377

The best credit card deals in Ukraine in one place

The difficult financial situation requires the selection of an operational solution.

What nuances should be considered when choosing a credit card?

A credit card is markedly different from conventional cash, but its use is reasonable if the customer wants to make a large non-cash purchase. In this case, the borrower will not lose excess money. So, when submitting an application, the client will need to specify the amount of the desired amount. The bank will analyze its credit history and set its limit. Next, it is fashionable to start confirming the data and obtaining the card. Some financial organizations offer free delivery of the card to the client’s address using the courier service.

You can start using the card immediately after its activation. The user independently specifies the password and can look at the interesting offers of the bank. Some organizations offer users free service for a certain period or free SMS notifications that remind you of timely payment. You can immediately adjust spending or connect an additional set of services that will allow you to use credit products quite efficiently and with minimal risks for your budget.

Advantages of the credit product:

- the possibility of instant use of funds;

- a small interest rate;

- large pre-approved limit;

- the possibility of receiving funds without providing certificates and guarantors;

- providing advice on any issues.

Requirements for borrowers

The main requirement for the client is the age of majority and the presence of permanent registration in Ukraine. To obtain approval, you must first select the optimal loan offer and start filling out the application. It includes such data as the name and date of birth of the client, income level, current place of work, as well as contact details for quick communication.

How to choose the best offer in the credit market of Ukraine?

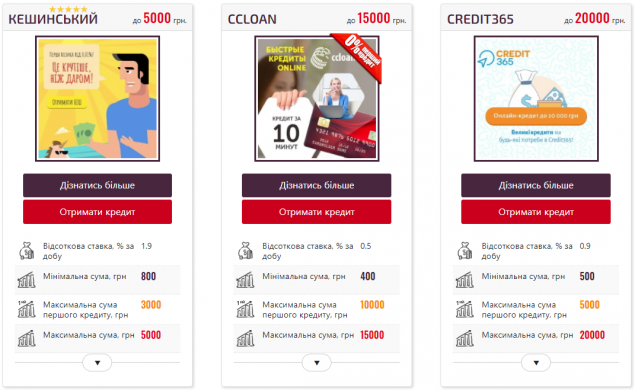

The convenient platform has collected the most profitable offers from leading Ukrainian credit institutions. Especially for them, a brief review of credit cards with an indication of the interest rate, repayment conditions is presented. Some organizations are happy to offer a special interest-free period during which the client does not have to pay interest on borrowed funds. To analyze the data, you can compare several similar stocks to choose the most attractive one.