Kevin O'leary: 4 stupid financial mistakes that make almost all

Bashny.Net

Bashny.Net

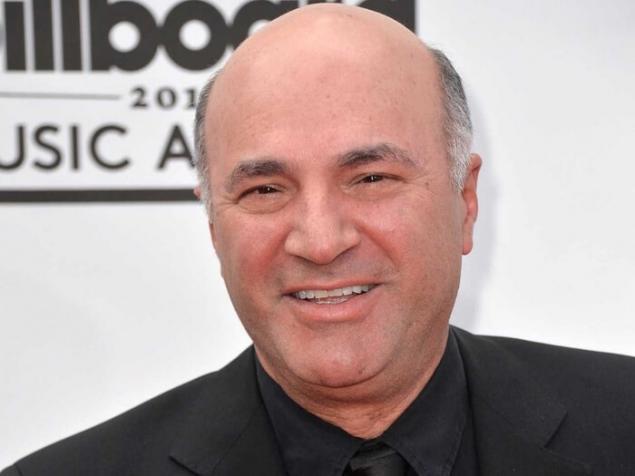

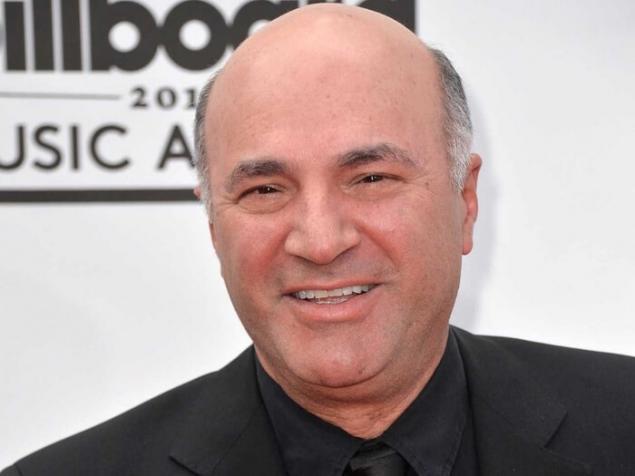

Kevin O'leary, the hero of the TV show Shark Tank and a successful millionaire, told about the most common mistakes associated with money, and gave advice on how to avoid them in the future.

Now how much life? If you have no answer to this question, it is quite possible that you are already on the path to financial disaster. Not now, then soon, says Kevin O'leary.

As for his own money, shrewd and sharp-tongued 61-year-old hero of the American TV show Shark Tank has long been meticulously gathered their capital by penny. It all began back in the days when he grew up a shy kid in Montreal, Canada. Young O'leary had carefully saved and set aside a percentage of each dollar earned or donated. And does so still, even as the stock tycoon with a multimillion-dollar fortune.

In an episode of Shark Tank the Thrifty millionaire asked what, in his opinion, the stupidest financial mistakes people make and how to avoid them. That's what told O'leary.

Mistake: Spending money on weird stuff you won't wear

"Most people buy more stuff than they can use. This applies to both men and women, especially when it comes to clothing. They like the feeling that gives such shopping, but the point is, if you look in your wardrobe, you will understand that in 80 cases out of 100 wear the same 20% of my wardrobe, and the rest just takes place."

Solution: Buy high-quality clothing and wear it

"If you are going to buy clothes or fashion accessories, choose really high quality and expensive goods. Save money and put them on good things, be selective.

It will pay off in the long run. I wear the same suit day in and day. I have 20, so don't have to worry about maintaining a style. I'm going on a trip with the four suits in a suitcase and Sadashiva them to pieces. And then throw out or give to charity."

Error: do Not know their monthly expenses

"What I find surprising, and this also applies to my very wealthy acquaintances, is the fact that nobody knows the amount of your expenses for the month. Bachelors, married, single parents, whatever — most people have no idea how much they pay for life for 30 days, and is walking on the edge".

Solution: to Calculate the cost of living and plan a budget accordingly

"Write it all down. All of your expenses. All of the profits. All additional sources of income. Storing them in a notebook right down to the penny within 90 days. Use it with paper and pen. You don't even need a computer. Then do what you have to — make a budget plan according to the expenses and stick to it".

