473

10 commercially viable alternatives to gold

The pursuit of jewels can lead to serious illness greed, and with it, as you know, to live is not very nice. Gold fever is treated with great difficulty, so we offer you ten commercially viable alternatives to gold.

Post marcionite bond market guru bill gross said that it would be better to invest the money in rare stamps, because with them, certainly nothing will happen. Nevertheless, he continued to trade in the stock market, losing a total of about $ 100 million and earning even more. Over the past six years the market dynamics of collecting is growing at an unprecedented rate. Special indexes GB30 show the growth dynamics of prices for postage stamps of 74%. So do not rush to give the stamp album to his nephew — it is possible that in the closet collecting dust your wealth.

A sheet of British stamps 1840.

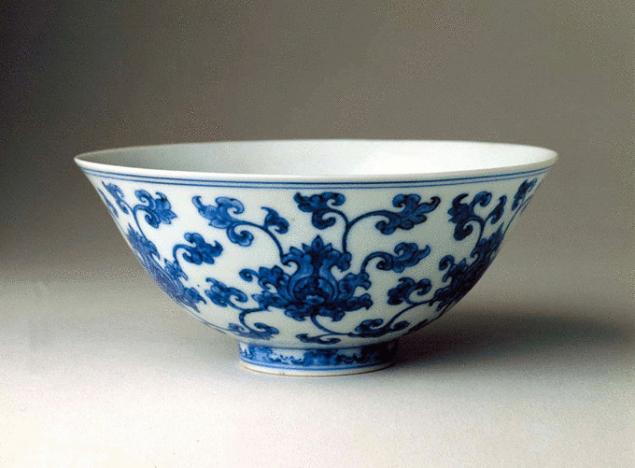

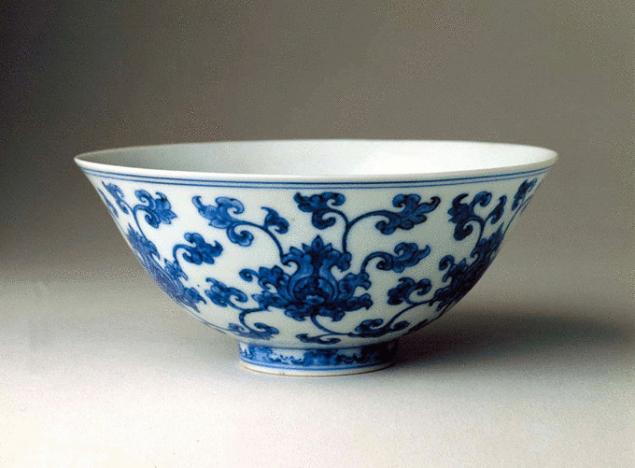

Chinese ceramics

Here is a couple of thousand years China is the leading supplier of ceramic art. Those who managed to get himself a pair of Chinese vases from the Ming dynasty, there is a great chance to capitalize on the rising prices of Asian ceramics. Analysts predict increase in the value of art come from ancient China by 45% over the next five years. Just a couple of months ago, a porcelain Cup with a cock of the Ming dynasty was sold for $ 36 million at Christie's auction. So do not be lazy to visit the nearest antique shop.

Bowl Ming dynasty, about 1368.

Wine

The rising prices of vintage wines exceeds dynamics of growth of cost of gold and oil. On this occasion in the UK even created a specialized Fund focused on investing in wines from Bordeaux Chateaux, producing a strictly limited quantity.

Wine over the years not only improves taste, but also rising in price.

