investments in contextual advertising, and the overall growth of the advertising audience. The ongoing popularization of content, that is, the qualitative expansion of its customer base, is today one of the most important trends in the development of the advertising market.

As the contextual advertising market and changes in the conditions of its placement and behavior changing advertisers. The most interesting trend in this area -extensions set of keywords, which displays ads. In 2006, the share repurchased requests in the total number of search queries of users has almost doubled. This growth also affected the ability to set lower rates.

The overall increase in impressions of contextual advertising in 2006 amounted to 475%; the number of clicks on contextual ads on sites of advertisers at the same time increased by 280%. The latter figure means that the traffic of interested visitors, which provides contextual advertising, for the year increased almost fourfold.

Dynamics of growth of market performance in previous years is maintained in the current year. During the first quarter of 2007 the average monthly budget of a contextual campaign has grown by 10% (more than one and a half times higher than the average monthly budget for the same period of 2006), the number of advertisers and the amount of advertising campaigns have also increased by 10%.

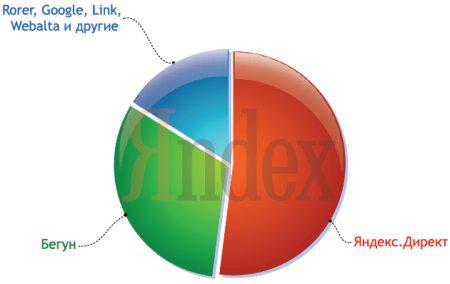

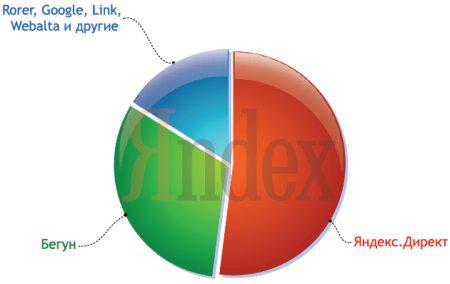

Today the Russian contextual advertising market is actually divided between two major players, "Yandex" and "Runner". According to reports, in value terms Yandex owns 55-60% of the Russian market of contextual advertising "Runner" - 30-35%. The remaining market share is divided between Rorer, Google AdWords, and Link.ru, «Optimist" and a number of other contextual networks.

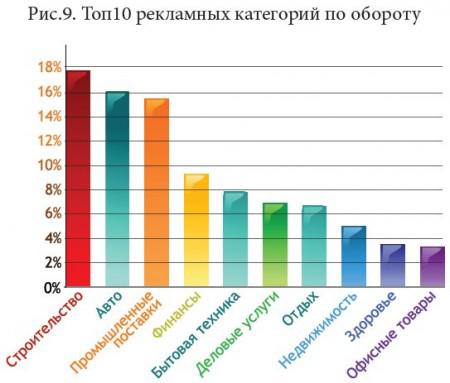

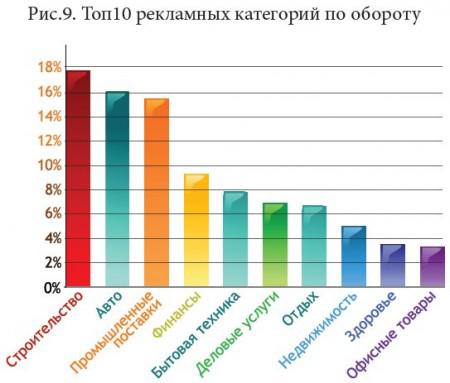

Who buys contextual advertising? The biggest contextual advertising budgets in Russia are ready to spend, mostly businesses with the high cost to attract customers: the participants of the construction and automotive markets, as well as manufacturers and suppliers of industrial products (B2B-segment). A significant share of market turnover of contextual advertising provides sellers of household appliances and electronics, representatives of the financial and insurance business, the business service sector, tourism and real estate market.

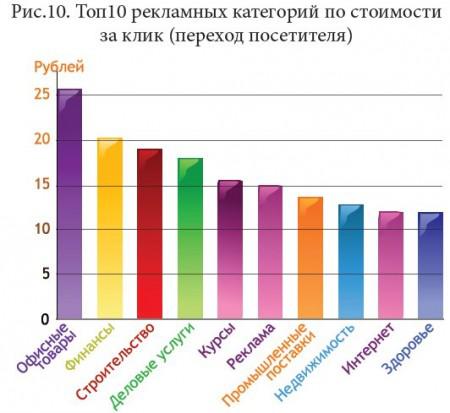

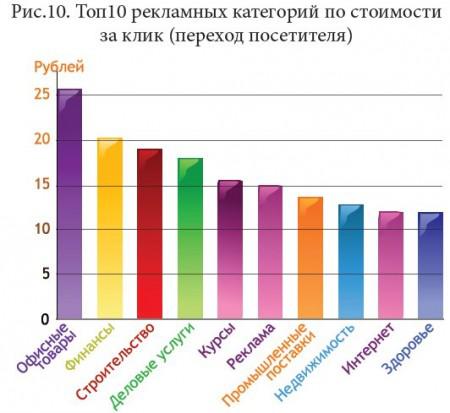

Almost all of these sectors are included in the top ten industries, whose representatives are willing to pay the highest price per click.

Some of the industries included in the Top10 for deposits in turnover of contextual advertising in the Top10 at a rate per click do not fall. In particular, sales of household appliances, travel services and cars, although spending in the amount of contextual advertising substantial budget, establish reasonable prices for the transition: the average cost of a visitor in these sectors is at the level of 8, 5, 7 and 5, 5 rubles, respectively .