Error: Spend more than earn

"Not focusing on their income and expenses, you run the risk of never succeed financially. Most likely, you will find yourself spending more than you bring in the house."

Solution: Tighten the belt more tightly, and quickly

"It's just, it's all about self-discipline: spend less, wait more. Rebuild their way of life, because of cost overruns usually followed by credit card debt, and this heavy burden can you simply flatten".

Bodo Schafer: 22 principle of WEALTH

Intuition is always the FIRST THOUGHT!

Error: to Accumulate credit card debt

"Credit card is a terrible thing. Do not put her under any circumstances, and especially few, if you can't pay interest on them every month without exception. And in this case I would advise to avoid them".

Solution: to renounce Forever these horrible cards

"Pay off debts on my credit cards and then cut them. You will not regret it. It is best that you can do to stay in the win right now."published

Source: ru.insider.pro/lifestyle/2016-11-23/4-glupyh-finansovyh-oshibki-kotorye-sovershayut-prakticheski-vse/

Now how much life? If you have no answer to this question, it is quite possible that you are already on the path to financial disaster. Not now, then soon, says Kevin O'leary.

As for his own money, shrewd and sharp-tongued 61-year-old hero of the American TV show Shark Tank has long been meticulously gathered their capital by penny. It all began back in the days when he grew up a shy kid in Montreal, Canada. Young O'leary had carefully saved and set aside a percentage of each dollar earned or donated. And does so still, even as the stock tycoon with a multimillion-dollar fortune.

In an episode of Shark Tank the Thrifty millionaire asked what, in his opinion, the stupidest financial mistakes people make and how to avoid them. That's what told O'leary.

Mistake: Spending money on weird stuff you won't wear

"Most people buy more stuff than they can use. This applies to both men and women, especially when it comes to clothing. They like the feeling that gives such shopping, but the point is, if you look in your wardrobe, you will understand that in 80 cases out of 100 wear the same 20% of my wardrobe, and the rest just takes place."

Solution: Buy high-quality clothing and wear it

"If you are going to buy clothes or fashion accessories, choose really high quality and expensive goods. Save money and put them on good things, be selective.

It will pay off in the long run. I wear the same suit day in and day. I have 20, so don't have to worry about maintaining a style. I'm going on a trip with the four suits in a suitcase and Sadashiva them to pieces. And then throw out or give to charity."

Error: do Not know their monthly expenses

"What I find surprising, and this also applies to my very wealthy acquaintances, is the fact that nobody knows the amount of your expenses for the month. Bachelors, married, single parents, whatever — most people have no idea how much they pay for life for 30 days, and is walking on the edge".

Solution: to Calculate the cost of living and plan a budget accordingly

"Write it all down. All of your expenses. All of the profits. All additional sources of income. Storing them in a notebook right down to the penny within 90 days. Use it with paper and pen. You don't even need a computer. Then do what you have to — make a budget plan according to the expenses and stick to it".

Error: Spend more than earn

"Not focusing on their income and expenses, you run the risk of never succeed financially. Most likely, you will find yourself spending more than you bring in the house."

Solution: Tighten the belt more tightly, and quickly

"It's just, it's all about self-discipline: spend less, wait more. Rebuild their way of life, because of cost overruns usually followed by credit card debt, and this heavy burden can you simply flatten".

Bodo Schafer: 22 principle of WEALTH

Intuition is always the FIRST THOUGHT!

Error: to Accumulate credit card debt

"Credit card is a terrible thing. Do not put her under any circumstances, and especially few, if you can't pay interest on them every month without exception. And in this case I would advise to avoid them".

Solution: to renounce Forever these horrible cards

"Pay off debts on my credit cards and then cut them. You will not regret it. It is best that you can do to stay in the win right now."published

Source: ru.insider.pro/lifestyle/2016-11-23/4-glupyh-finansovyh-oshibki-kotorye-sovershayut-prakticheski-vse/

Tags

See also

Common errors in communication between people

Conflicts between children in a family: the mistakes made by many parents

10 mistakes that ruined the life of your daughter

Life after forty: you just can't go on living like this...

Hand washing: the psychological aspect

That can destroy relationships: 5 bad habits