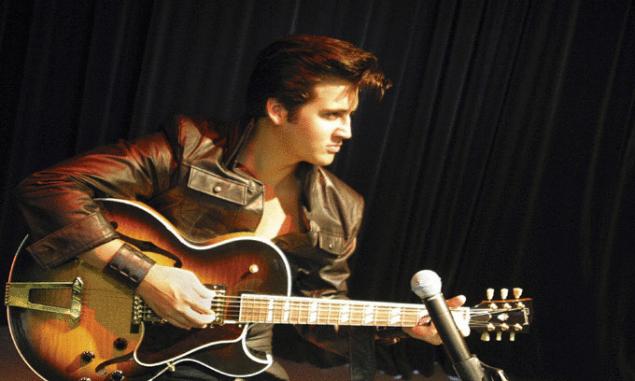

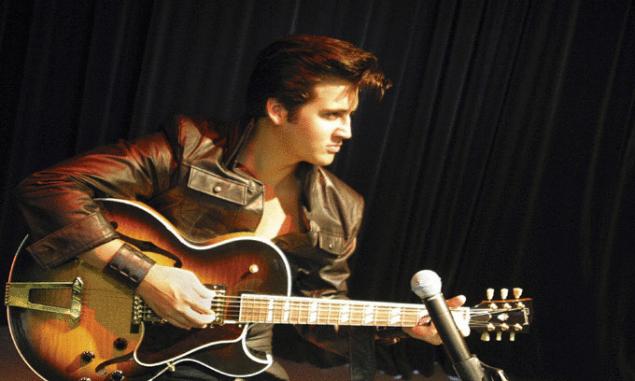

Effects

Old posters with the autographs of dead rock stars, things owned by celebrities can cost a fortune and is able to enrich its owners. But even if you own such a thing solely for the love of art, do not be afraid to lose in price — the cost of these things is growing every year.

Guitar Elvis Presley was sold for $ 4 million—a record price for a musical instrument belonging to celebrities.

Old cars

The indices show that over the last 10 years, the investment value of classic cars has increased by almost 500 percent. Rare cars, released over thirty years ago, with proper care, and the state can bring its owners a lot of money, provided that they manage to sell. So, for example, recently a vintage Ferrari 250 GT was sold for 8.8 million dollars(despite the fact that it was purchased in 2011 for 5 million).

Aston Martin Lagonda 1970 — the object of hunting of collectors around the world. The price of a well-preserved instance starts from 300 thousand dollars.

Wrist watch

Growing demand, limited supply and low cost of maintenance — you have every reason to invest in a luxury watch. For example, collectibles, Rolex or Patek Phillipe not only do not lose in value, but will increase, making you a happy owner of rather big percent.

Diamonds "Diamonds are forever" — sung in the famous song, and price indices confirm this. Buying diamonds — the lesson is more difficult than selling gold, but can bring much more profit with the right approach. The diamond market is one of the most stable in the world and shake it unless the opening of the unseen fields that is unlikely to happen in the near future.

To determine the "purity" of a diamond is much harder than the gold alloy.

Rare coins

Private and independent stock indices numismatic market can become a place of battle for untold riches in modern currency. Rising prices for rare coins is 220 percent over the past two years and continues to grow.

To altogetherbut on the autographs is not a new idea, but it is working today. For the painting of Elvis today it is possible to obtain a five-digit amount. And if you wait another five to ten years, the figure will only increase. Buying autographs are not only collectors, but also major museums and foundations with the aim of preserving the undeniable cultural value of the signature historical figures.

