713

The youngest stock swindler in the world

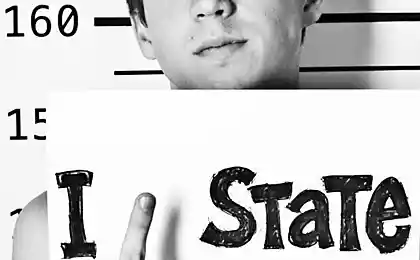

On the stock exchange, Jonathan Lebed started playing at 13 years of age, however, the US Commission on the Securities and Exchange Commission (SEC) became interested in his personality until two years later. Gathering evidence in the 11-minute episodes (the proceeds of crime in each of which ranges from $ 11 thousand. To $ 74 thousand.) SEC brought 15-year-old charge of "market manipulation". And in the US is serious financial crime at the federal level, which fall under any action aimed at creating a "false price targets" in the securities market.

Jonathan Lebed was born in New Jersey, September 29, 1984 in a family of middle management, and lived in a suburb of the town of Cedar Grove. Like most middle-class Americans, his father was playing a little bit on the Exchange, continuously monitor the stock quotes and commenting on the dinner table his small fortune and losses.

Faced ranting father, Jonathan became interested in the stock exchange business and began to walk on financial sites, reading online discussions about trading stocks, then take part in them. Having read all the teenager persuaded his father to withdraw from their accumulative insurance bill of $ 8 thousand. And for him to buy shares of America Online for $ 25 per share.

Despite the negative predictions of analysts, the shares of the two weeks were up $ 5, after which they were sold. Playing in such a way in courses and further, Jonathan managed for 18 months to turn their $ 8 thousand. At $ 28 thousand., And his father became seriously listen to the financial advice of his infant son.

A son, meanwhile, has created a website Stock-dogs.com., Dedicated to illiquid securities, and began to place on it all sorts of interesting stock information, which is available to do on the basis of this information, conclusions and make recommendations. The site began to enjoy a certain popularity, and had got about 1, 5 thousand. Calls per day. At the same time, Jonathan managed without aides and advisers, continuing to study hard in school.

It was 1999, and people are much more than now believe what they write on the internet. Noting that investors do not only listen to his recommendations, but follow them, Jonathan realized that "Pipil hawala". And has developed a simple scheme: he bought a small package of illiquid shares, the price of which is as compared to other stocks from the same sector slightly undervalued, and PR-launched a project to support these actions.

Having got a couple of dozen IP-addresses and several hundred accounts, Jonathan placed the fictional news on financial websites and wrote comments in chat rooms traders, market participants sent out e-mail, which informs about the future prospects of the rainbow exchange their chosen companies.

After receiving this information, many began to buy up the shares, which dramatically increased the demand and shareholder value. After waiting for the peak of growth, Jonathan sold his stake, at a profit, of course.

Total from September 1999 to February 2000, Jonathan cranked 27 such operations, and intelligent boy would go away, but he was stopped by SEC, were charged with market manipulation. The boy did not cry and promise dedenkam of the Commission on Securities and Exchange Commission that it "no longer" and launched a PR-project support is no longer someone's shares, and myself loved.

Jonathan raised the hype on the Internet first, and then in the newspapers and on television, claiming that it is absolutely not done anything wrong. He just honestly thought that soon quotation of these shares will increase in value, and so they bought. And since he is very sociable, then he shared his thoughts on the subject with others. And it has always turned out the same rights - shares grew steadily in price!

And the fact that after some time, these stocks will inevitably fall, and a lot of people lost money on them, because it's the market: it is always someone earns, and someone loses. Besides, no one bothered to these people in time to sell their shares as they sold Jonathan Lebed.

The case received quite a lot of publicity, and the SEC thought it best not to bring him to trial, concluding with Jonathan Lebed 20 September 2000 extrajudicial deal. According to its terms, Jonathan could not admit his guilt, but had to return to the proven 11-minute episodes produced $ 272,826 thousand. Plus interest. The resulting $ 515 tys.po remaining unproven episodes Jonathan could leave himself promised not to misbehave. And the SEC, in turn, is removed from the young trader charged with market manipulation, limiting its exponential flogging, and continue to advise investors to be careful to treat the messages on the Internet about the projected stock prices.

At the same time, it is not surprising that none of the investors defrauded by Jonathan Lebed did not bring your teen separate civil suit. It's like we all football fans consider themselves connoisseurs of football so in America, who plays a little bit on the exchange, consider themselves connoisseurs of the stock market - well, who admits that he cheated because 15-year-old kid?

Now Jonathan Lebed 29 years, and like most geeks grew up he stopped to stand out from the crowd - is now working as a financial analyst middling, and has a website from which distributes to everyone Exchange Council.

But it does not matter, as interesting as it responded to the father of the young wheeler-dealer of the exchange on charges of committing a federal crime. He said he was proud of his son: "Jonathan is seriously working on the Internet, rather than hang around with bullies on the doorways, smoking marijuana so removing wheels with neighboring machines." And after Lebed father was right about something, probably ...

But on the Internet, you can do different things, so you be careful what they do there your kids?

Source: oadam.livejournal.com