The main share of budgets for contextual advertising accounts for customers from Moscow. Capital provides a 70, 92% of the advertising turnover, while all other regions of Russia - only 25, 78% (the rest - the CIS, with two-thirds - Ukraine). For comparison, the daily audience search for "Yandex" for Muscovites account for only 38% of the visitors.

Moscow advertisers are willing to pay for the audience's attention much higher price - the average price a clique in Moscow and regions differ 2-2, 5 times.

via www.habrahabr.ru

Contextual Internet advertising - the most dynamic segment of today the Russian advertising market. The rate of growth of its volume in terms of money is 150-200% per year, which is several times greater than the rate of sales of advertising in traditional media (no more than 30-36% growth for 2006, according to the ACAR). And the pace of development, and on the absolute sales figures ($ 110 million in 2006 alone), contextual advertising in RuNet ahead banner (+60% in 2006).

Contextual advertising market is becoming more widespread. As of June

2007 in only one system, "Direct" weekday contextual ads displayed 140 million times, and performed more than 1, 2-1, 3 million crossings users to advertisers' websites. From January to December 2006 in the "Direct" it was registered 147 million users transition to advertisers' websites. Overall, the 2006 monthly traffic to the sites of the Russian Internet generated targeted ads increased almost fourfold. In 2006, on the "Direct" campaigns have been more than 30 thousand. Advertisers.

Along with the expansion of the market and increase its coverage and increasing the budgets of advertisers in the contextual advertising. In 2005 and 2006 the monthly budget, releases the middle on their contextual advertiser company during the year nearly doubled, so that in March 2007 exceeded 7,000 rubles.

A good illustration of the changes in demand and the corresponding changes in supply dynamics is the average rate per click. During 2005 it grew steadily (+ 65% by the end of the year), but in 2006 the growth rate stopped. This was largely due to the fact that a large number of advertisers could not increase the bid: their business is simply not allowed to pay for each visitor to your site even more.

To attract new customers, which is severely restricted and small size of the rate, "Direct" in late 2006 reduced the minimum rate of 3 rubles and 30 kopecks. As a result, the average rate for the transition from one advertiser by significantly decreased, but began to increase the number of advertisers and advertising campaigns. This, in turn, caused the increase in turnover of contextual advertising due to lower average interest rate. However, after a few months of growth in the average rate resumed as among newcomers start growing competition.

As of April 2007, the average rate for the transition was approximately 10% higher compared to the same period of 2005. Thus, the change in the average rate has stimulated the expansion of the market; opened its advertisers from the regions and low-margin business segments. In the high-margin and highly competitive segments (to what is, for example, is the market of plastic windows), the average rate for the visitor as she was, and has remained high.

The observed decrease in the average rate for the transfer can not be considered a trend common to the entire Russian contextual advertising market: reducing the minimum rates per click spend only "Direct", while the "Runner", and left them at the same level. Money growth of the Russian market of contextual advertising is not only due to the price competition between advertisers (though its influence is undeniable), but also due to the arrival of new advertisers (including those from low-margin businesses), increased investments in contextual advertising, and the overall growth of the advertising audience. The ongoing popularization of content, that is, the qualitative expansion of its customer base, is today one of the most important trends in the development of the advertising market.

As the contextual advertising market and changes in the conditions of its placement and behavior changing advertisers. The most interesting trend in this area -extensions set of keywords, which displays ads. In 2006, the share repurchased requests in the total number of search queries of users has almost doubled. This growth also affected the ability to set lower rates.

The overall increase in impressions of contextual advertising in 2006 amounted to 475%; the number of clicks on contextual ads on sites of advertisers at the same time increased by 280%. The latter figure means that the traffic of interested visitors, which provides contextual advertising, for the year increased almost fourfold.

Dynamics of growth of market performance in previous years is maintained in the current year. During the first quarter of 2007 the average monthly budget of a contextual campaign has grown by 10% (more than one and a half times higher than the average monthly budget for the same period of 2006), the number of advertisers and the amount of advertising campaigns have also increased by 10%.

Today the Russian contextual advertising market is actually divided between two major players, "Yandex" and "Runner". According to reports, in value terms Yandex owns 55-60% of the Russian market of contextual advertising "Runner" - 30-35%. The remaining market share is divided between Rorer, Google AdWords, and Link.ru, «Optimist" and a number of other contextual networks.

Who buys contextual advertising? The biggest contextual advertising budgets in Russia are ready to spend, mostly businesses with the high cost to attract customers: the participants of the construction and automotive markets, as well as manufacturers and suppliers of industrial products (B2B-segment). A significant share of market turnover of contextual advertising provides sellers of household appliances and electronics, representatives of the financial and insurance business, the business service sector, tourism and real estate market.

Almost all of these sectors are included in the top ten industries, whose representatives are willing to pay the highest price per click.

Some of the industries included in the Top10 for deposits in turnover of contextual advertising in the Top10 at a rate per click do not fall. In particular, sales of household appliances, travel services and cars, although spending in the amount of contextual advertising substantial budget, establish reasonable prices for the transition: the average cost of a visitor in these sectors is at the level of 8, 5, 7 and 5, 5 rubles, respectively .

The main share of budgets for contextual advertising accounts for customers from Moscow. Capital provides a 70, 92% of the advertising turnover, while all other regions of Russia - only 25, 78% (the rest - the CIS, with two-thirds - Ukraine). For comparison, the daily audience search for "Yandex" for Muscovites account for only 38% of the visitors.

Moscow advertisers are willing to pay for the audience's attention much higher price - the average price a clique in Moscow and regions differ 2-2, 5 times.

via www.habrahabr.ru

Advertisement for real divers in the world's first underwater billboards.

Microsoft touts new games for Xbox using green clay (Filigree production !!)