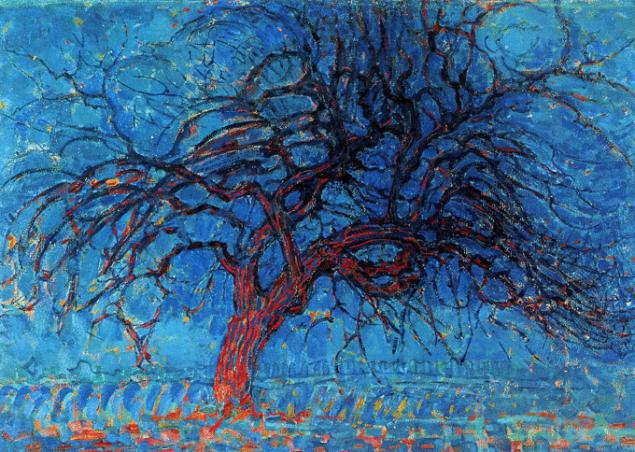

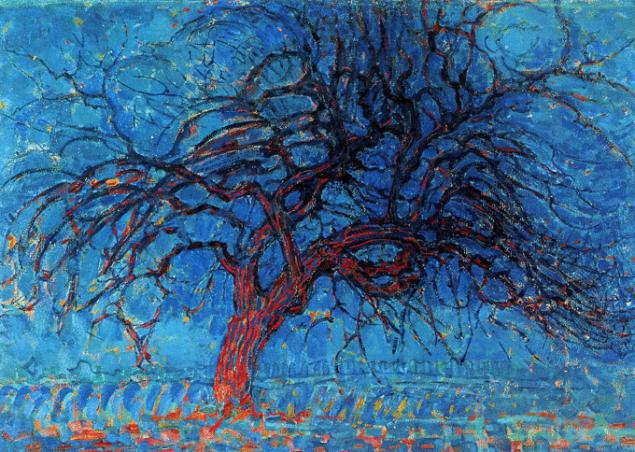

Piet Mondrian, Red tree, 1910

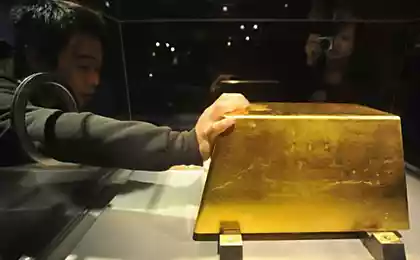

Art

Experts call for investment works of art meaningful version of gold. And it's not just that works of art are more interesting to watch than the bars of filthy lucre. The rising prices of art objects is growing steadily and adds every year. The undoubted commercial benefits of art says at least the fact that 76% of transactions in the art market are made primarily for the purpose of resale.

source: trendymen.ru

Source: /users/1077

Post marcionite bond market guru bill gross said that it would be better to invest the money in rare stamps, because with them, certainly nothing will happen. Nevertheless, he continued to trade in the stock market, losing a total of about $ 100 million and earning even more. Over the past six years the market dynamics of collecting is growing at an unprecedented rate. Special indexes GB30 show the growth dynamics of prices for postage stamps of 74%. So do not rush to give the stamp album to his nephew — it is possible that in the closet collecting dust your wealth.

A sheet of British stamps 1840.

Chinese ceramics

Here is a couple of thousand years China is the leading supplier of ceramic art. Those who managed to get himself a pair of Chinese vases from the Ming dynasty, there is a great chance to capitalize on the rising prices of Asian ceramics. Analysts predict increase in the value of art come from ancient China by 45% over the next five years. Just a couple of months ago, a porcelain Cup with a cock of the Ming dynasty was sold for $ 36 million at Christie's auction. So do not be lazy to visit the nearest antique shop.

Bowl Ming dynasty, about 1368.

Wine

The rising prices of vintage wines exceeds dynamics of growth of cost of gold and oil. On this occasion in the UK even created a specialized Fund focused on investing in wines from Bordeaux Chateaux, producing a strictly limited quantity.

Wine over the years not only improves taste, but also rising in price.

Effects

Old posters with the autographs of dead rock stars, things owned by celebrities can cost a fortune and is able to enrich its owners. But even if you own such a thing solely for the love of art, do not be afraid to lose in price — the cost of these things is growing every year.

Guitar Elvis Presley was sold for $ 4 million—a record price for a musical instrument belonging to celebrities.

Old cars

The indices show that over the last 10 years, the investment value of classic cars has increased by almost 500 percent. Rare cars, released over thirty years ago, with proper care, and the state can bring its owners a lot of money, provided that they manage to sell. So, for example, recently a vintage Ferrari 250 GT was sold for 8.8 million dollars(despite the fact that it was purchased in 2011 for 5 million).

Aston Martin Lagonda 1970 — the object of hunting of collectors around the world. The price of a well-preserved instance starts from 300 thousand dollars.

Wrist watch

Growing demand, limited supply and low cost of maintenance — you have every reason to invest in a luxury watch. For example, collectibles, Rolex or Patek Phillipe not only do not lose in value, but will increase, making you a happy owner of rather big percent.

Diamonds "Diamonds are forever" — sung in the famous song, and price indices confirm this. Buying diamonds — the lesson is more difficult than selling gold, but can bring much more profit with the right approach. The diamond market is one of the most stable in the world and shake it unless the opening of the unseen fields that is unlikely to happen in the near future.

To determine the "purity" of a diamond is much harder than the gold alloy.

Rare coins

Private and independent stock indices numismatic market can become a place of battle for untold riches in modern currency. Rising prices for rare coins is 220 percent over the past two years and continues to grow.

To altogetherbut on the autographs is not a new idea, but it is working today. For the painting of Elvis today it is possible to obtain a five-digit amount. And if you wait another five to ten years, the figure will only increase. Buying autographs are not only collectors, but also major museums and foundations with the aim of preserving the undeniable cultural value of the signature historical figures.

Piet Mondrian, Red tree, 1910

Art

Experts call for investment works of art meaningful version of gold. And it's not just that works of art are more interesting to watch than the bars of filthy lucre. The rising prices of art objects is growing steadily and adds every year. The undoubted commercial benefits of art says at least the fact that 76% of transactions in the art market are made primarily for the purpose of resale.

source: trendymen.ru

Source: /users/1077