What is the difference between a microloan and a loan?

Bashny.Net

Bashny.Net

Both loans and credits have their advantages and disadvantages. The choice of a particular financial solution will depend on the circumstances and solvency of the borrower.

What is the difference between a microloan and a loan?

Lending has become increasingly popular in recent years. At the same time, microfinance organizations and banks offer a large selection of financial products of various durations. Loans, credits and borrowings are traditionally considered synonymous. However, there are a number of differences between them.

What is a microloan and what is a loan

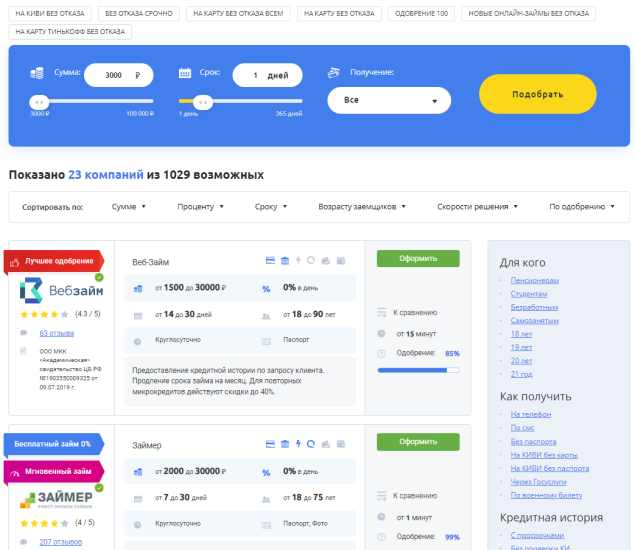

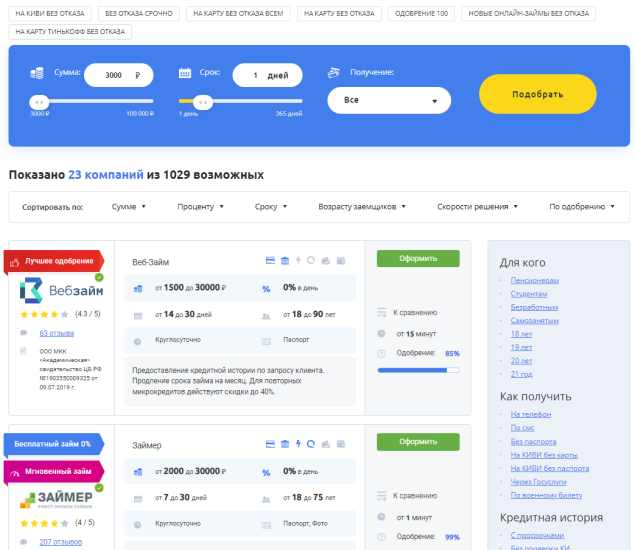

A microloan is a loan issued by an microfinance organization for a short period of time. Microcredit companies issue no more than 500,000 rubles, and microfinance companies - up to a million. On average, a loan is issued for an amount of up to 30,000 rubles. The interest rate is within 1% per day or 365% per annum. This type of loan is easy to apply for and is often done online. We advise you to look at the available options on the information portal.

A loan is a loan of money issued by a bank after signing an agreement. The rate will be significantly lower than in the case of a microloan. In addition to the package of documents prepared by the borrower, sometimes obtaining a loan requires the involvement of a guarantor.

Types of loans and credits

Microloans can be issued in cash, to an electronic wallet or to a card. There are unsecured, with a guarantor, secured, annuity, differentiated, classic or online. In accordance with the duration of the provision of funds, short-term, medium-term or long-term ones are distinguished.

As for loans, the main types are consumer, mortgage and car loans. In addition, one-time loans, bill of exchange, investment, factoring, leasing, national and international are common. If lending is provided by several banks, then this means a syndicated loan. In form, a financial product can be commodity, monetary or mixed. The loan is divided depending on the sectoral focus into industrial, agricultural and trade.

What documents are needed to apply for a loan, which ones for a loan

The requirements for microloans are not nearly as strict as for traditional loans. To receive a microloan, you need to submit a passport, an application and a second document to the microfinance organization. The written or electronic application indicates personal data, tax identification number, and information about the place of employment. Some forms contain a request for information about the presence of a family and children.

