692

The interest rate on the mortgage influences the amount of overpayment?

Sixty two million three hundred thirty three thousand six hundred sixty six

Interest rates on mortgage programs are constantly changing. Fortunately, in recent years, banks have adopted a sustainable policy to reduce the level of overpayments on loans to buy housing. In times of economic recovery, Russian lenders are willing to make advances to borrowers and reduce the interest rate on housing programs for trustworthy customers. However if banking institutions see "in front of" potentially insolvent debtor, and observe an increased risk of not returning money, rates go up again.

The important point is that any Bank of Russia, despite the fact that it is an independent subject of economy, when choosing the interest rates analyzes the overall situation in the country and the current situation in the credit sector in particular.

What factors affect the interest rate on the mortgage?

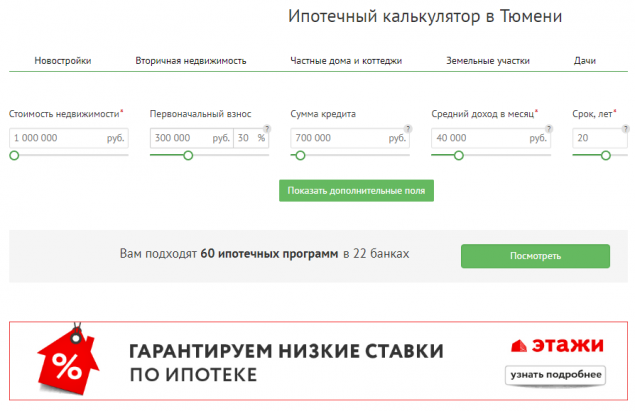

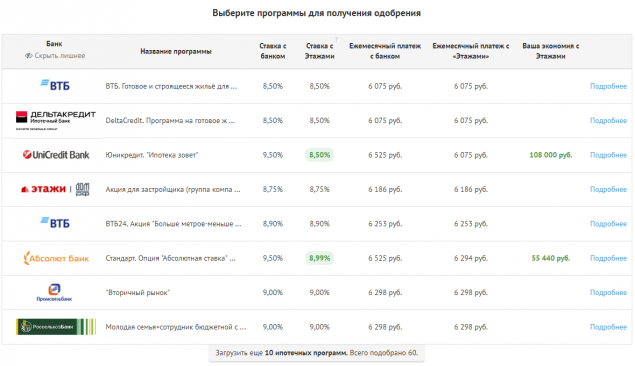

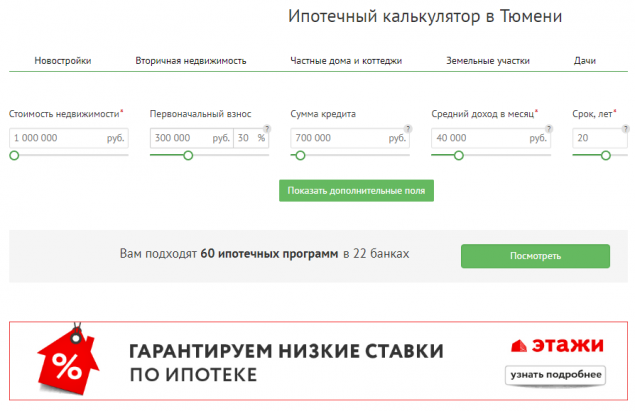

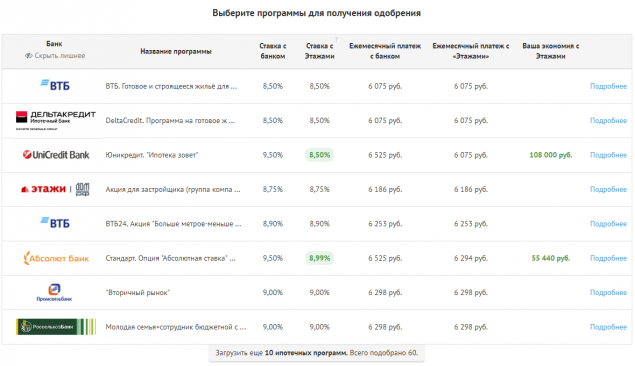

To calculate interest rate on a mortgage loan in Tyumen, we recommend you to use a special online calculator: https://www.etagi.com/ipoteka/calculator/. Enter the required system data, and the amount of overpayment for a possible to the design of the home loan you'll know in advance.

In General, when determining the rate for a particular borrower, the banks take into account three key factors:

If your credit reputation is not spoiled by the arrears and unpaid debts, you can also count on a loyal attitude. Trustworthy discounted mortgage programs if they agree to take out insurance not only acquired housing, but to your own life and health. To pay for the policy will have, at its own expense, but often its price is lower than the amount of overpayment on a mortgage loan.

Interest rates on mortgage programs are constantly changing. Fortunately, in recent years, banks have adopted a sustainable policy to reduce the level of overpayments on loans to buy housing. In times of economic recovery, Russian lenders are willing to make advances to borrowers and reduce the interest rate on housing programs for trustworthy customers. However if banking institutions see "in front of" potentially insolvent debtor, and observe an increased risk of not returning money, rates go up again.

The important point is that any Bank of Russia, despite the fact that it is an independent subject of economy, when choosing the interest rates analyzes the overall situation in the country and the current situation in the credit sector in particular.

What factors affect the interest rate on the mortgage?

To calculate interest rate on a mortgage loan in Tyumen, we recommend you to use a special online calculator: https://www.etagi.com/ipoteka/calculator/. Enter the required system data, and the amount of overpayment for a possible to the design of the home loan you'll know in advance.

In General, when determining the rate for a particular borrower, the banks take into account three key factors:

- The credit period. The longer the period of cooperation, the greater will be the amount of the overpayment in the end;

- The value of the initial payment of own finances of the borrower. If you want to get a mortgage on the most favorable terms, get ready to make an impressive first installment from his personal funds;

- Solvency and possible future financial well-being. To reduce interest rates on housing loan, you must prove to the Bank that you are financially wealthy man. To this end, we recommend that you provide a credit institution for a maximum of documents certifying your high income. Apart from inquiries about salary, you can bring Bank statements, check deposits and deposits, securities on the delivery of real estate in recruitment, documentation of the right of ownership of valuable assets (real estate, vehicles, precious metals, etc.). In addition, you can offer the Bank liquidity provision.

If your credit reputation is not spoiled by the arrears and unpaid debts, you can also count on a loyal attitude. Trustworthy discounted mortgage programs if they agree to take out insurance not only acquired housing, but to your own life and health. To pay for the policy will have, at its own expense, but often its price is lower than the amount of overpayment on a mortgage loan.