498

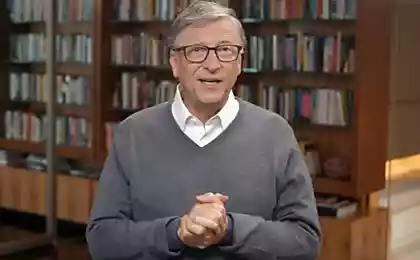

Bill gates believes that robots should pay taxes

Robots are gradually freed people from work, taking their jobs. Automation is a natural process, which goes many decades. Several centuries ago the main occupation of people was agriculture. The cars freed people from the heavy physical labor, now 1% of the population using the technique is easy to feed the remaining 99%. Or recall the recent past when one of the most popular professions in the United States was an operator of telephone systems. Thousands of girls worked in huge rooms, connecting millions of subscribers with each other. Soon they were replaced by automatic switches.

But if you had the technical modernization was gradual, slowly — over centuries or decades, the situation in the early 21st century is developing much more rapidly. People have much less time to adjust. Perhaps society will not have time to transform fast enough to provide jobs to millions of people simultaneously fired in the coming years: truck drivers, taxi drivers, workers in factories, notaries, cashiers, collectors, inspectors of traffic police, interpreters, waiters, construction workers, cooks and many others.

Famous guru of the IT-business, the billionaire theoptimist bill gates agree that technical progress cannot be stopped. The software becomes more advanced. AI develops very quickly. Gates offers some measures that will help to slow the progress to mitigate the shock to the society and to Fund alternative types of employment.

Bill gates fully supported the idea of additional taxation in the field of production automation.

The logic here is. Consider a simple worker at a factory that produces products $2 000 000 per year. He was supposed to wage "dirty", for example, $50 000 per year. With this "dirty" sum is paid about $20,000 payments to the state budget. Income tax, deductions in Fund of social protection of the population and other deductions. Getting your hands on a $30 000 net, work continues to make contributions to the budget of the state, paying the excise duties for goods and VAT on every purchase in the store. In the end, the worker remains much less than half of the money apportioned to it by the employer. The state receives more than half of his salary, withdrawing it at different stages. The money necessary for the construction of roads, maintenance of the police and the army, the production of weapons, guarding the borders of the state of space exploration, payment, free health care, education, research, sport development, payment of pensions, maternity capital, the construction of social housing Malayasia population, etc. All this requires huge government spending and therefore the worker gives a state more than half their salary to it have fulfilled a social contract.

But what happens if this worker will be replaced by a robot? The state is immediately deprived of a significant income. There is no money to support the elderly, to build aircraft carriers and to repair roads. No money even to pay unemployment benefits to millions of people who lost their jobs.

Bill gates says that if the robot does the same work that the dismissed worker, he shall be subject to the same tax. Although bill gates does not say, but the idea is that "tax automation" should be taxed and software that performs the work of the dismissed person.

The money the state sent for "humanitarian purposes", including for employment of the unemployed. For example, you can employ several times more social workers who will help pensioners, homeless people, dying people, to care for children in kindergartens and schools. Classes in schools are four-five people at the teacher instead of the current 20-25, what's wrong? Children with disabilities and with special needs will get full attention and good care, but even in developed countries there is a shortage of personnel in these areas. If you send people there and to dramatically increase the us, the society will be more humane, says bill gates. Tax automation can help to Fund this process.

Bill gates supports automation and the widespread introduction of robots. It really is economically more profitable — they do not need to pay salaries, and their work they often make a better person. But this does not mean that the company is exempt from taxes that she paid before, when it worked.

How to tax the robots? There are several different approaches. Bill gates believes that there is a place for discussion, to find the best option. For example, a tax can impose additional profits that the company received after implementation of automation. Or fixed tax rates for each model of robot, on the basis of its technical characteristics. The more efficient, more powerful and more productive model — the higher the fixed tax. Bill gates believes that robotics manufacturers are not against the introduction of such a tax. Many people understand the need to remove tension in society and to solve social problems.

It's time to think about how robotics will affect a particular city and community residents, in which areas are most likely to increase unemployment. How to help these areas, what infrastructure to build? In the next 20 years robots will replace several mass professions, therefore, the state should well in advance develop a program of care.

The goal is that people were not afraid to lose my job. It's not their problem. Technological progress and innovation is not a threat to society and a great blessing. People need to understand that they have nothing to lose if their workplace is a more effective machine.

And of course, taxation of the robots is a much better option than a simple ban on the use of robots with the dismissal of workers. Although some politicians such bans seem more simple solution, but it's not so, says bill gates. Innovation occurs in different forms, so it's impossible to cover them all prohibitions.

This problem the market cannot decide for itself, says bill gates, so this government regulation. Otherwise, the entire profits from the robot will receive only their owners, not society. It will only increase social stratification.

Source: geektimes.ru/post/286014/

13 gorgeous examples of advertising that didn't leave chances to competitors

Elon Musk told why he started drilling tunnels