In case of a loan, you will also need a certificate of income and employment. If we are talking about a large amount, it may also be necessary to involve a guarantor in the transaction or issue a pledge. In any case, a bilateral agreement is prepared, which details the terms of the loan, the procedure for returning funds, terms, penalties, etc.

Advantages and disadvantages of loans and credits

Both loans and credits have their advantages and disadvantages. The choice of a particular financial solution will depend on the circumstances and solvency of the borrower.

The undeniable advantages of loans:

What and when is it more profitable to take?

In situations where you urgently need to get cash before your payday and it is a small amount, it is recommended to take out a quick loan. In cases where large expenses are planned and there is no need to rush through the processing, it is preferable to contact the bank for a loan and conclude an agreement. Before signing the agreement, it is important to carefully read all the terms and conditions of the loan.

What is the difference between a microloan and a loan?

Lending has become increasingly popular in recent years. At the same time, microfinance organizations and banks offer a large selection of financial products of various durations. Loans, credits and borrowings are traditionally considered synonymous. However, there are a number of differences between them.

What is a microloan and what is a loan

A microloan is a loan issued by an microfinance organization for a short period of time. Microcredit companies issue no more than 500,000 rubles, and microfinance companies - up to a million. On average, a loan is issued for an amount of up to 30,000 rubles. The interest rate is within 1% per day or 365% per annum. This type of loan is easy to apply for and is often done online. We advise you to look at the available options on the information portal.

A loan is a loan of money issued by a bank after signing an agreement. The rate will be significantly lower than in the case of a microloan. In addition to the package of documents prepared by the borrower, sometimes obtaining a loan requires the involvement of a guarantor.

Types of loans and credits

Microloans can be issued in cash, to an electronic wallet or to a card. There are unsecured, with a guarantor, secured, annuity, differentiated, classic or online. In accordance with the duration of the provision of funds, short-term, medium-term or long-term ones are distinguished.

As for loans, the main types are consumer, mortgage and car loans. In addition, one-time loans, bill of exchange, investment, factoring, leasing, national and international are common. If lending is provided by several banks, then this means a syndicated loan. In form, a financial product can be commodity, monetary or mixed. The loan is divided depending on the sectoral focus into industrial, agricultural and trade.

What documents are needed to apply for a loan, which ones for a loan

The requirements for microloans are not nearly as strict as for traditional loans. To receive a microloan, you need to submit a passport, an application and a second document to the microfinance organization. The written or electronic application indicates personal data, tax identification number, and information about the place of employment. Some forms contain a request for information about the presence of a family and children.

In case of a loan, you will also need a certificate of income and employment. If we are talking about a large amount, it may also be necessary to involve a guarantor in the transaction or issue a pledge. In any case, a bilateral agreement is prepared, which details the terms of the loan, the procedure for returning funds, terms, penalties, etc.

Advantages and disadvantages of loans and credits

Both loans and credits have their advantages and disadvantages. The choice of a particular financial solution will depend on the circumstances and solvency of the borrower.

The undeniable advantages of loans:

- simplicity of design;

- filling out an application online;

- speed of delivery;

- large selection of microfinance organizations;

- interest-free period;

- prolongation.

- high percent;

- large fines for late payments;

- short lending period.

- reduced interest;

- long term;

- cooperation under the agreement;

- convenient payment schedule;

- large amounts.

- the need to wait;

- risk of failure;

- personal visit to a bank branch;

- a large package of documents.

What and when is it more profitable to take?

In situations where you urgently need to get cash before your payday and it is a small amount, it is recommended to take out a quick loan. In cases where large expenses are planned and there is no need to rush through the processing, it is preferable to contact the bank for a loan and conclude an agreement. Before signing the agreement, it is important to carefully read all the terms and conditions of the loan.

Tags

See also

The difference between the life after 50 from all previous life

The differences between the twins from twins

How to clean according to the principles of Kaizen

15 great movies for the evening after work

Popontovatsya and waking. Russia began secretly to the terms of the United States to resolve the crisis in Ukraine

38 brutal truths and truthful about relationships

Nissan Leaf vs Chevy Volt