How not to deny yourself and to live within their means — a secret from the American financier

Bashny.Net

Bashny.Net

While we are looking for short-term pleasures and seek to impress others, we ourselves Roy financial hole, according to Trent Hamm, author of the financial blog The Simple Dollar. And he knows how to stop doing it and to secure a stable future.

The editors of the Website under the impression he seriously wondered whether or not to surrender a double latte in the morning. Large sums of small things.

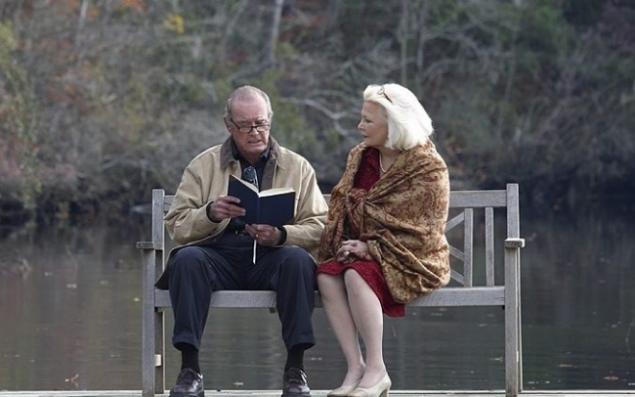

I recently corresponded with a reader (let's call him Tim) about the financial problems faced by his relatives of the wife due to his advanced age.

They are already over 70, and they practically had nothing saved for retirement. Soon they will find themselves unable to work, and since Tim's wife is the only child in their family, they expect that Tim will provide for them.

On the other hand, parents of Tim a little over 60 of them are already retired, and almost certainly will never become a financial burden for himself, his wife and children.

I asked Tim: what, as it seems, the reason for this difference between these two situations? May be the case in income? Or the ability to plan? His answer was simple: "My parents didn't spend my life trying to pretend to be rich."

The main reason why many people do not save, they prefer to spend money now.

They get what you want today home, car, travel, clothes, gadgets and so on, they are more important than things like savings.

But a normal financial life involves at least 10 % of their income you set aside for the future, before I spend the money on anything else; to do otherwise is like walking a tightrope without a net. However, most people do not save for retirement enough money.

People live as if they have more money than they actually are. For most people, more importantly, they want to right now to feel rich. People have to make hard choices between important items of expenditure: minor purchases and savings for old age — and they prefer a double latte or the latest iPhone, but not protection in the future (and sometimes even go into debt and credits).

But why do people do it? What is the reason?

Some want to impress others. But in fact few people notice, what kind of car you drive or what clothes you wear, and those for whom it matters even less.

Some people so struggle with stress — spending money, they forget about problems. But shopping is not only costly, but also deprives of free time that could be spent on other entertainment.

There are a few good ways to stop fighting with the stress by spending:

- constantly remind yourself about more important purposes.

- to configure the automatic deduction of the money in a savings account;

- often talking with friends, focusing on those who do not support your passion for shopping;

- to limit access to Finance;

- look for other sources of strong emotions in addition to impulsive purchases.

The key to solving this problem is mediadata. Watch TV less, I do so. I read mostly books, so I see ads in magazines.

Someone too important opinion of friends and neighbors, and they take over their consumer habits. Because according to Jim Rohn, you — the arithmetic average of the five people you spend the most time.

The best strategy here is to not live in the area where you have the lowest incomes among neighbors; your income must be above average in the area, so you never have to spend more to "keep up with the Joneses". Review the circle and try to spend more time with friends who are not inclined to spend a lot.

Some prefer to "catch the moment"while young and healthy, not to save money for old age when their health may already be not so cloudless. They believe that their "future selves" you take care of them.

You can't know what the future holds. Employment opportunities change with age, as physical ability, and given how fast the technology is evolving, it is difficult to guess that awaits us all in 20 years.

Retirement savings — not only the money that will allow you to lead a comfortable life in old age.It's money in order to survivewhen the rules of your life will change dramatically — both from the point of view of personal situation, and from the point of view of society.

Don't pretend you're rich. You can get momentary pleasure, but it will not stay with you for a long time. And this leads to stress, when you begin to reflect on his life.

The best thing you can do to start saving for retirement today. Don't leave time to talk himself out of this thoughts. And then decide to start living a little less "rich" than before.

You will never regret it.

Source The Simple Dollar

Transfer Insider.pro

According to the materials Insider.pro

See also

How to kill a consumer: the experience of the person with the money

10 celebrities who have proved that strength in simplicity

via www.adme.ru/svoboda-avtorskie-kolonki/10-znamenitostej-kotorye-dokazali-chto-sila-v-prostote-1352815/

Tags

See also

10 Tips to fall in love with MAN

Alexander Roitman: Now I know how to behave in marriage

Types of girls and what they are looking for the guys

Average electrical treasures amassed millions

Operation without anesthesia in Ukrainian

As the girls break their bones to lengthen the legs

8 ways to deceive the woman herself.

"What's the point to invent difficulties?"

How to learn to behave the way you would like to