651

9 signs that you overestimate their "Financial Intelligence"

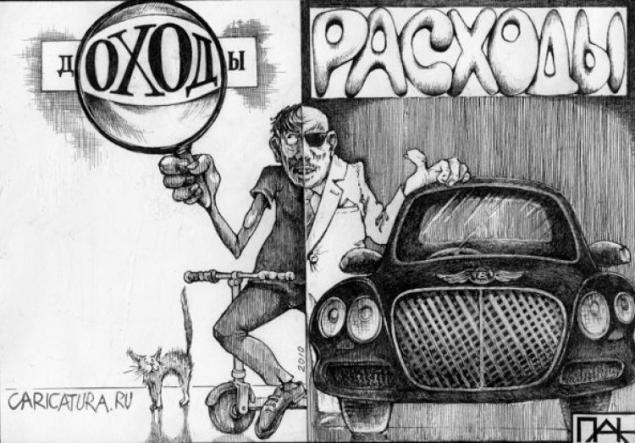

Rash purchase from time to time commit many. What then, of course, regret. However, some lifelong manage to avoid a variety of monetary errors, which lead to holes in the personal budget and financial weight problems. Do you think you are an exception, and know how to skillfully handle their own savings? Revision Anews with Business Insider publication offers this check. Here are the 9 most faithful indicators of the fact that you are constantly making a financial mistake.

Check if at least three points, you know yourself is to think seriously about their financial well-being

1.. You do not know the exact amount of your monthly expenses

This is perhaps one of the most important and obvious signs - you do not know the exact amount that flows away from your credit card or wallet. If you are building a monthly budget and track expenses, then you spend too much, without even noticing.

In Russia, according to the financial consulting company "Private capital", only 10% of people keep records of expenditures and revenues. Remaining manage money intuitively. For comparison, in the United States for costs should be 40% of the citizens

Solution -. To keep a diary of expenses and income. This can be done with a simple notebook and pen (old grandfather's method) or by means of special applications for smartphones.

2. You have a permanent debt on loans

Just imagine, in Russia in mid-spring of 2015, Federal State Statistics Service counted 39, 4 million people with overdue payments on bank loans. As of April this year, the Russians have been the order of the banks 10, 6 trillion rubles. Moreover, almost 40% of borrowers called the cause of the deterioration of arrears of their personal financial situation

The solution -. Not to communicate with the new credit, put the current debt payment in priority to reduce and track expenses, forming an accurate monthly budget.

3. Are you constantly worried due to spending money

Living paycheck to paycheck is like balancing on a tightrope under the big top. I spend a little more and all - fell. Because of this, some tend to be in a constant state of stress, especially when it comes to parting with money. Letting another amount not included in the list of mandatory spending, many feel guilty, knowing that payday is still far, but already fairly emaciated purse

The solution -. Or reduce the amount of waste and more attentive to keep records of income and expenses, or to find an additional source of income, that is a second job.

4. You do not think about pension savings

So, you have no idea what it is - to save money. A couple of years ago sociologists "Public Opinion" Foundation conducted a survey and found that only 10% of Russians think about pension savings. 27% of respondents admitted that they ever will alone save for old age, however, has not yet begun to do so. Experts have warned for his part: the later a person starts to think about finances "old age", the greater the risk that in old age he will remain with nothing

Solution - to find the time. and explore the latest innovations in the pension system, to choose for themselves the best option savings.

5. You never talk about money with spouse

This means that your family budget - something illusory akin Castle Fata Morgana. In Russia, for example, only 49% of women share information about their income with their husbands. At the same time representatives of the stronger sex are more open - 62% of men wives reveal the size of their income

Solution -. Stop secretive and reveal the card already. This will more clearly form the family budget, monitor expenditure and make savings.

6. You do not talk about money with children

Another big mistake - avoid issues of money and how they earned in communicating with your child. Poll financial company T. Rowe Price has shown that those parents who explained to children, adults are making money and they have to do this, have had fewer problems with unnecessary spending that provoked childish whims In other words, the children through such conversations started to understand the value money, and the fact that they do not accrue just

Solution -. explain to the child, where the money come from and why they can not spend the right and left. The sooner this discussion takes place, the easier it will be to convey to the children of the basic idea.

7. You scared the idea of investing in something

If you are afraid to invest money in a project, which in the future may benefit or income (for example, in real estate or education), this means that you have a habit manages to spend money only on things.

< Solution - to reduce spending on the purchase of unnecessary things and try to invest in something that will benefit after some time. For example, additional education for yourself or children.

8. You hide your true financial position

From friends, relatives and acquaintances. You are afraid that they will learn about the real situation. For example, the fact that the machine on which you drive, is still owned by the bank and the credit for it has not yet been paid. A mortgage on the apartment in which you live, too, has not been canceled, and moreover, has acquired delinquency

Solution problems -. To try to reshape their own budget, proportioned income and expenses, and if not out - ask for help from a financial advisor

.

9. Do you think that seriously engage in their own finances - boring

Are you sure you budget planning, tracking income / expense and also seeking advice from a financial adviser - unnecessary movements and a waste of time. Failure to take seriously the "cash nexus", most likely, says that at the moment you deal with your finances on an intuitive level. If this approach is not to lead to any consequences, you can be sure - it is only a temporary phenomenon

The solution -. Remember the proverb, "is aware - is forearmed", closely look at their finances , isolate the fault and try to fix them on their own or with the help of a specialist.

Loading ... Loading ...

Liked? Share with your friends!

Loading ... Loading ...