563

Features of outsourcing accounting

Thirty two million two hundred thirty two thousand nine hundred thirty eight

The word "outsourcing" doesn't surprise anyone. This phenomenon has come from Western countries, when a serious question arose about optimizing costs and increasing the profits of the company. If you need to concentrate on making profits, minimize risks, it is advisable to seek the services of outsourcing, that is, lower costs through the outsourcing of professionals and non-recruitment of staff on an ongoing basis.

Peculiarities of organization of accounting

Optimization, implementation of algorithms, individual approach to the tasks — that is professionalism. More information can be found on the website afdk.ru acquainted with the direction of the work of the accounting Department. Features:

Professional approach to business

It is important to take into account the legal aspects, because the tax interaction involves knowledge of the legal framework. The value is always available — you need to take into account the competition in this field. Even if the company does not conduct business activities temporarily, it is not exempt from the need to submit documents to the tax authorities, keep accounting according to the rules. Otherwise, the supervising agencies have the right to impose substantial fines. Once entrepreneurs, representatives of small, medium and large businesses, convinced that this approach is more advantageous, practical and reliable.

The word "outsourcing" doesn't surprise anyone. This phenomenon has come from Western countries, when a serious question arose about optimizing costs and increasing the profits of the company. If you need to concentrate on making profits, minimize risks, it is advisable to seek the services of outsourcing, that is, lower costs through the outsourcing of professionals and non-recruitment of staff on an ongoing basis.

Peculiarities of organization of accounting

Optimization, implementation of algorithms, individual approach to the tasks — that is professionalism. More information can be found on the website afdk.ru acquainted with the direction of the work of the accounting Department. Features:

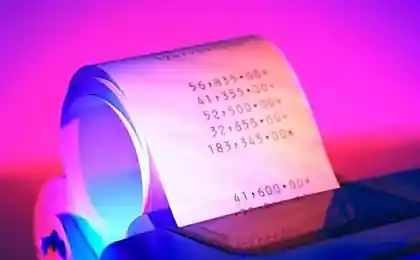

- Registration for the tax. Classic example: filing a tax return, surrender, and zero accountability, working with legal and physical persons, carrying out verifications of settlements on taxes, tax optimization.

- Sometimes you have to restore the document flow in accounting due to various reasons, for example, the big break in the company either due to mistakes made earlier.

- Relevant accounting services wholesale and retail trade, individual entrepreneurs, preparation of electronic reporting and one-time or periodic advice of an accountant.

- Actual audit, identifying the state of the accounting at this stage. This service order including to future audits by regulatory authorities.

- Often have to work with wages to be calculated for employees in the state.

Professional approach to business

It is important to take into account the legal aspects, because the tax interaction involves knowledge of the legal framework. The value is always available — you need to take into account the competition in this field. Even if the company does not conduct business activities temporarily, it is not exempt from the need to submit documents to the tax authorities, keep accounting according to the rules. Otherwise, the supervising agencies have the right to impose substantial fines. Once entrepreneurs, representatives of small, medium and large businesses, convinced that this approach is more advantageous, practical and reliable.

The provision of tax disputes for individual enterprises, LLC: engroup-consult.com

Features of the real estate market of Kostroma