Investing and speculation on the stock exchange: How does futures trading on the dollar

Bashny.Net

Bashny.Net

Good day!

In this article I want to share their knowledge on the theme "Investing and speculation on the stock market", in particular, it will be about derivatives. Do not be put off by this terrible word, because after reading this article you will understand better than any professional trader. Please note that the deal does not mean to make. The article is very informative in nature and will be considered on the futures of the dollar, since the last time I have seen an increased interest in the topic among people unrelated to the case.

So, first you should have an understanding of the main sections of our country's Moscow stock exchange (as of 06.02.2015):

For these data, you can watch on-line on the main page of the site Exchange moex.com/

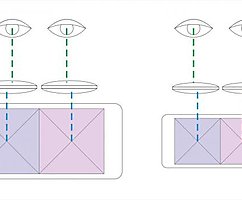

As you can see, the stock market, which includes stocks, bonds and exchange-traded shares, is only 25%. Comparable daily turnover takes the futures market, which includes trading in futures and options (one word derivatives). And a significant share of 50% takes the foreign exchange market, which is not surprising, as the main transactions between banks in the currency is held in this section. But back to the topic of the post, to the futures market, as in this section there is a very great advantage over the foreign exchange market. In more detail, we stopped on futures, as options - it is a sophisticated tool for the layman, and options are used mostly by professional players in the market.

A futures contract - it is a derivative of purchase and sale of the underlying asset, which can act as the index action, the currency pair or commodities (oil, gold, etc.), which has two parameters - the price and terms of implementation (supply chain). For example, consider futures on the dollar.

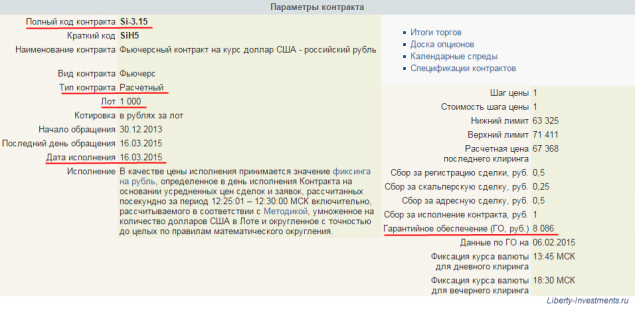

Each contract has its short name (Si - futures on the dollar, Eu - to the euro), and the expiration date. Below the main parameters of the contract for convenience I've highlighted the ones that we consider:

Exchange traded futures on the lots. One lot of futures on the dollar is equal to $ 1,000, so the quote 66782 ruble equivalent to $ 1,000.

What does the term of the contract, which is specified in the short name of the futures contract Si-3.15? If you think that in the future the dollar will cost above the current price, you buy at the current price 66782 rubles and assume you forget for a while. Given that each futures contract has a "lifetime" that March 16 (the day of expiration) your current contract ended its existence and if on that day, the average price (namely, as specified by the average price during the interval 12.25-12.30 Moscow time) will be equal to 70,000, then you will get profit 3218 rubles per lot). In other words, you bought originally priced at 66,782 future, as the market is considered that such a price will be March 16.

Futures contracts can be calculated, as in our example, and deliverable. If futures on the dollar would be deliverable, then March 16 at your foreign currency account "fell" to $ 1000 at a price of 66.78, you could immediately sell it at the price of 70 on the MICEX currency section and would profit 3218 rubles. This is what happens with the deliverable futures, which include all futures contracts where the underlying asset share (Gazprom, Sberbank, etc.).

You do not, of course, was to keep this lot until March 16, you could sell it at any time. And we must also say that the result of the transaction is not formed at the time of closing of the transaction, as it happens in the shares. A futures contract is a daily calculation result at the end of the trading session at 13.45 and 18.30 Moscow time (day and evening clearing), so the score will change every day. Incidentally, this is a very important feature of the derivatives market.

If you had originally planned to hold "bought" dollars for longer than until March 16, there are two options: either you go to the next contract on March 16, it will be a Si-9.15, or you could buy initially September contract. In the year only four expiration (March, June, September and December).

Now let's get to the "economy" of our transaction. And here comes the fun part.

As the table shows the parameters of the futures, there is a very important parameter, as guaranteed security (CS), ie, it is the money market freeze your account. In our example, GO futures dollar is equal to 8086 rubles. As a result, you purchase $ 1,000 for 66782, and "paid" just 8086 rubles. The remainder of the funds will remain in your account. Technically you appeared 8 times the shoulder, in other words, we can say that you bought "on credit".

Size = 66782 shoulder rub. / 8086 rubles = 8.25 i>

But most importantly - it's free shoulder! You do not pay a penny for this marginality, as it would be with the purchase of shares or currency on the MICEX currency section.

We continue our "economy". If you bought 1 lot at the MICEX currency section, you would use would be 100% of its assets. As a result, the profit from the transaction amounted to about 5%.

The profit on the MICEX currency section = 3218 rub. / 66782 RUB = 4.8% i>

But in our example, the profits will be much higher, since we used the "effect of the shoulder." After buying 1 lot, as you already know, the stock exchange "freezes" 8086 rubles as GO. Further, given that the result of the movement of the quotes is changing every day, the rate may decrease, so the account must be a reserve, for example, 20 thous. Rub. The remaining funds 38696 rubles. we can use a different destination to another.

The profit on the futures market = 3218 rub. / (8086 + 20 000 rubles) = 11.4%

I>

You tell me, what is necessary to take into account a fee for the transaction? The fact that it is so small that it is not even considered in the calculation. Average commission brokers for the operation of 2 rubles per 1 lot (contract). As you can imagine, the cost of the entire transaction will be equal to only 4 rubles!

Should warn you of one mistake that all sophisticated "investors". Given a free shoulder and low GO newly minted participants included in the deal on all available funds, ie in our example could buy 8 contracts, which is equivalent to 8,000 dollars. This is very dangerous and, as a rule, always leads to great losses, so I highly recommend using a maximum of the first arm.

Source: geektimes.ru/post/245454/

Tags

See also

How to stay in good health, using a 3D printer

60 facts about Austria through the eyes of Russians

Homemade Lambo "REVENTON"

Mahjong its Rukmi

As I was a guest worker.

Khortytsya Island and the Zaporizhzhya Sich

My piece of iron

My bd

New Zealand - Ride on the northern island

As I came to a healthy lifestyle.