912

Mr. Money Mustache retired in 30+ years

Mr. Money Mustache i>

In 2005, blogger and popularizer Downshifting Mr. Money Mustache (he prefers not to disclose the real name) retired at 30-something years old (exact age he did not say), accumulated amount of $ 600 000. Interest on this amount is enough to spend rest of his life traveling, parenting , favorite activities and rare part "for the soul."

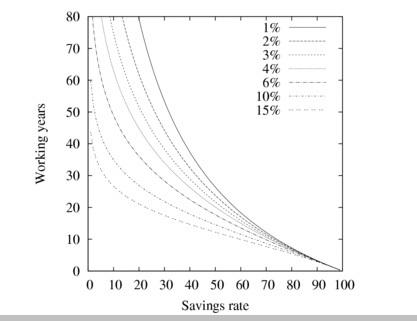

Concept of financial well-being Mr. Money Mustache formulated in his blog , which in recent years has attracted many followers. The main task - set aside each month to your personal "pension fund" 50-90% of salary.

Mr. Money Mustache in 2011, keeps a blog and teaches you how to control costs and make useful habits.

It calls for not spending money for nothing: do not need paid entertainment (because you can have fun for free is not worse), do not need to go to restaurants, take out loans and spent on bad habits. Should quit drinking and smoking, reduce the cost of clothing, not to buy "junk" foods (sodas, chips, sugar, etc.), to form a community of friends who live nearby. Another principle - to move from consumption to creation, ie instead of consumption items / content to create their own hands. Good examples - cooking, photography, caring for the house, garden or car.

If you follow these principles, says the author, it is actually set aside in the bank or in a safe securities up to 90% of salary. Mr. Sam Money Mustache My wife and I (both work in the field of IT) in the early 2000s failed to reach the level of savings of $ 4,000 per month, and then $ 7,000 per month.

Mr. Money Mustache calls on record its financial costs and analyze every purchase: is it really necessary?

Recently Mr. Money Mustache gave interview Mashable, which talked a little bit about your current lifestyle and shared a few thoughts on how to achieve the level of savings in the 50-90% of salary. What is interesting, the author of the blog, even after reaching the "retirement" almost did not change their way of life and still tries to spend money in the best way, rides a bike every day and tries to devote a couple of hours of physical work.

Mr. Money Mustache i>

If you work for a good paying job and save most of the salary, it is possible to secure a retirement after about 10 years of work experience.

Dear megacities like NYC for this approach is even better because it provides more opportunities to save.

Mr. Money Mustache offers the following formula to calculate the size of the "safety cushion" that requires you to quit your job and live on the interest: the accumulated amount should be equal to the amount of expenditure for the year multiplied by 25 (pravilo 4% ).

It should be noted that after the "gain freedom" no one bothers to earn extra income by small part if you really itching from idleness. But this will be a job for the soul, and the resulting income - just a bonus to the existing software.

Source: geektimes.ru/post/244127/

Bamboo Tower, which produces water from the air

Auto dealers continue to attempt to ban Tesla to sell electric cars in Georgia, Michigan and Missouri